The crypto market has been a trending topic for the past few months. Too much has happened, much more than the market can bear.

Pic by @unarchive on Unsplash

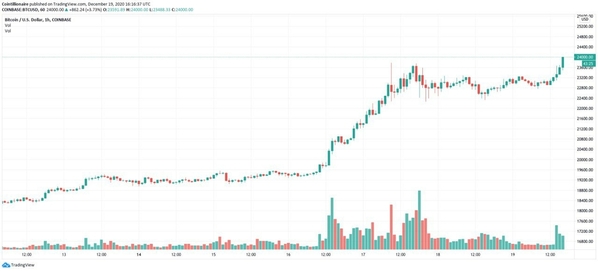

The most recent price level of bitcoin is around $41,000. This level reflects an early recovery to the most recent low, but there is still a long way to go. So far, bitcoin is much closer to halving to the all-time high of $69,040 in November last year than to a strong recovery or experiencing new highs.

While it is uncertain what may happen, the chances of a fall are somewhat closer, and this has put many cryptocurrency investors on edge even if the upside is positive. For now, the suffering of investors continues. On the subject, Pan Helin, a member of the Expert Committee of the Ministry of Industry and Technology and executive director of digital economy research at Zhongnan University, told reporters that he expects bitcoin to go into recession in a few years.

Perhaps this opinion has a lot to do with China's attitude recently, but it is something that many market analysts have already commented on. While it is not a fact, it is one of the many possibilities on the table that directly threaten the financial stability of many countries and that of investors of different levels.

Bitcoin loses an advantage over traditional currencies

Some say that bitcoin has been gaining ground in the conventional economy for some time now. More people are betting on cryptocurrencies and preferring them over traditional currencies due to ease of access and apparent resistance to inflation.

Yin Zhentao, from the Institute of Finance of the Chinese Academy of Social Sciences, reminded people that the differences between traditional currencies and cryptocurrencies are more than stark. First, the latter are nothing more than digital commodities and have no currency quality, thus lacking security and other positive features that traditional currencies do have.

In addition, he assured that any digital currency that is out of regulation does not have the legal right to circulate in a country, presenting severe operational risks for investors and nations. Although many countries do not have serious rules, this is a matter of time. As for Zhentao, cryptocurrencies will not survive much longer than they already have.

For this analyst, the most prosperous days of cryptocurrencies have already happened. The remaining time is full of uncertainty and what many call a definitive fall. This theory postulates that bitcoin and other cryptocurrencies will become worth $0. If this happens, the losses will be immense and economic stability will be a thing of the past.

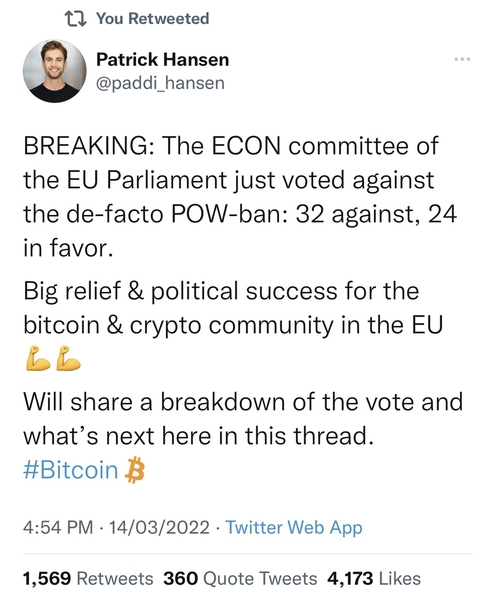

Regulation will become increasingly restrictive.

China was the first country to establish fairly specific regulations on cryptocurrencies. While other nations had already issued bans, China went further by banning all types of activity involving cryptocurrencies. It is now illegal in China to buy, sell, hold, exchange, and mine cryptocurrencies.

China's regulatory changes have caused the crypto market to change forever and have left it in a place of quite significant danger. With China's bans, the regulatory environment globally has started to grow considerably. Many institutions are having conversations about the future of bitcoin and cryptocurrencies in general, and unfortunately, the sentiment is somewhat pessimistic.

Many analysts who have taken Invesco's forecasts into account claim that considering the last ten major events that have had to do with cryptocurrencies, the bitcoin bubble will finally burst next year. They say that the cryptocurrency's price could be lower than $30,000 causing multi-billion dollar losses.

Also, last February 4, Gary Gensler, the U.S. Securities and Exchange Commission chairman, commented that there is no clear proposal to regulate cryptocurrencies. The U.S. has had years of back and forth with the crypto issue, and although the topic is now being touched on more insistently, there is still a long way to go.

One positive thing about this that benefits the market is that the U.S. is one of the leading cryptocurrency mining and trading countries. Cryptocurrencies being in a regulatory gray area has helped the market's growth globally. Also, most institutional investment comes from there, but it doesn't mean that everything is perfect.

The SEC has already assured that cryptocurrencies like bitcoin are vulnerable to fraud and manipulation, so all is not rosy. It is likely that when they decide, the situation in the United States and the whole world will change dramatically.

The IMF has spoken out

One of the most important events for the crypto market and bitcoin happened last year. El Salvador, a Central American country, passed the bitcoin law in which the popular cryptocurrency became a legal tender. This revolutionary change would mark a before and after for cryptocurrencies.

However, it seems that things could get a little complicated for El Salvador and the regulation. Last January 25, the Executive Director of the International Monetary Fund urged El Salvador to change the regulatory status of cryptocurrencies and eliminate the law that allows bitcoin to circulate as a legal tender. The rationale for this is that this cryptocurrency threatens financial and economic stability.

In addition, the executive director of the IMF conducted a consultation on the law of El Salvador. He assured that they could do so if the executive directors consider regulating bitcoin differently because it represents risks to financial stability, integrity, consumer protection, and related fiscal policies.

In short, the IMF has also been urging the authorities below the president to discuss the regulatory issue. They want to change the status of bitcoin in the country. Already on different occasions, Salvadoran CEOs have expressed their concern about the risks posed by cryptocurrencies. Although there are no specific figures, some estimations say that El Salvador's losses with the most recent fall of bitcoin are too high.

The issue is that the president disagrees with changing bitcoin's status. Last year the country's parliament passed the bill in June. It made bitcoin a legal tender. El Salvador was the first country to approve such a measure when it went into effect in September of the same year. But for some, it has been the first country in the world to put its citizens at risk.

Things could get more and more complicated

El Salvador was not enough. The regulatory trend is practically worldwide. Last January 20, the Central Bank of Russia commented that it was considering submitting a proposal to ban cryptocurrency trading and mining of this asset class. This project intends to ban decentralized digital assets from being used in any activity in the country.

Regulatory agencies in the UK, Spain, and Singapore spoke against cryptocurrency advertisements. They think that ads put the protection of investors at risk. As a result, the possibility of much stricter regulations on promotions has been raised, which could seriously affect the market.

With everything going on right now, it is practically a perfect combination for the collapse of the overall crypto market. For many analysts, that bitcoin and the market will collapse is unavoidable. It's something they've been expecting for a very, very long time. The thing is, we hear this kind of commentary all the time as every time bitcoin crashes, the naysayers use it as an excuse to discredit cryptocurrencies.

The truth is that the year has just begun, and many predictions claim that the value of bitcoin and other cryptocurrencies could increase considerably in the coming months. Some projections suggest that the value of bitcoin could reach $100,000 very soon if the conditions are right. But so far, it is uncertain what will happen to the market tomorrow. Everything could change radically, but it is not known for better or worse.