Forum

Sorted by last update

In 2024, the financial industry is becoming increasingly competitive and dynamic, driven by digital innovation and shifting consumer preferences. Whether you're managing a financial advisory firm, a fintech startup, or an insurance company, grow your financial business requires a blend of traditional strategies and modern approaches. Expanding your client base, enhancing brand visibility, and adapting to new technologies are key to thriving in this evolving landscape.

Leverage Digital Marketing

Digital marketing remains a critical avenue for growth in 2024. Financial businesses can take advantage of search engine optimization (SEO), pay-per-click (PPC) advertising, and social media marketing to reach potential clients online. Platforms like LinkedIn, Facebook, and Google Ads are ideal for targeting specific demographics. Investing in high-quality content, such as blogs, podcasts, or webinars, can further position your brand as an industry expert.

Build Trust with Transparency

Transparency and trust are vital in financial services. In 2024, more consumers expect companies to provide clear, understandable information about their offerings. Having a customer-centric approach by providing clear terms, transparent pricing, and easy-to-understand policies can foster long-term relationships.

Enhance Client Experience with Technology

Embracing financial technologies (fintech) is crucial for improving client experience. Utilize tools like AI-powered chatbots, mobile apps, and automated investment platforms to offer personalized and efficient services. Digital tools can help streamline operations, reduce costs, and increase client satisfaction by making financial management more accessible.

Focus on Customer Retention

While acquiring new clients is important, retaining existing ones is often more cost-effective. Implement loyalty programs, offer personalized financial planning, or host exclusive events to keep clients engaged. Regular communication through newsletters or financial health check-ups can further strengthen relationships.

Network and Build Strategic Partnerships

Strategic partnerships with other businesses, such as real estate firms, insurance providers, or fintech companies, can offer mutual benefits. Partnering with complementary services allows you to broaden your offerings, cross-sell products, and access new client bases. Networking events and industry conferences also present opportunities for collaboration and brand exposure.

The rise of blockchain technology has opened new avenues for businesses, including multi-level marketing (MLM). The integration of cryptocurrency into MLM models offers a unique opportunity for companies to enhance transparency, security, and efficiency. With a white-label crypto MLM software that includes auto payment, a user panel, an admin panel, and blockchain integration, businesses can create a highly functional and scalable platform to manage their network and operations effectively.

In this blog, we’ll explore the key components of white-label crypto MLM software and why they are crucial for the success of an MLM business.

1. White Label Crypto MLM Software: A Smart Choice for Businesses

White-label software solutions are pre-built, ready-made platforms that can be customized and rebranded to suit the needs of a business. For MLM companies, opting for a white-label crypto MLM software solution saves time, resources, and development costs. The software comes with essential features that can be tailored to fit the business’s specific requirements.

Some of the key benefits of choosing white-label crypto MLM software include:

Faster time to market: Launch your platform quickly without the need for lengthy development.

Cost-effectiveness: Avoid the high cost of building software from scratch.

Customizability: Personalize the software with your company’s branding, design, and unique features.

2. Auto Payment Integration

In the world of MLM, seamless payment processing is critical. With auto payment functionality integrated into the white-label crypto MLM software, businesses can automate the distribution of rewards and commissions to users. This ensures that participants are paid accurately and on time, boosting trust and satisfaction within the network.

Auto payment integration leverages smart contracts on the blockchain to execute payments automatically when certain conditions are met. This reduces the risk of human error, fraud, and payment delays, making the payment process more transparent and efficient.

3. User Panel: Empowering Participants

The user panel is the interface where MLM participants manage their accounts, track their earnings, monitor downline activities, and access other essential features. A user-friendly and intuitive panel is essential for keeping participants engaged and motivated.

With blockchain and cryptocurrency integration, users can track transactions, view earnings, and manage their wallets securely. The transparency offered by blockchain ensures that participants have real-time visibility into their financial activities and network growth.

Key features of a user panel in crypto MLM software:

Account management: Easy access to user information and settings.

Earnings tracking: Real-time updates on rewards and commissions.

Referral tracking: Monitor downline performance and network growth.

Wallet management: Manage cryptocurrency transactions directly from the panel.

4. Admin Panel: Efficient Business Management

The admin panel is where MLM businesses manage the entire platform, from user activities to financial transactions. A well-designed admin panel enables business owners to oversee operations, manage participants, and monitor payments with ease.

For crypto MLM software, the admin panel often comes with tools to manage blockchain-based transactions, set up auto payments, and ensure compliance with local regulations. Blockchain technology ensures that every transaction is recorded on an immutable ledger, giving admins greater control and visibility over the platform.

Key features of an admin panel in crypto MLM software:

User management: Manage participant accounts, including adding or removing users.

Payment control: Monitor and manage automated payments and commissions.

Network management: Oversee the performance of the MLM network and analyze growth metrics.

Blockchain monitoring: Track and verify all blockchain-based transactions.

5. Blockchain Integration: The Backbone of Security and Transparency

Blockchain technology is the backbone of any crypto-based MLM platform. By leveraging blockchain, businesses can ensure that every transaction is secure, transparent, and immutable. The decentralized nature of blockchain prevents any single point of failure, which reduces the risk of fraud and manipulation.

Moreover, the use of smart contracts allows businesses to automate processes like commission payments, making the entire system more efficient. Since smart contracts are self-executing contracts coded on the blockchain, they operate without the need for intermediaries. This reduces operational costs and enhances trust among participants.

Benefits of blockchain integration for MLM software:

Transparency: Every transaction is recorded on a public ledger, enhancing trust.

Security: Blockchain's encryption and decentralization provide strong protection against fraud.

Efficiency: Automated processes reduce manual work and speed up transactions.

Cost-effectiveness: By eliminating intermediaries, blockchain reduces operational expenses.

6. Why Choose a Crypto MLM Software Development Company?

Creating a robust and scalable crypto MLM software requires expertise in both MLM business models and blockchain technology. A crypto MLM software development company specializes in providing customized solutions that meet the unique needs of your business. They can build white-label software that integrates auto payment systems, user and admin panels, and blockchain technology.

Partnering with a reputable development company ensures that your platform is not only functional but also secure, compliant with regulations, and scalable for future growth.

Conclusion

Incorporating a white-label crypto MLM software into your business can revolutionize the way you manage your network and operations. With auto payment integration, user and admin panels, and blockchain technology, businesses can streamline processes, improve transparency, and create a more efficient and secure MLM platform.

If you’re ready to take your MLM business to the next level, working with a crypto MLM software development company is the best way to ensure you get a tailored solution that meets your specific needs. With the right software in place, your MLM business will be positioned for success in the evolving world of cryptocurrency.

Interested in automating cryptocurrency trading? Building a crypto trading bot helps you trade 24/7 without constant supervision. Here is a simple guide to start your crypto trading bot development journey:

Define your trading strategy: Before you start building your crypto trading bot, you need to define your trading strategy. Decide on factors such as the cryptocurrencies you want to trade, the frequency of trades, and the metrics you use to make your trading decisions.

Choose a programming language: Choose a programming language you are comfortable with and intend to use. suitable for building a trading bot. Popular options include Python, JavaScript, and Java.

Choose a crypto exchange: Choose a crypto exchange that offers an API (Application Program Interface) for trading. Some popular exchanges with robust APIs include Binance, Coinbase Pro, and Kraken.

Understand the Exchange API documentation: See the exchange API documentation. You will understand how to connect to the API, authenticate requests and execute trades.

Develop and test your bot: Start by writing code for your trading bot based on the strategy you have defined. Be sure to include error handling and risk management features. Once your bot is ready, test it thoroughly using historical data or a paper trading account.

Use risk management strategies: Incorporate risk management strategies into your trading bot to minimize potential losses. This can include setting stop loss orders, position sizes and portfolio diversification.

Monitor and optimize your bot: Once the trading bot is running, check its performance regularly. Monitor its profitability and make changes to your trading strategy if necessary. Optimization is an ongoing process.

Stay informed and adapt: The cryptocurrency market is constantly changing, so it is important to stay up to date with market trends and news. Be prepared to adjust your trading strategy and make necessary changes to your bot to ensure it is effective.

In conclusion, starting to develop a crypto trading bot can be an exciting journey. By following these steps, you can create a solid foundation for your project. Be sure to take advantage of the resources available, including Beleaf Technologies, to build a successful and profitable trading bot.

Visit>> https://www.beleaftechnologies...-development-company

Contact details

Whatsapp: +91 7904323274

Skype: live:.cid.62ff8496d3390349

Telegram:https://telegram.me/BeleafSoftTech

Mail to:business@beleaftechnologies.com

Although halving is a fundamental event for the Bitcoin market, there are several misconceptions and misunderstandings about what it entails.

Bitcoin (BTC) halving is a fundamental event for the digital currency that halves its issuance every four years. However, several myths and misconceptions can distort its impact and significance. A few days before the next halving, which will occur around April 20, 2024, it is more than timely to banish the misinformation that revolves around it.

1. Halving impacts the price of bitcoin

Some believe that Bitcoin’s halving automatically causes an increase in its price. But this is not the case. Like any financial asset, its rise depends on the demand and supply balance. The halving bitcoins issued per mined block halves the amount of issued BTC per mined block. The event lowers the amount of BTC released to the market by miners. This decrease in supply allows the price to rise if there is enough demand. It does not happen promptly, since miners can dump coins they have held before into the market.

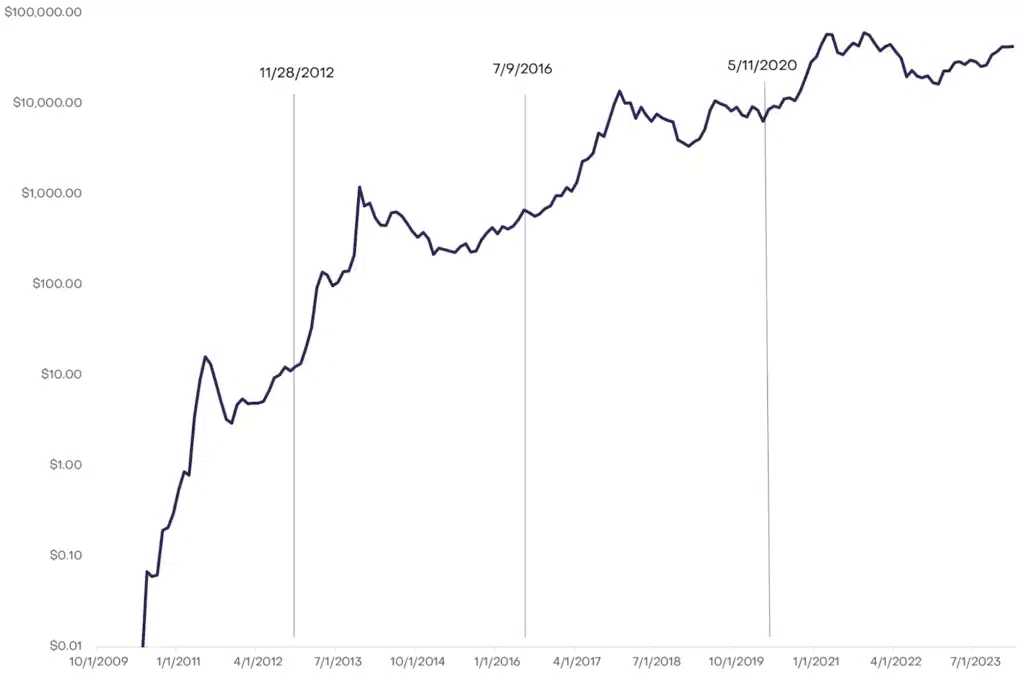

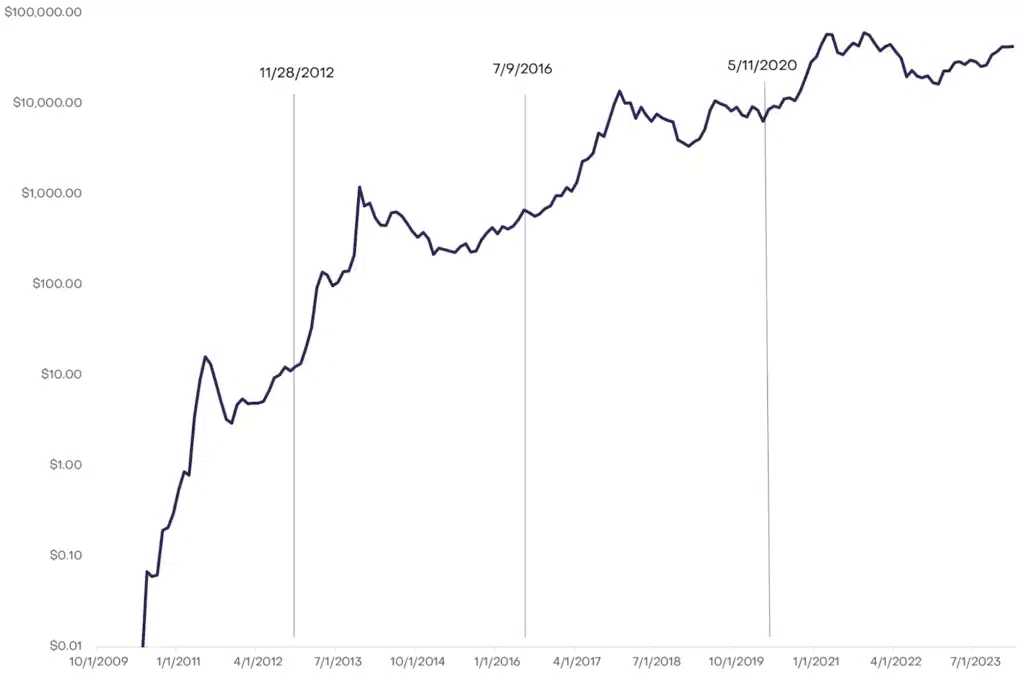

Therefore, halving is a crucial factor for Bitcoin’s rise, but it does not fully determine it, as it depends on the supply and demand perceived at any given moment. Historically, this event has acted as a catalyst amid other macroeconomic conditions, which drove the price to new highs a few months later, as the chart shows.

2. Bitcoin halving guarantees a bullish cycle for all cryptocurrencies

There is a misconception that Bitcoin’s halving triggers a bullish cycle for all cryptocurrencies. But, the truth is that there is no direct relationship between this bitcoin event and the prices of such assets. The rationale behind this myth is that the approach and attainment of halving have always driven a bullish cycle for Bitcoin, generating an impact on cryptocurrencies. With its rising price, investors’ appetite to take more risk grows.

The demand for cryptocurrencies increases, putting upward pressure on their prices. In this scenario, the most popular cryptocurrencies with low capitalization experience yields that exceed those of bitcoin. Many cryptocurrencies do not have solid fundamentals to sustain their rise. That is why, after price surges, large profit-taking occurs, causing its price to plunge, leaving many traders in losses. For this reason, it is essential to foresee the risks involved in trading them. It is also possible that many cryptocurrencies, despite Bitcoin’s halving and the general bull market, will never see price rallies.

3. Bitcoin halving is triggered externally

Some may believe Bitcoin halving is an externally triggered event or human decision. Far from it, this event occurs automatically and predictably every 210,000 blocks mined, occurring every four years. Blocks of the coin are data units containing a set of confirmed transactions. Miners compete to add these to the chain by solving mathematical problems, earning bitcoin as a reward for their work. The protocol that gave birth to Bitcoin 15 years ago determined these actions. The creator behind all this uses the pseudonym Satoshi Nakamoto.

4. Bitcoin halving is equivalent to deflation

Although halving decreases the issuance of new BTC, this process is not equivalent to deflation. This term fits better for monetary systems where issuance is negative (i.e., there is coin destruction), which is not the case for such a digital currency. The number of bitcoins in circulation will continue to increase until reaching the maximum limit of 21 million BTC. What halving produces is that, until reaching this milestone planned for 2140, the issuance rate halves every four years or so, as seen below.

Some prefer to call Bitcoin “anti-inflationary,” as it will cease to have an inflationary monetary system when no more coins are issued. This characteristic is one of its bullish catalysts that makes it different from fiat money, pressured to devaluate by its unlimited issuance at the hands of governments.

5. Halving makes Bitcoin mining unprofitable

Since halving halves the amount of bitcoins issued in each block, some think it makes mining no longer profitable. However, the activity remains profitable if the BTC price remains higher than mining costs. In the end, for it to be profitable, it all depends on supply and demand in the market and whether miners can adjust their operations to adapt to the new environment of reduced rewards.

The challenge for miners in halving correlates to technological advances that allow them to do their business at lower costs through more energy-efficient equipment. Therefore, we expect that efforts to find innovations will continue as long as interest in Bitcoin continues. If the number of Bitcoin miners decreases, the remaining miners could mine more coins on average. Therefore, while halving may lead some to quit the activity, others get favored as long as they can profit from their achieved holdings.

6. Bitcoin halving increases transaction fees

There is a belief that Bitcoin halving increases transaction fees on the network. However, while this event may have an influence, it does not directly and necessarily lead to it. As rewards for miners decrease for such an event, miners may select transactions with higher fees to include in the blocks they mine. The action depends on whether demand wants to pay more expensive fees; otherwise, this will not be the case. Therefore, supply and demand determine transaction fees.

7. Halving is the only element that gives Bitcoin its value

Although bitcoin halving is critical for the scarcity of the currency, it is not the only element that gives it value. Multiple factors make this asset considered valuable digital money to people. Anyone can access Bitcoin without any restriction and can transfer it freely. Also, if you use self-custody wallets to do this, it is impossible to confiscate holdings and allow them to be kept private.

Likewise, the value of Bitcoin lies in the fact that its issuance is defined and done in a decentralized way by those who want to be part of this activity. All this occurs while maintaining the security of the network. All these attributes motivate the demand for Bitcoin, propitiating its upward trend. These characteristics led some to label the currency as a store of value.

Understanding these common misunderstandings is critical to interpreting the impact of halving on Bitcoin and cryptocurrencies, especially at this time when the eyes of the market are on this important upcoming event.

Embark on the forefront of the latest online trend – NFT trading, and delve into the art of crafting NFTs using the powerful Chainlink Oracle. Whether you're a seasoned NFT trader or just venturing into this dynamic space, understanding the sixteen versatile ways to leverage Chainlink oracles for NFT creation is essential.

In this blog post, you''ll read about What are Dynamic NFTs, its importance, real-time examples, How To Create it Using Chainlink Oracles and how much cost to develop an Dynamic NFTs.

Introduction:

In the age of digital agility, the future of finance belongs to the decentralized crypto exchanges, or more known as the DEXs. As it differs from the conventional centralized exchange systems, DEX empowers traders to have full control of their funds and property. In Justtry Technologies, Madurai, we keep ourselves committed to helping startups or enterprises with decentralized crypto exchange development solutions.

A decentralized crypto exchange simply means that it is a marketplace where buyers exchange assets with sellers in the crypto currency market. While CE’s work based on third-party servers; Decentralized exchanges are based on blockchain, which provides complete transparency, security, and autonomy of the user’s assets. As the world moves towards DeFi there is a constant need for the best and efficient decentralized exchange DEX.

That is why at Justtry Technologies, we are focused on building an intuitive, safe, and highly-scaled decentralized exchange. Thus, we employ a team of blockchain specialists to design sophisticated DEX platforms that meet business objectives. At EZ Exchange we believe in creating tools for trading that also consider security as an equally important factor in providing good trading platforms.

Key Features of Our Decentralized Exchange Solutions:

Enhanced Security Measures: Mechanisms that involve multi-signature wallets, and the encryption of data to enhance security.

Customizable Interface: A trading platform that caters for the investors’ needs in the most convenient and effective manner.

Cross-Chain Interoperability: Integration of multiple blockchains that will enable asset swaps across the chains.

Liquidity Management: Sophisticated algorithms of executions for best price/liquidity execution and trade matching.

Continuous Support and Maintenance: Constant support to ensure your platform’s up and running as it should be 24/7.

Conclusion:

From the present time, the decentralization of finance is in progress and with the advancement of blockchain technology, decentralized crypto exchanges are present at the core. Justtry Technologies, we are excited about the decentralised finance (DeFi) concept in the world of trading and moving value in digital assets. Our development services for decentralized exchanges aim at providing business, start-ups and other enterprises with the necessary tool to build a reliable, efficient and adaptable trading system to fit their particular needs and requirements of the market.

In our capacity as a reliable ally for blockchain development, we owe it to ourselves to create solid decentralized systems that are engaging, secure, and optimized. To add, at CaseWare, our team comprises professional blockchain developers and auditors to guarantee that each DEX platform that we build complies with best practices and boasts of the highest levels of efficiency. SelectingJusttry Technologies means selecting a future in which your enterprise stands at the vanguard of the decentralized finance industry. Welcome you as our guest on this journey to revolutionise the way the world trade, invest and transact using digital assets.

Halving reduces miner rewards every four years, which could increase value, but volatility may influence it.

Bitcoin Halving History Lessons. The crypto world is on the threshold of a crucial event: the expected Bitcoin halving in April 2024. This phenomenon has profound implications for supply, demand, and, of course, the price of the pioneering cryptocurrency. Incidentally, halving, a phenomenon that occurs every four years, halves the reward miners receive for each block of Bitcoin they generate. This mechanism seeks to limit the total amount of Bitcoin, set at 21 million. But how does halving affect the price?

Halving has several impacts on Bitcoin. First, it decreases the supply of Bitcoin on the market, making the cryptocurrency potentially more valuable. Available supply can lead to significant BTC price increases. A price surge occurred in previous halvings. However, it is crucial to consider the crypto market volatility. Results can vary.

Background of Bitcoin halving

When we analyze the above, we observe some patterns. For example, each has been followed by a significant increase in the Bitcoin price, although the timing and magnitude of this increase have varied. To cite one situation after the first halving, the price experienced exponential growth the following year. In the subsequent ones, the consequence was the same: an exponential increase in price, although with a slightly different behavior, as the rise came with a delay. This is because market conditions were different, something we must consider when the long-awaited halving of 2024 arrives.

For a clearer view, the first time it happened was in November 2012, when the miners’ reward decreased from 50 to 25 Bitcoin per block. Before the halving, one Bitcoin was worth about $12.31. After the event, the price remained stable for a few months and climbed to over $1,000 in November 2013. For this first halving, its community was relatively small, public awareness of cryptocurrencies was limited, network computing power was low, and mining costs were lower.

Expectations and results on price

Next, the second halving took place in July 2016, reducing the reward to 12.5 Bitcoin per block. Before the event, one Bitcoin was worth around $650.63. After halving, the price experienced a slower rise but reached over $19,000 in December 2017. Bitcoin has achieved greater general recognition. This event attracted increased attention, which led industry insiders to anticipate a positive impact on the price to offset the reduction in rewards to miners.

The third halving occurred in May 2020, at the height of the pandemic, reducing the reward to 6.25 Bitcoin per block. Before the event, one Bitcoin was worth about $8,800. Subsequently, the price declined slightly but raised to $69,000 in November 2021. It effectively captured worldwide attention, which intensified the focus on its future. Numerous investors and analysts tried to predict the direction of Bitcoin’s price after that halving.

We expect the next Bitcoin halving event to take place in April 2024, and investors will have to wait and see how this event will affect its price. Finally, it is worth mentioning that the first three Bitcoin halves coincided with periods of global economic and financial prosperity. By the way, staying informed and being prepared to take advantage of these fluctuations is essential for those interested in entering the Bitcoin market.

I leave with this quote from Saifedean Ammous: “The Bitcoin halving is like a clock that marks the passage of time in the digital economy every four years, signaling that the system works as designed and that the system controls predictably the Bitcoin supply.”

Myths and truths

This event has generated several myths and realities. Below, I will provide you with some of them:

Myth 1: Halving leads to Bitcoin scarcity

Fact: Although halving reduces the rate of creation of Bitcoin, it does not automatically lead to a shortage. The total supply of Bitcoin is limited to 21 million, and halving adjusts the creation rate of new Bitcoins. Scarcity has been an intrinsic feature of Bitcoin since its original design.

Myth 2: Halving affects the price of Bitcoin.

Fact: Historically, Bitcoin halving is associated with significant increases in the Bitcoin price. Price movements are because the reduction in miner rewards can reduce Bitcoin supply in the market. With steady or increasing demand, this decrease in supply can lead to an increase in the price of Bitcoin.

Myth 3: Bitcoin halving makes mining less profitable.

Fact: Bitcoin halving, on the one hand, reduces miners’ rewards, potentially affecting mining profitability. However, it is crucial to note that many miners continue their operations even after halving. They maintain the conviction that the price of Bitcoin will increase sufficiently to compensate for the reduced reward. In addition, technological advances in mining may boost efficiency and, consequently, miners profitability.

Bitcoin, a prominent cryptocurrency, undergoes significant milestones referred to as halving events, which wield substantial influence over its network dynamics. These events involve reducing the mining reward by half. Before 2020, miners received 12.5 bitcoins (BTC) for successfully mining a block.

In this article, we'll delve into the economics behind Bitcoin's halving, examining its impact on price movements and market sentiment. Understanding these dynamics offers valuable insights for both investors and cryptocurrency enthusiasts.

Bitcoin Halving Overview

Bitcoin Halving is an event occurring every four years in the network. It involves the reduction of the block reward received by Bitcoin miners for adding new blocks to the blockchain. Initially set at 50 Bitcoin for each block in 2009, the reward was later halved to 25 Bitcoin in 2012 and further reduced to 12.5 Bitcoin in 2016. This event influences not only supply control but also the economics of Bitcoin mining, incentivizing miners to become more efficient and adapt to lower rewards.

Supply and Demand Dynamics

Bitcoin halving directly impacts the supply and demand dynamics of the cryptocurrency. By reducing the rate at which new BTC enters the market, halving effectively decreases the available supply. According to basic economic principles, when supply decreases while demand remains constant or increases, the price of Bitcoin tends to rise. The scarcity effect generated by reduced supply may drive the price upwards if demand remains steady or increases.

Bitcoin's controlled supply, limited to 21 million coins, is a crucial factor in its value proposition. The halving mechanism gradually reduces the rate of new BTC production until the maximum supply is reached. This scarcity, combined with increasing recognition and adoption, creates a perception of limited availability, potentially increasing demand and impacting the price.

Historical Price Movements

Historically, halving events have been linked with substantial increases in Bitcoin's price, exhibiting significant upward momentum before and after previous halvings. For instance, during the 2012 halving, Bitcoin's price surged from about $12 to over $200 within a year. Similarly, after the 2016 halving, Bitcoin experienced a notable recovery, reaching around $19,700 in December 2017.

After the most recent halving in May 2020, Bitcoin's price surged from $8,787 to nearly $69,000 in November 2021.

Investor Sentiment and Market Perceptions

Bitcoin halving events often trigger heightened market attention and anticipation. The prospect of reduced supply and potential price surges tends to foster positive sentiments among investors and traders. This optimistic outlook could drive increased demand for Bitcoin as traders seek to capitalize on anticipated price hikes. Consequently, a Bitcoin halving might create a self-fulfilling prophecy, boosting market sentiment and spurring demand.

However, it's important to note that during halving events, market sentiment isn't always uniformly positive. There can be instances where market participants experience fear, uncertainty, and doubt (FUD) concerning the potential consequences of a price halving. Conflicting sentiments can lead to short-term price fluctuations and increased market volatility.

Network Security and Long-Term Outlook

Despite the initial impact on mining economics, Bitcoin's halving plays a vital role in ensuring the network's long-term security and stability. The carefully managed decline in block rewards encourages miners to continue securing the network through transaction validation. As mining adapts to decreased block rewards, the network becomes more robust and less reliant on freshly created currencies for security.

Impact on Mining Economics

The decrease in block rewards caused by halving directly affects miner profitability, impacting their income from block rewards and transaction fees, crucial for confirming transactions and safeguarding the Bitcoin network. Consequently, after a halving event, miners might find it less profitable to operate, potentially leading to a drop in mining activity.

In summary, Bitcoin halving significantly influences the cryptocurrency's supply dynamics, impacting its price and market sentiment. Understanding these effects is crucial for participants navigating the ever-evolving landscape of the cryptocurrency market.

A man was going to the house of some rich person. As he went along the road, he saw a box of good apples at the side of the road. He said, "I do not want to eat those apples; for the rich man will give me much food; he will give me very nice food to eat." Then he took the apples and threw them away into the dust.

He went on and came to a river. The river had become very big; so he could not go over it. He waited for some time; then he said, "I cannot go to the rich man's house today, for I cannot get over the river."

He began to go home. He had eaten no food that day. He began to want food. He came to the apples, and he was glad to take them out of the dust and eat them.

The fourth halving is anticipated by moneymystica to occur at the beginning of 2024. It is one of the few factors that can affect Bitcoin’s price. Because bitcoin is one of the most volatile assets, it’s worth investigating some of the factors that may influence its price.

The White-label NFT marketplace has been one of the most popular platform development in the NFT verse. The massive and beneficial growth of non-fungible tokens provides various opportunities for business minds and entrepreneurs to succeed. This time-saving and customizable solution facilitates one to customize them according to their preferences. Doing in-depth research on whether that platform development is right for one by strategic business analysis is before starting a business. Once started, the platform owner should only focus on the development and beneficial progress of the platform to attain its target audience and high success.

many entrepreneurs and business owners are interested in involving in the blockchain space. To support their venture, an IDO platform proffers its valuable advantages. An Initial DEX Offering (IDO) is a crowdfunding method that enables business minds to raise funds for their project development. As with any other platform, an IDO platform also needs effective IDO marketing strategies to stand out among other platforms.

A white-label solution is a pre-engineered NFT marketplace that enables its users to customize the platform according to their needs and requirements. Many entrepreneurs and business owners opt for this solution as they are cost-effective and time-saving. A White-label solution consists of similar features and functionalities of a popular NFT marketplace, which can be customed to launch a new NFT marketplace.

Mind-boggling NFTs which are recently launched, blue-chip, rarity, or utility-based tokens which are commercially available in the web3 need some medium to be sold. The high frequency of its presence in blockchains preserves ownership and uniqueness. In this essence, developers also found the solution to sell them in a more customized form so that everyone could avail of them, which is nonetheless a white-label NFT marketplace. A familiar trading platform now, that showcases millions of Non-fungible tokens which are decades of innovation. Then how does the white-label NFT platform work?

The talk about cryptocurrency exchanges has been increasing rapidly in recent years. There are many leading cryptocurrency exchange platforms in the crypto marketplace. Among them, Bittrex is one of the top exchanges. This exchange consists of the best security features and an easy user interface. So many entrepreneurs showed their interest in starting their own cryptocurrency exchange by using the most effective solution - Bittrex clone script

Bittrex clone script is a tailor-made crypto exchange clone software that helps you to set up a cryptocurrency exchange like Bittrex. This script includes all the current features, functionalities, and plug-ins of the bittrex exchange.

By using this script, you can develop your currency exchange easily at a budget-friendly cost. This clone script is modifiable according to your business requirements. So you can enable additional security features or functionalities to your cryptocurrency exchange platform.

Salient features of bittrex clone script

- Admin panel

- IEO Launchpad integration

- Security token interchange

- Payment gateway integration

- Cryptocurrency wallet integration

- Attractive UI/UX and more

Security features of Bittrex Clone Script

- Data encryption

- SSL integration

- Two-factor authentication

- Cross-site forgery protection

- Cross-site request forgery protection

- Service site request forgery protection

If you are an entrepreneur planning to create a cryptocurrency exchange platform like Bittrex within a short period at a budget-friendly price, then the Bittrex Clone Script is the best choice for your exchange business. You can get the best Bittrex Clone Script from a top-notch crypto exchange clone script provider.

By contacting them, you can get more clarification about the Bittrex Clone Script.

Developing a Binance-like crypto exchange is the best way for established firms and entrepreneurs to generate huge revenue in the cutthroat crypto sphere. Rather than developing the Binance clone from scratch, one can go for a budget-friendly Binance clone script. Binance clone script is a 100% ready-made, customizable, secure, and multi-tested clone script software that is a perfect replica of the Binance crypto exchange platform. Get the best Binance clone script from a leading crypto exchange development company in the market. Conduct deep research before finalizing the best Binance clone script provider in the market.