Here's the most recent fintech, crypto and blockchain news from all around the globe:

Sorted by last update

Here's the most recent fintech, crypto and blockchain news from all around the globe:

Cryptocurrency Hub online community appreciates and cherishes the time and effort its members invest communicating, interacting and contributing on its platform and as a token of appreciation and giving back to the community we came up with a a prize points system based on members activities in the community! Yaaaaayyyyyy 😎

So that's how it will work:

Registered members earn points based on certain activities. Each activity has a number of points for each action taken. These points will be added for each member automatically.

Points will be calculated according to the below formula (subject to change upon the discretion of the admins):

| ACTION | POINTS |

|---|---|

| New Visit | |

| Follow Content | |

| Follow Member | |

| Post Blog Post | |

| Post Topic | |

| Post Event | |

| Post Survey | |

| Post Resource | |

| Post Comment/Reply | |

| Post Chat Message | |

| Vote on Survey | |

| RSVP To Calendar Event | |

| Purchase Premium Membership | |

| React To Post | |

| Author Has Content Featured | |

| Author Has Post Reacted To By Someone | |

| Author's Content Receives New Follower | |

| Share Content | |

| Member Invitation Accepted |

Don't forget that you can invite new members to our community and help it grow while collecting points for each invited member! 🤪

The regular crypto giveaway will be in the form of weekly Cardano (ADA) and monthly Ripple (XRP) prizes! 🎁😁

Weekly Cardano (ADA) prizes (2 winners):

Every end of the week a First Prize will be given to 1 winner (1st highest number of activity points collected for the corresponding week): 30 ADA

Every end of the week a Second Prize will be given to 1 winner (2nd highest number of activity points collected for the corresponding week): 20 ADA

Monthly Ripple (XRP) prizes (1 winner):

Every end of month one Prize will be given to 1 winner (with the highest number of activity points collected for the corresponding month): 50 XRP

Members usernames will be of course announced in due dates and contacted to have their crypto prizes transferred to their wallets addresses.

Remember the more you are active and contributing to the growth of our online community the more points you earn and the more chances you get to win BIG with us! 😛🤗

Good luck to everyone! 👏

The network continued to operate optimally despite a DDoS attack. Cardano’s blockchain successfully defended against a Distributed Denial of Service (DDoS) attack aimed at stealing staking tokens. The attack had little impact on ADA’s value, with a modest 0.4% increase over the past 24 hours, standing at $0.38 at the time of publication, according to CryptoSlate data.

On June 25, Fluid Token CTO Raul Antonio Rosa Padilla reported that the blockchain suffered an attack on block 10,487,530.

According to him, the attacker tried to overload the network by spending 0.9 ADA per transaction, targeting 194 smart contracts with multiple transactions per block. Despite this, the Cardano network maintained normal operations, resulting in the attacker losing funds rather than stealing them.

Phillip Disarro, founder of Anastasia Labs, a Cardano-based development company, suggested that users could help stop the attack by deregistering any of the 194 staking credentials used by the attacker. He highlighted deregistration as the fastest method, rewarding users with 2 ADAs per credential until the attacker’s 400 ADAs were exhausted.

Disarro stated:

“Just to clarify, the network is functioning as expected. Liveness is not affected. Everything (block size limit, transaction size limits, block times) is configured so conservatively that any attack on liveness is a total waste of funds. Even with the validators deserializing 194 junk scripts (~16kb each) per transaction, the validators are fine processing these transactions (which involve deserializing about 200 times what they are used to).”

Phillip Disarro

Following Disarro’s post, the DDoS attacker ceased its efforts to avoid further financial loss. Disarro noted the irony of the attacker inadvertently funding open-source development work at Anastasia Labs and Midgard.

Although the blockchain continued to operate normally, Intersect, a Cardano membership group, reported that the attack negatively impacted some staking pool operators (SPOs). However, efforts are underway to identify solutions to prevent future occurrences. The group commented:

“The network has experienced higher than normal load and some SPOs have been negatively impacted due to an intensification in block height battles. However, the chain as a whole is performing as expected, with only a small impact on overall transaction times and a reduction in chain density.” Source.

@IntersectMBO

The Cardano DDoS attack incident demonstrates the robustness and resilience of its network. Despite the attacker’s attempts, the blockchain continued to operate without significant interruptions, evidencing the effectiveness of its blockchain security measures. In addition, the Cardano community showed rapid response and collaboration to mitigate the impact, highlighting the collective strength and commitment to continuous improvement of the network.

Cardano Foundation CTO Matthias Benkort, @KtorZ, encapsulated the entire Bitcoin blockchain within a single block on the Cardano blockchain.

This announcement, made via X, has generated a lot of buzz in the blockchain community. It highlights the potential for advanced data management and interoperability between different blockchains.

Benkort’s revelation goes along with releasing a new open-source library on GitHub titled “Merkle Patricia Forestry.” This library introduces on-chain and off-chain tools designed to work with Merkle Patricia Tries in Cardano. According to documentation, a Merkle Patricia Trie is a “persistent, authenticated data structure for mapping between arbitrary keys and values.” It essentially functions as a highly efficient and secure hashmap.

The structure of this library is detailed in the documentation. “The elements are represented in a space-optimized trie (also known as a prefix tree) of radix 16. The hash of the keys provides the path to the values in the tries“. This approach offers numerous use cases, such as maintaining large on-chain records (e.g., domains). It may also provide vast oracle datasets of intrinsic data (e.g., a delegator/delegate map) or extrinsic data (e.g., GitHub data related to a project ecosystem). It is particularly suited for long-running datasets that grow slowly, such as a Proof-of-Work (PoW) blockchain.

Key features of the library include fast membership, insertion, and deletion of any key/value element in a large store facilitated by a root hash (32 bytes) and succinct proof (<1KB). The library incorporates several optimizations inspired by the Ethereum Modified Merkle Patricia Trie (MPT) but introduces a novel approach to organize nodes as small Dispersed Merkle Trees. This innovation results in much smaller tests and is the basis for the library name: Merkle Patricia Forestry.

Benkort explained the performance tradeoffs, noting that the optimization sacrifices some memory and CPU execution units to achieve smaller test sizes. Despite this, the library finds a good balance between test size, memory usage, and CPU efficiency, as detailed in the performance tables included in the documentation. These tables summarize the test size, memory units, and CPU units required, highlighting the efficiency of the library in different scenarios.

In a series of detailed posts on X, Benkort provided more information on the implementation and capabilities of the library. He explained that the library consists of two parts: one implemented in Aiken for utilities specific to Smart Contracts and another in Node.js for off-chain operations. This comprehensive implementation of modified Merkle Patricia Tries, with a unique twist, is what Benkort calls “Merkle Patricia Forestry.”

“Fundamentally, this is an authenticated data structure for mapping arbitrary keys to arbitrary values. However, it’s done in such a way that it’s possible to perform some operations from just a small hash and a succinct proof without the need to carry the entire data structure.”

Matthias Benkort

Merkle Trees are a similar, albeit simpler structure used primarily to represent lists of items and verify their membership using a root hash. However, Merkle Patricia Tries (MPTs) extend this functionality, allowing membership verification and the insertion and deletion of key/value pairs. Ethereum employs MPTs for its blockchain state and transaction storage. Their use allows thin clients to query balances without storing the entire blockchain.

A significant problem with traditional MPTs is the large size of the tests. The size can span several kilobytes for large data stores. The size is not as problematic for off-chain operations, but on-chain, every byte is valuable. Benkort’s implementation addresses this by using small 16-element Dispersed Merkle Trees at each level, effectively creating trees within tries. This structure drastically reduces the size of the tries, trading off some computational steps for efficiency gains in Cardano.

Benkort demonstrated this capability through a recent transaction that spent a UTxO containing the root hash of a Merkle Patricia Forestry. This MPF represents the header hashes of the entire Bitcoin block, compressed into just 32 bytes. The transaction demonstrated the ability to continue the chain by inserting a new block into the trie, maintaining an authenticated chain of over 850,000 blocks with minimal data.

Benkort highlighted the potential applications of this technology, ranging from trustless bridges to arbitrarily large key/value stores managed on-chain. “Imagine the realm of possibilities with such large data sets,” he suggested. “A domain registry? A financial market data feed? GitHub statistics? I see a world where institutions or committees publish large data sets in the form of a simple on-chain root hash, effectively serving as oracles for a variety of smart contracts in the future.” Benkort concluded by reflecting on the journey of this project, which began as a side project late last year. “It feels good to finally release this,” he said. “It was originally something I started late last year, a bit of a side project. Given the many conversations about it lately, I thought I’d resurrect and properly package that code. Open source to win.”

This innovative integration of technologies highlights not only the technical capability of the Cardano Foundation but also the vast potential of blockchain technology to evolve and adapt to new demands and use cases. This breakthrough pushes the frontier of what is possible in the realm of cryptocurrencies and decentralized technology.

Cardano, with its innovative approach to blockchain technology, is gaining momentum in India's thriving blockchain development landscape. Let's delve into the rise of Cardano and explore the emerging trends in blockchain development in India, with a focus on Cardano blockchain development companies.

As Cardano continues to evolve as a leading blockchain platform, it's crucial to understand its impact on the Indian blockchain ecosystem. With its focus on scalability, interoperability, and sustainability, Cardano offers a promising foundation for various blockchain-based solutions across industries.

In India, the demand for blockchain development services, including Cardano, is witnessing significant growth. As businesses and enterprises explore the potential of blockchain technology to streamline operations, enhance security, and foster innovation, the need for skilled blockchain developers and reputable development companies is on the rise.

When it comes to Cardano blockchain development in India, partnering with the right company is essential to harness the full potential of this advanced blockchain platform. Here are some key considerations when choosing the best Cardano blockchain development company in India:

Expertise and Experience: Look for companies with a proven track record of expertise and experience in Cardano blockchain development. Assess their knowledge of Cardano's unique features, such as its layered architecture, proof-of-stake consensus mechanism, and smart contract capabilities.

Portfolio and Projects: Review the portfolio and past projects of Cardano blockchain development companies in India. Evaluate their experience in developing and deploying Cardano-based solutions across various domains, such as finance, healthcare, supply chain, and decentralized applications (DApps).

Technology Stack and Tools: Inquire about the technology stack and development tools used by Cardano blockchain development companies. Ensure they have access to the latest Cardano development frameworks, libraries, and resources to build robust and scalable applications.

Compliance and Regulation: Compliance with regulatory requirements and industry standards is critical in blockchain development, especially in sectors like finance and healthcare. Choose a Cardano blockchain development company in India that prioritizes compliance with relevant laws and regulations, such as KYC/AML (Know Your Customer/Anti-Money Laundering) and data privacy regulations.

Collaboration and Communication: Effective communication and collaboration are essential for successful blockchain projects. Partner with a Cardano blockchain development company that values transparent communication, understands your project requirements and actively involves you in the development process.

Support and Maintenance: Post-launch support and maintenance are vital for the long-term success of Cardano blockchain projects. Ensure the development company offers comprehensive support, regular updates, and timely bug fixes to keep your Cardano-based applications running smoothly.

By partnering with a reputable Cardano blockchain development company in India that aligns with your project goals, requirements, and values, you can embark on a successful journey to leverage Cardano's capabilities and drive innovation in the Indian blockchain ecosystem.

However, there are many other markets with enormous potential. Ignoring them would be bad for the global adoption and success that Cardano deserves. The population of Latin America is 665,798,000 people, equivalent to 8.28% of the world’s total. The population percentage over 14 without a bank account is 42.5%. Hundreds of millions can benefit from Lenfi and Liqwid Finance, among others.

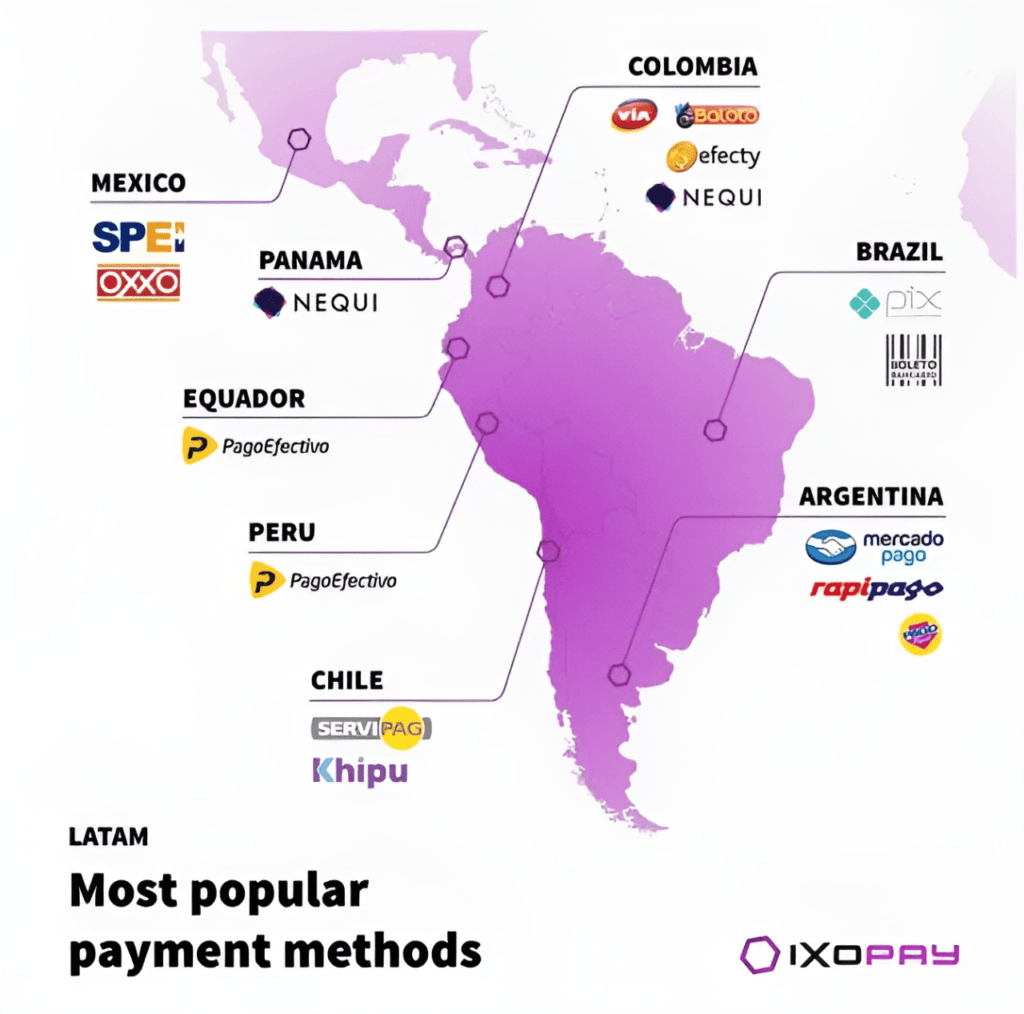

The use of credit cards is low in Latin America. Only about 1/5 of the population owns a credit card. Perhaps it can be influenced by the fact that the use of credit cards has become a bit demonized due to a lack of financial education. Very few people have the profile ideas to get a credit card from traditional banks. Despite this, making payments is still a latent need, and different payment methods have been created, such as Nequi (in Colombia). The map below shows some of Latin America’s most popular payment methods. Note that each country uses its methods.

This is the perfect environment for cryptocurrency adoption. It is a population already accustomed to electronic payments, which credit card companies ignore, and would benefit from a unified system across the region. Solutions like COTI, Mehen, or others would be perfect. Even with the lack of credit cards, e-commerce is growing. With annual growth rates of 30% projected through 2025. And with few credit cards and very different banking options, crypto is an obvious, but little-known option that offers many benefits.

If we take a look at the migrants coming from Latin America, they represent about 10% of the population, compared to about 2%, on average, worldwide for developing economies. These people send large amounts of money averaging about 6% of GDP to support relatives in their home countries. Currently, the only option is Western Union, which charges high fees and similar services. Don’t you think this is a perfect opportunity to use ADA or stablecoins from COTI or Indigo? Who wouldn’t prefer a 1 ADA fee instead of hundreds of dollars?

What about new developer talent? According to uniRank, there are currently 1,869 official universities in Latin America. These are millions of talented, intelligent, and passionate young people, eager to get ahead and capable of creating Web 3 development, Cardano can’t miss out on these talents because of barriers such as language or the very complexity of blockchain.

Cardano has yet to arrive at the $0.8 price level this year, even though most cryptocurrencies have surpassed their old price levels. Although the blockchain has seen some developments, the price action has lagged behind its peers. However, Cardano continues to give investors a glimmer of hope as activity rises to new highs. Chain data shows that active addresses on Cardano’s network are increasing, and the monthly active count has reached its highest point in the last year.

Cardano’s active address count just hit a one-year high, indicating strong adoption of the network and suggesting big things are on the horizon. According to data from Danogo, active addresses in the last 30 days reached 596,915 on March 11, their highest level since May 2023. Interestingly, this number is nearly double the 279,000 active addresses recorded in September 2023, the lowest number of monthly active addresses in the last year.

Active addresses are one of the few metrics to consider when measuring the adoption rate of cryptocurrencies. Notably, several metrics have shown an increase in Cardano’s network activity and its ability to process more transactions. Further analysis of the chart data presented by Danogo shows that monthly active addresses reversed to begin an increase in late February after plummeting in January.

Cardano Blockchain Insights data tells a similar story of increased activity, with daily active addresses staying above 50,000 since Feb 29. Active addresses in the last 24 hours were 66,970. A similar activity metric from IntoTheBlock shows an increase in Cardano whale activity. Its “large transactions” metric, which measures transactions greater than $100,000, puts the number of whale transactions at 6,810 in the last 24 hours and $73.86 billion in seven days. Ethereum’s large transactions amount to USD 63.17 billion over the same period. Supply in the top 1% has also shown strong accumulation by whales, increasing by around 60 million ADA on March 10.

Interestingly, ADA has more than tripled from a price of $0.24 at the September monthly active address low. At the time of writing, ADA is trading at $0.79, up 42% in the last 30 days. ADA has been rejected twice at the $0.8 level this month but is now on track to retest that price level. If the bulls can push ADA above $0.8, this could give the cryptocurrency a clear path to reach $1 for the first time since April 2022. Overall, the cryptocurrency market continues to maintain bullish sentiment, which could push ADA above $1 this month.

Cardano Upgrade Gives New Utility to Holders. Cardano will soon have a hard fork. With this network upgrade, the system will force nodes to install it to continue operating on Cardano. Chang will enable governance and usher in the fifth phase of network development. Developers named the fork “Chang.” It is scheduled for the first quarter of 2024 and promises to improve the network’s scalability and interoperability. Over the last year, activity on Cardano peaked in May and December.

Cardano is currently the eighth most capitalized cryptocurrency on the market. The project is in the Basho phase, the fourth of its five phases, making the network capable of hosting more users without losing functionality (a quality grouped under the concept of “scalability”) and connecting better and more simply with other networks and interoperability.

Through the Chang fork, Cardano will advance to the next phase, Voltaire, which will mark the transition to full community governance. In that decentralized model, decision-making is distributed among its participants, who must hold ADA, the network’s cryptocurrency, to participate.

In addition, Emurgo, the entity behind the Cardano network, reported in X that development focuses on greater tokenization and promoting the creation of decentralized applications. There are already 150 projects and 1,300 more on the way, they detail.

To this end, the fork will also bring a protocol upgrade called Plutus V3. Chang brings critical improvements to Plutus Core, the functional programming language used to write smart contracts on the network. The new system introduces “Sums of Products” (SOPs) and promises smaller and more efficient scripts, with a possible 30% performance improvement. Scripts are programs or code that represent and execute the logic of smart contracts.

More in detail, Chang will allow Cardano to enrich its cryptography with BLS12-381, Blake2b-224, and Keccak-256. These primitives open the door to advanced implementations, such as sidechains or sidechains. The inclusion of CIP-58 provides developers with capabilities for low-level bit manipulations. From performance to cryptographic support, these primitives improve the efficiency and functionality of Plutus.

Ethereum’s experience with technical upgrades suggests that events like Chang may increase the price of the network’s native cryptocurrency. That’s what’s happening with Cardano (ADA), which saw an increase of almost 20% in the last week. It was trading at $0.57 at the close of this note, further driven by a bull market led by bitcoin (BTC).

Decentralized protocols developed on top of Cardano exceed USD 465 million in total value locked (TVL). The network had significant activity peaks in December, with several days above 100,000 daily transactions, well above the average for much of last year.

BBC and ITV submitted a joint bid and are sharing insurance of the games-ITV showing of the institution video games, the BBC one-at the same time as knockout video games will be divvied up at a later date. Each broadcasters will show the final.

While diving into the world of $ADA, have you also explored cost-effective solutions? Don't just secure your crypto investments, secure your academic future too with a cheap dissertation writing service. Share your crypto insights and academic aspirations below! Also I am curious to know the insight related to cardano when to sell?

Cardano decentralized payment platform: Hydra. The implementation of Hydra brings quite a lot of expectations to Cardano developers and users. It is a scaling protocol that will allow the projects of this network to have a kind of personal Layer 2 Blockchain to verify hundreds of thousands of transactions per second at a low cost.

Thus, Cardano will eventually have many such networks, as if they were many heads, hence the name of the mythological multi-headed beast “Hydra.” This solution will enable projects such as Hydra Pay, a decentralized payment system that claims to be poised to transform the way payments settle on the Cardano network. It aims to provide near-instantaneous settlement on Cardano L2 and its compatibility with Web 3.0 wallets.

As we said before, this is a payment solution in the style of Paypal, Google Play, etc., only focused on the Cardano network and fully decentralized. The developer of this proposal is the Twitter user AimDemoShip, who, from his Github repositories, shows the construction of this solution. In addition, on Twitter, he has shown us how this tool works:

One of the outstanding features of Hydra Pay is its ability to facilitate almost instant settlement. It is possible thanks to the Hydra protocol, which allows off-chain transaction processing through parallel networks called “Heads.”

As investors, it is legitimate to wonder about the real potential of these solutions in Cardano. And while it is impossible to forecast these types of developments accurately, we can give a personal assessment:

First, We can assess the demand for products and services on the Cardano blockchain network through the volume of transactions. Precisely, DeFi projects significantly impact Cardano transactions; for example, the launch of Djed significantly increased activity on the network.

Therefore, with the deployment of Hydra and the emergence of projects such as Hydra Pay, a significant increase in Cardano’s trading volume is expected. However, we won’t see or know the real impact until implementation. The exact launch date of Hydra Pay has yet to be confirmed; We all expect it to be a central offering of the Cardano protocol. Developers have already conducted tests on the Android version since May 2023.

It is a common question among cryptocurrency enthusiasts whether Cardano is a security. The answer to this question is complex, depending on each jurisdiction’s specific circumstances and regulations. However, it is essential to note that developers designed Cardano to focus on decentralization, interoperability, and sustainability, which are not typical characteristics of securities. Additionally, the Cardano Foundation and its partners have worked closely with regulatory authorities to ensure compliance with applicable laws and regulations. Ultimately, it is up to each investor to do their due diligence and make an informed decision about investing in Cardano or any other cryptocurrency.

The problem with the SEC arises from the ICO concept as a parallel to a traditional company stock public offering. A crypto ICO is a fundraising method that utilizes cryptocurrencies such as Bitcoin or Ethereum to raise capital for a new blockchain-based project or startup. It is similar to an initial public offering (IPO) in traditional finance, but instead of offering company shares, investors receive tokens or coins in the new project. You can trade these tokens or coins on cryptocurrency exchanges. ICOs have gained popularity in recent years due to their potential for high returns and the ability to invest in new and innovative technologies. However, they also come with risks and regulatory challenges, and investors should thoroughly research the project and team before investing in an ICO.

Cardano is one of the projects most affected by SEC lawsuits against crypto projects. Therefore, this is when this network needs decentralization and innovation the most to raise capital from new markets. Cardano’s ADA price is challenging as it tries to overcome obstacles. Over the past week, ADA attempted to rise above the $0.285 area. It even overpowered resistance at $0.295, but bearish traders were active near the $0.30 mark.

A high was formed around $0.302 before a further decline occurred. The price dipped below the $0.285 level and tested support at $0.277. At the time of writing, it is consolidating with losses below $0.292, following a similar pattern to Bitcoin and Ethereum. If Cardano’s price fails to break above the $0.292 resistance level, it will likely continue its downtrend. Immediate downside support is near the $0.282 level and the uptrend line mentioned above. The following support is near the $0.277 level. If the price breaks below this number, it could open the door for a steep decline toward $0.255.

In a recent video, Hoskinson shared his vision for the project’s future, setting high standards for expansion and advancement. He also stressed the importance of regulatory certainty to ensure Cardano’s long-term success. With strategic partnerships and a focus on regulatory stability, Hoskinson seeks to decentralize the network and expand the Cardano ecosystem.

Hoskinson has an ambitious plan for next summer, which includes forming strategic alliances to decentralize the Cardano network further. His goal is to enhance the functionality of Smart Contracts and expand the project ecosystem.

The vision is to establish Cardano as a scalable, secure, and durable blockchain platform by meeting these goals. With a more decentralized network, Cardano developers expect to offer better services and attract more developers and investors.

In addition to the technical expansion, Hoskinson highlights the need for regulatory stability in the cryptocurrency industry. He recognizes the importance of complying with legal requirements to encourage innovation, protect consumers and ensure the long-term viability of cryptocurrencies.

Hoskinson advocates creating a climate that promotes the growth and use of cryptocurrencies through explicit rules and regulations. Transparent regulations are especially relevant as institutional investors show interest in cryptocurrencies and can provide certainty to Cardano stakeholders.

ADA’s recent successes have strengthened its market position and increased investor and user confidence in its potential. Cardano’s Total Locked-in Value (TVL) has reached new levels, demonstrating the growing interest in Cardano within the DeFi ecosystem.

These achievements further support the project’s appeal and increase the anticipation around the ideas and improvements Hoskinson will reveal in the coming weeks. The cryptocurrency community is eager to see how Cardano will develop over the summer and how the project will address regulatory challenges to ensure its long-term viability.

During his video update, Charles Hoskinson highlighted the importance of Hydra, Cardano’s layer two technology. “We’re seeing great progress on the Hydra layer,” Hoskinson indicated, suggesting that his development team is on the right track toward implementing this critical piece of Cardano’s infrastructure.

Hoskinson emphasized that “Hydra is important because it will allow Cardano to adapt as it grows, to serve more users and process more transactions.” Hydra plays a crucial role in Hoskinson’s long-term vision for Cardano. Growth and adaptability are essential in the dynamic and constantly evolving world of cryptocurrencies, and scalability is a critical factor in this equation.

Not only that, but the implementation of Hydra is one of the most awaited developments on Cardano’s calendar for this year. “One of the most thrilling things this year is that we will see the implementation of Hydra,” Hoskinson enthused. Cardano fans and cryptocurrency enthusiasts will undoubtedly be keeping an eye out for this news.

He stated that “Hydra is being built open-source. We follow an open-source model because we want the entire community to participate.”

The open-source philosophy is fundamental in cryptocurrencies and blockchains, enabling collaboration and transparency in developing technologies. By adopting this approach, Cardano ensures its technology is open to community review and contribution and aligns with the industry’s decentralized ideals.

He noted, “We believe that building Hydra open-source is the best way to secure its long-term success.” In this regard, Hoskinson sees the open-source model as a critical factor in ensuring that Hydra lives up to expectations and can adapt to future challenges in the cryptocurrency space.

Finally, Hoskinson highlighted that “building Hydra is an important milestone for us, a game-changing innovation in terms of scalability in cryptocurrency.” This statement reinforces that Hydra is important to Cardano and can influence the entire cryptocurrency industry.

“By developing Hydra, we are anticipating the future of the Cardano ecosystem, and that is something we are very excited about,” concluded Hoskinson. Continuous innovation and anticipation of the future are critical to success in the cryptocurrency industry, and Cardano is on the right track.

In his video, Charles Hoskinson addressed the governance issue in the Cardano network. He stressed that “governance is a key element to the long-term success of any cryptocurrency. At Cardano, we are working to ensure that governance is open, transparent, and democratic.“

Hoskinson emphasized that Cardano is implementing a governance model allowing the community to participate actively in decision-making.

“We are creating a system where ADA holders can vote on improvement proposals. We believe this is crucial to make certain that Cardano’s direction is in the hands of those who care most about its future.”

Charles Hoskinson

This approach seeks to decentralize the network further and, in doing so, allow ADA holders to influence Cardano’s future direction. This vision represents a commitment to democracy and active community participation in Cardano’s evolution.

Charles Hoskinson’s vision for Cardano this summer promises exciting developments and breakthroughs. His plans for decentralization, network expansion, and his focus on regulatory stability highlight Cardano’s ambition to become a leading platform in the blockchain industry.

Moreover, the project’s recent successes and increasing Total Blockchain Value support its potential to attract more investors and users. The crypto community is fervently awaiting the upcoming ideas and improvements that Hoskinson will unveil, hoping they will propel ADA, Cardano’s native cryptocurrency, to outperform Bitcoin, Ethereum, and other prominent cryptocurrencies.

Cardano’s TVL Over 400 Million ADA. The Cardano token price has touched $0.353 (May 11th), breaking the $0.36 support. However, the DeFi system of the said blockchain continues to grow. So what is the reason for such a paradox? Cardano achieved a significant milestone, as its blockchain’s total Value locked (TVL) surpassed ₳420 million. This achievement comes just over a month after TapTools, a Cardano wallet tracker, predicted a substantial increase in the network’s TVL.

It is worth noting that TapTools made this prediction and highlighted several factors that could play a crucial role in Cardano’s explosive growth in the coming months. Precisely the Cardano DeFi ecosystem has reached a TVL of ₳428 million, according to DefiLlama. This figure amounts to approximately $155 million when converted to U.S. dollars.

Indeed, if we take a short-term look, it could look more attractive, but ADA’s performance in 2023 is a 116% increase in Total Value locked in since the beginning of the year. In addition, Cardano’s TVL has seen an increase of almost 8% in the last month, indicating a steady adoption and expansion of its DeFi ecosystem.

Looking at the blockchain data, it becomes clear that Minswap is the leading protocol on Cardano’s network by a significant margin, with a TVL of $57 million. This decentralized exchange has a market share dominance of 29.84%. Indigo is the second-highest secured debt protocol, with a TVL of $30 million.

Other notable protocols within the Cardano DeFi ecosystem include WingRiders, Djed stablecoin, and Liqwid, which have TVLs of $15.6 million, $13.9 million, and $12.2 million, respectively. It is also worth explaining that the Total Value locked metric estimates the cryptocurrency locked within the DeFi protocols on a specific blockchain.

You can compute TVL by summing up the value of all crypto assets locked in various DeFi protocols, including cryptocurrencies used as collateral, liquidity, or staked in various DeFi applications. This metric is essential for measuring economic activity and how relevant a particular project is.

Total Value Locked (TVL) in crypto refers to all cryptocurrency assets currently locked in various DeFi protocols. DeFi stands for decentralized finance, which refers to financial applications built on blockchain technology, allowing users to access financial services without middlemen like banks or traditional financial institutions.

TVL is an essential metric for measuring the success and growth of the DeFi ecosystem. It provides an overview of the total assets users utilize within DeFi protocols. The higher the TVL, the more popular and successful the DeFi protocol is among the crypto community.

TVL has become an increasingly important metric in the crypto space, providing insight into the overall health and adoption of DeFi protocols. As DeFi continues to gain traction and mainstream adoption, TVL is likely to become an even more important metric for measuring the success and growth of the DeFi ecosystem.

Altcoins may face challenges at this time due to the recent interest rate increase by the Fed. In the coming months, the Fed must stop this draconian policy for the price of altcoins to resume its recovery path from its all-time highs of 2021. Therefore, amid this uncertainty, the projection shared by most analysts is bearish. Dan Gambardello, a well-known cryptocurrency trader and analyst, offered an example of this view and said that ADA had been trapped in a prolonged period of sideways price action, generating frustration among investors.

Gambardello further explained that ADA’s chart formed a significant red rectangle, signifying a consolidation phase that lasted for nine months, with a narrow price range between $0.43 and $0.31. Although the altcoin broke out of this range, it quickly returned. However, he emphasized that prolonged periods of sideways movement are not unusual during bear market transitions.

Analyzing the daily chart of ADA from a technical point of view, the analyst highlighted a recent breakout of a descending wedge pattern. However, the price of the Cardano token struggled to overcome the resistance of the 20-day moving average. Leaving bearish projections aside, some events that may contribute to ADA resuming its upside are a resolution in the Ripple vs. SEC case and a worsening of the U.S. banking crisis.

In a recent analysis by popular cryptocurrency influencer Ben Armstrong, also known as BitBoy Crypto, the potential of Cardano‘s native token, ADA, to make millionaires in the upcoming bull run was explored. His “moon math” is designed to help investors understand what they need to achieve their millionaire dreams by investing in ADA.

The cryptocurrency market is still in a phase of consolidation, while most of the coins this week saw some minor advances. Prices appear to be gradually rising despite some bearish sentiments hovering around.

From the beginning of 2023, Cardano’s ADA has gained by nearly 50% and is currently trading at $0.39. Nonetheless, Cardano has encountered stiff competition at the $0.40 mark. In particular, Cardano’s digital asset has hit a “colossal” sell wall worth 3.85 billion ADA.

Analyst and cryptocurrency researcher Ali Martinez highlighted the IntoTheBlock data to show how “Cardano whales” (those holding between one and ten million) had just purchased 150 million ADA tokens worth $57 million.

As Ali Martinez showed, there is a lot of selling pressure between $0.40 and $0.42. According to Ali, there is a significant 3.85 billion $ADA sell wall between $0.40 and $0.42. He continued by saying that if ADA can surpass this barrier, nothing should stand in the way of a price increase.

NFTs (Non-Fungible Tokens) have gained immense popularity in recent years, with various blockchain platforms providing the infrastructure to support the creation and trading of NFTs. One of the latest platforms to enter this space is Cardano, a third-generation blockchain platform that has been making waves in the industry. In this article, we will explore the potential of Cardano NFT marketplace and discuss its benefits.

What is Cardano?

Cardano is a third-generation blockchain platform that was launched in 2017 by the IOHK (Input Output Hong Kong) team led by Charles Hoskinson. The platform is designed to be scalable, sustainable, and secure, and it uses a proof-of-stake (PoS) consensus mechanism. Cardano is unique in that it separates its settlement layer from its computation layer, allowing for more efficient transactions and improved scalability.

What are NFTs?

NFTs, or non-fungible tokens, are unique digital assets that are stored on a blockchain. They are often used to represent ownership of a digital item, such as artwork, music, or videos, and can be bought, sold, and traded like any other asset.

NFTs are different from cryptocurrencies like Bitcoin or Ethereum because each NFT is unique and cannot be exchanged for another NFT. This makes them ideal for representing ownership of one-of-a-kind digital items, as they cannot be duplicated or counterfeited.

NFTs are created using smart contracts, which are self-executing contracts that are stored on the blockchain. These smart contracts contain all of the rules and logic for the NFT, including how it can be bought, sold, and traded.

One of the key features of NFTs is that they can be programmed with certain properties and behaviors. For example, an NFT representing a piece of artwork could be programmed to automatically pay a small percentage of each sale to the original artist.

Overall, NFTs have quickly become a popular way to buy, sell, and trade digital assets, and their use cases continue to expand.

The Potential of Cardano as an NFT Marketplace

Cardano has the potential to be a major player in the NFT space, thanks to its advanced technology and unique features. Here are some of the benefits of make a Cardano NFT marketplace:

Scalability: One of the main advantages of Cardano is its scalability. The platform uses a layering system that separates its settlement layer from its computation layer, allowing for more efficient transactions and improved scalability. This means that Cardano can handle a high volume of transactions without compromising its performance.

Security: Cardano is designed with security in mind. It uses a proof-of-stake consensus mechanism, which makes it less susceptible to attacks than proof-of-work mechanisms used by other blockchain platforms. Additionally, Cardano's code is audited and reviewed by experts in the industry, making it more secure than other blockchain platforms.

Sustainability: Another advantage of Cardano is its sustainability. The platform is designed to be energy-efficient and eco-friendly, unlike other blockchain platforms that consume a lot of energy. This makes Cardano a more sustainable choice for NFT creators and collectors.

Interoperability: Cardano is designed to be interoperable with other blockchain platforms, making it easier to create and trade NFTs across different platforms. This means that NFT creators and collectors can reach a wider audience and trade their NFTs on multiple platforms.

Conclusion

In conclusion, Cardano has the potential to be a major player in the NFT space, thanks to its advanced technology and unique features. With the help of NFT development company Cronj, you can launch of an NFT marketplace on Cardano in the near future, NFT creators and collectors will have another platform to buy, sell, and trade their unique digital assets.

The NFT market has seen explosive growth in recent years, with more and more artists and creators utilizing this technology to sell their digital creations. Cardano's blockchain platform has the potential to become a major player in the NFT market, thanks to its unique features such as low transaction fees, fast processing times, and energy-efficient mining.

An NFT marketplace built on Cardano's platform could offer a more secure and efficient way for creators to sell their digital assets, while also providing a more user-friendly experience for buyers. With the continued growth of the NFT market, it will be interesting to see how Cardano's platform develops and evolves to meet the needs of creators and collectors alike.

References:

DJED, the first stablecoin for Cardano, is just around the corner.

It will be an "over-collateralized" stablecoin.

Its operation has its base on ADA, DJED, and SHEN.

SHEN is the token that brings additional properties to support DJED

Decentralized exchanges are now ready to start trading DJED

The Cardano ecosystem is getting closer and closer to receiving its first official stablecoin, a coin known as DJED developed by the IOG (IOHK) and the COTI teams, which aims to expand the range of options available to those operating within the Blockchain.

Given that there are still many doubts about DJED, its proposal, its operation, and the mechanisms that will allow it to maintain parity with its reference fiat currency, below we present a summary with everything you need to know about this new stablecoin that arrives in the Cardano ecosystem.

Other publications mention that DJED is a stablecoin that runs on the Cardano network. It will have parity with the US dollar. Although its operation is somewhat similar to other algorithmic currencies, specific differences make it more of an "over-collateralized" cryptocurrency.

Developers announced the proposal for creating this cryptocurrency at the end of September 2021, an initiative mainly designed to provide more options within Cardano's decentralized finance ecosystem. In this regard, its founding Djed White Paper reads:

"DJED is an algorithmic stablecoin protocol that acts as an independent bank buying and selling stablecoins for a price in a range linked to a target price. It is cryptocurrency-backed because the bank holds a volatile cryptocurrency in its reserve. The system uses the reserve to buy stable coins from users who want to sell them. And the proceeds from the sales of stablecoins to users are stored in reserve. In addition to stablecoins, the bank trades reserve coins to capitalize itself and maintain a reserve ratio significantly higher than one."

In terms of its mechanisms that guarantee parity with the US dollar, DJED centers its operation on an over-collateralization model, which, although it has Cardano's native ADA token as the backbone for exchanges, also incorporates another asset known as SHEN that has additional properties to maintain the stability of the project.

Simply put, DJED works as follows:

Its main collateralization cryptocurrency is ADA: Users can exchange DJED for ADA based on the associated exchange rate, for which there will be a Smart Contract from which swaps occur in both directions.

Since the price of ADA can fluctuate based on market conditions, the SHEN token is introduced, which will serve as a second reserve asset and set a guaranteed rate on DJED of 400% - 800%.

The parity of DJED with USD is over-collateralized, eliminating the need for a governance token, as seen in algorithmic models. The platform is fully decentralized, community-driven, completely open source, and has mechanisms for minting and burning DJED and SHEN.

The dynamics between ADA, DJED, and SHEN would guarantee the over-collateralization of the project, which goes even further than the simple algorithmic functioning under which some market exponents operate while ensuring complete decentralization as opposed to those stablecoins that work with fiat reserve systems.

Additionally, the DJED project will include periodic reserve testing of its assets, ensuring complete transparency in issuing, minting, and burning the associated tokens.

The interesting point for DJED comes from SHEN, the third component of the project that makes the difference and guarantees the stability of the project. It is a token whose value fluctuates according to the free market, but its owners can receive rewards for ADA for DJED and vice versa. The team explained its functioning as a reserve currency on its official COTI blog.

By buying and selling SHEN, users can maintain DJED's peg to USD while earning a share of the transaction fees in the reserve pool. Since the reserve currency is a tradable asset, users can also benefit from short- and medium-term price fluctuations as an additional incentive.

As SHEN will allow its owners to derive dividends from the exchange between ADA and DJED, developers designed the token so that its Smart Contract limits the possibility for someone to accumulate new tokens once they reach a maximum threshold. This detail will ensure fair distribution among existing holders.

And among the associated benefits for SHEN users, the COTI team notes:

SHEN holders receive all DJED and SHEN minting/burning fees.

They will soon introduce a proxy reward system for SHEN users.

The SHEN price will also correlate with the price of ADA, boosted by an upward multiplier.

And in addition to the above, confirmed Cardano-based decentralized exchanges will also open Yield Farming groups to generate rewards through SHEN.

Given the high expectations among Cardano developers, enthusiasts, and users, several platforms within the network's Decentralized Finance (DeFi) ecosystem have already confirmed that they have the necessary mechanisms to support DJED and SHEN.

There is already feedback from at least two DEX platforms on Cardano, MuesliSwap, and MinSwap that they are ready for the stablecoin launch and will offer these coins as part of the liquidity pools on their services. In addition to the above, COTI's developers have announced that they expect DJED to be available in more than 40 Cardano-based dApps by its launch.

Alongside the development of the stablecoin, COTI has also been working on a DjedPay, a payments application using the stablecoin, which would allow users to transfer tokens to merchants and businesses.

Last November 21, the Cardano Summit 2022, a conference held by the Cardano Foundation, focused on the network itself. During the event, different personalities from the foundation took the stage to talk about the network's performance in 2022. Still, the new implementations being prepared for the ecosystem to have undoubtedly been the most exciting point.

Shahaf Bar-Geffen, CEO of COTI, accessed the event as a guest and asked a key question "Do we want a stable currency in Cardano?". The answer to this question takes the form of the new Cardano stablecoin, named DJED.

DJED has been revealed as the first algorithmic stablecoin to arrive on the Cardano network. The stablecoin will be backed by ADA and SHEN, a reserve asset that will be a backstop for the coin to maintain its 1-to-1 parity with the U.S. dollar. According to the developers, the asset successfully passed its latest audit and is set to launch to the public next January 2023.

DJED's operation is simple; like any algorithmic stablecoin, the interested user can send ADA to a Smart Contract address on the Cardano network. The network will convert the value of the ADA sent to DJED, and the asset can then be converted back to ADA and the tokens retrieved.

SHEN will be a reserve token to ensure parity with the DJED dollar. Loss of parity may occur due to fluctuations in the digital asset market, which may affect the value of ADA. According to management, SHED reserves allow for a 400-800% guarantee rate. SHED will fluctuate in the free market, and token owners will get dividends every time they exchange DJED or SHEN for ADA.

Shahaf Bar-Geffen highlighted implementing a "Proof of Reserve" system for DJED, which allows verification of the token's financial management, already a standard procedure in the industry. Still, after the events with the FTX exchange, the need for transparency within the digital asset ecosystem is almost a must. Proof of reserves reveals the management of the resources themselves, revealing the exact amount and proportion of the distribution of an asset's funds.

The Cardano Foundation used the presentation to unveil DJED Pay, which will launch with the asset next January 2023. DJED Pay is a mobile application that allows users to receive the DEJED token as a payment method. This method makes it possible to make payments with the asset in a much more user-friendly way for Cardano network users.

Cardano's reach in recent years has positioned it as one of the most solid projects today. Still, the crypto market volatility prevents users from taking full advantage of the global nature of Cardano's services as a means of payment, store of value, or money exchange.

Creating a stablecoin anchored to the dollar will generate the necessary investor confidence. It will enable the creation of new financial opportunities in the Cardano ecosystem; this will serve as a backing for a stablecoin that will help reduce the uncertainty around stable algorithmic currencies, especially after the collapse of TerraUSD in May.

Therefore, creating a stablecoin backed by the dollar reserve will help build confidence in Cardano investors and enable stable financial offerings for ADA holders. In addition, this stablecoin will help reduce uncertainty around algorithmic stablecoins, especially after the recent events of FTX and Terra.

Lars Brünjes holds a Ph.D. in mathematics, teaches courses on the Haskell programming language worldwide, and has been following Cardano from an early age as a developer at IO Global for over five years. The initial vision turned into a global network that has grown into one of the largest Smart Contract platforms.

The Cardano native token ADA consistently ranks among the top 10 cryptocurrencies. With the upcoming hard fork "Vasil," Cardano is getting another upgrade that should significantly increase its performance. We wanted to know from Lars Brünjes: What are the concrete improvements, how does the scaling solution "Hydra" actually work, and where does Cardano stand out from Ethereum?

Smart Contracts will become more efficient and cheaper, i.e., they will need less memory and thus fewer transaction fees. With the upgrade, there is a change called Reference Inputs that allows certain classes of applications to transact much more simultaneously in one block than you could before.

It will be more powerful, perform better, faster, and lower storage space and transaction costs. For users, it will mainly be quicker and more affordable. For developers, there will be more opportunities to write even more powerful Cardano Smart Contracts that do more.

With the Hydra, Cardano's Layer 2 solution, you don't do transactions on the blockchain but off-chain. The mechanism is, in principle, quasi-free and as fast as you want. You exchange transactions independently of the blockchain, which is much faster and effectively free, but you can still use the blockchain to secure the transactions.

Bitcoin Lightning works similarly. You use features with time locks and half-signed transactions. Hydra has the same effect that you don't have to use the blockchain to do certain transactions, which is much faster and accessible but still has the security provided by the blockchain. However, Hydra has certain theoretical and practical advantages compared to Bitcoin Lightning.

The Smart Contracts you write for Hydra don't even need to know that they are running on Hydra. So it's a Hydra off-chain network. The part of the blockchain that Hydra handles looks precisely like the actual blockchain from the stakeholders' perspective. You don't have to customize code to run anything on Hydra specifically. That means it's much easier than taking existing stuff and running it on Hydra.

Cardano has been developed from the beginning to be better than Ethereum and not to repeat the mistakes, especially not only those of Ethereum but also of Bitcoin. A big problem with Bitcoin and Ethereum is that they use Proof of Work (PoW), which is problematic, especially concerning climate change. Cardano was the first blockchain in the world where there was a mathematical proof that Proof of Stake (PoS) works.

Many people doubted the feasibility of PoS. Some even PoS was not valid as a consensus algorithm. Cardano showed that it is possible and is much more scalable and energy-efficient than Bitcoin and Ethereum, at least until the implementation of ETH2. Of course, it has environmental and very concrete financial consequences.

The fact that the transaction fees on Ethereum are so high is ultimate because Proof of Work is so expensive. Ethereum's infrastructure for Smart contracts is bold and widely used. Solidity is the most commonly used programming language for Smart Contract development, but it quickly becomes costly. That's why Cardano developers made their blockchain so that the transaction fees are significantly lower.

They also provide two environments from Smart Contract Development. Based on Haskell, the Plutus programming language inherits many characteristics of its parent language, including its functional soul and secure development even at compilation time.

On the other hand, you can use a more straightforward alternative, at least apparently, named Marlowe. It is a Domain-Specific language that uses a graphical approach for programming.

Cardano is a third-generation of Blockchain technology that comes with a Proof-of-stake mechanism. it performs in more scalable and technologically adaptable at any tech emerging occurrence. In trending, NFTs have a set of audiences are occurred in every season and it hasn't downfall under any circumstance. Thus attract your customers via Cardano Blockchain-based NFT Marketplace with distinctive features to amaze your crypto audience. Quote your business requirements about Cardano NFT Marketplace Development with maticz to build your NFT Marketplace in the best place.

Cardano has money inflow on the chart. the last time it happened there was a jump from .22 to .34 cents. If it pumps the same this time, your are looking at a .50 ADA in the next couple days. Alos, great fundementals, and Celsius just said they are moving to the cardano blockchain. It can do now what ETH 2.0 is trying to do with scaling and lower fees. And it is code compatable with ETH so that ERC-20 tokens can easily move to this blockchain. It is in a great place to blast off.

On another front and despite the repetitive crashes everytime there's a #bullrun or #Bitcoin #btc hitting a new ATH, @coinbase is still a powerhouse of a #crypto #exchange and them listing #ADA will definitely and significantly boost the price of #Cardano. My estimation is sometime 1st quarter 2021🙏🏻

Cryptocurrency Hub is an online community platform that covers a plethora of topics related to cryptocurrency and blockchain technology.

We have specialized discussions board related to Bitcoin (BTC) and to the best altcoins currently being traded in the crypto space such as Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Cardano (ADA) and many others!

This is in addition to boasting a variety of other crypto related subjects such as blockchain tech, decentralization, crypto trading and mining, technical analysis, jobs in the fintech space, etc.

We would love to welcome you as an active member of our ever growing online community of crypto enthusiasts, investors, traders, entrepreneurs, businesses and influencers and we genuinely hope you will enjoy your time with us and contribute positively to cryptocurrency and blockchain mass awareness and adoption!