Cardano is a third-generation of Blockchain technology that comes with a Proof-of-stake mechanism. it performs in more scalable and technologically adaptable at any tech emerging occurrence. In trending, NFTs have a set of audiences are occurred in every season and it hasn't downfall under any circumstance. Thus attract your customers via Cardano Blockchain-based NFT Marketplace with distinctive features to amaze your crypto audience. Quote your business requirements about Cardano NFT Marketplace Development with maticz to build your NFT Marketplace in the best place.

Forum

Sorted by last update

In the crypto industry, Binance Smart Chain is famous for Crypto token Development. Binance Smart Chain holds some popular token standards namely BEP20, and BEP721. Among these, BEP20 is the most preferred choice for token development among many startups and entrepreneurs.

BEP20 has advanced features so it makes it easier for startups to raise funds. It is a fungible Token standard that uses a smart contract to create new BEP20 tokens. In fact, this means that it relays the set of rules which apply when creating and deploying new tokens. The BEP20 is equivalent to the ERC20 token standard of Ethereum.

Key benefits of BEP20 tokens:

- BEP20 tokens have a high value in the crypto market, so funds can be raised quickly

- Manage a large number of transactions in a short time

- Transactions fee is lower for all types of transactions

- BEP20 tokens can be exchanged for BEP2 tokens

- Many crypto wallets support BEP20 tokens so users can store and receive, transfer the token globally

To create a BEP20 token on the Binance smart chain on your own, then you need to consider some essential steps. Such as name, symbol, supply, features of the token, and more.

If you are willing to develop BEP20 tokens on your own without spending your time and effort, then choose the renowned BEP20 Token Development Service Provider. They will help you to create BEP20 tokens with updated technical and essential features. So that startups can raise their funds easily to develop their business.

For more information About BEP20 Token Development

Whatsapp / Telegram: 91 95005 75285

Email: hello@icoclone.com

Skype: live: hello_20214

NFT Marketplace Script is a ready-to-deploy White label NFT Marketplace Solution that helps you to start your own NFT Marketplace like Rarible, Opensea, etc.

Being a top-rated NFT Marketplace clone script provider, Maticz provides a complete tech suite of NFT Marketplace Clone Script with a clean code structure assuring the best NFT trading experience to your users. Get out a robust NFT Marketplace Clone Script, customize it based on your business requirements, and deploy your NFT Marketplace Platform.

Rarible clone script is a complete source code to launch the NFT marketplace. Rarible clone is built over Ethereum blockchain and helps aid in the mint token, sell, and buy NFTs.

Zodeak will offer the beszt Rarible Clone Script that can help you launch your NFT marketplaces like rarible with advanced features and functionalities.

Feel Free to consult with our experts

Whatsapp – +91 9360780106

The new development improves privacy and lowers fees and transaction costs on the Ethereum Blockchain. Aztec has unveiled the first transactions with its new rollup.

In Short

Aztec focuses not only on enabling lower commissions but also on more privacy.

It had been announced in March and was in the testing phase, but now it started trading on Ethereum.

Ethereum users have a new option for cheaper and faster transactions. It is the Aztec rollup, which also adds privacy benefits when trading. Like Ethereum's other second-layer Ethereum rollup scalability solutions, Aztec's primary purpose is to lower the fees paid for each transaction at the network's main (L1) layer. The fee reduction is achieved by grouping or "rolling up" several of them into a second layer, then moving them all together and paying the fee for a single transaction.

However, as described on the Aztec official site, the new feature also allows for greater privacy by encrypting information about the participants of a transaction so that their transaction history is not visible. Thomas Walton-Pocock, CEO of Aztec, announced the development of this rollup in late March. Even Vitalik Buterin, the co-founder of Ethereum, highlighted the novelty through a Twitter post.

However, although it already existed, it was not until last Wednesday, June 15, that the rollup brought its first transactions to Ethereum's main layer (L1), as reported by Aztec through its account on the social network.

Features of the Aztec rollup for Ethereum

In a post on Medium, Aztec's CEO had explained that it is a zero-knowledge or "zero-knowledge" rollup, which uses proofs of validity to prove the existence of a valid chain. Its differences from optimistic rollups have been explained in a Vantica Trading article. They are based precisely on the method each adopts to prove the validity of the transactions it covers.

Aztec allows up to 100 transactions per second (TPS) at the core layer. Its operation and the functionality it attempts to offer in terms of privacy make the rollup somewhat less efficient than others focused solely on cost and speed. In theory, the latter rollups provide up to 2,000 TPS or even more.

As Walton-Pocock describes in his article, several technical factors make privacy-focused rollups like Aztec more challenging to execute, driving up the time and cost demanded by each transaction.

To offer more affordable rates and greater privacy, Aztec uses a protocol called ZK-SNARK (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge). It consists of cryptographic proof allowing a transaction participant to prove that they have specific information without disclosing it.

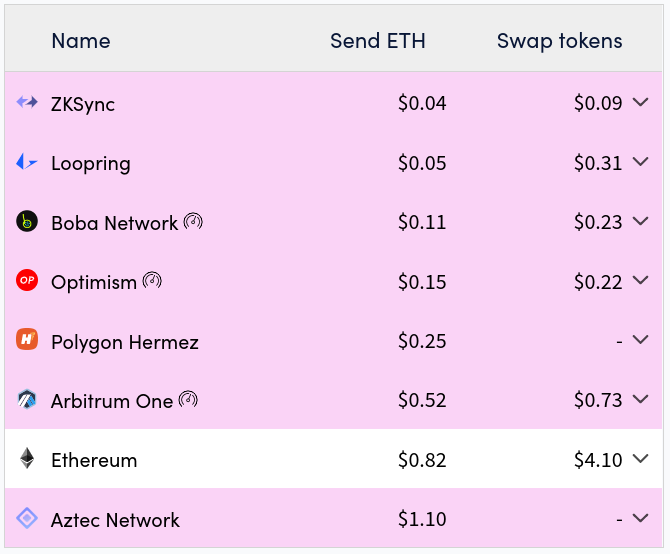

How much does it cost to trade with Aztec and other rollups?

Data from the l2fees.info site shows Aztec is the rollup with the highest commission for trading Ethereum. Currently, the fees are even above those of L1, but this situation is not frequent. In April, with the rollup still in the testing phase, this newspaper reported that its fees were $0.67 lower than Ethereum's L1.

And what precisely are rollups? They are second-layer scalability solutions that "wrap" many transactions and bring them all together to the L1. In this way, the user can take advantage of the network's security by paying a lower fee than the main layer when entering the rollup.

ETH2 poses specific economic changes from the current version of the network. What will happen to ether (ETH) after The Merge?

In Short

The economics of ETH will get based on two factors, coin minting, and fees.

Cryptocurrency issuance depends inversely on the amount of ETH staked.

Aside from the changes that Ethereum 2.0 will bring to the current network, it also raises questions about what will happen to ether (ETH), Ethereum's coin, after The Merge, the network's transition to the new version, which will take place in the second half of this year. Twitter user DeFi Surfer (@808 Investor) wrote a thread on Twitter detailing the future of ether in the following months to explain what will happen.

According to these discloser details, which relied on publications by well-known Ethereum developers such as Justin Drake, Ryan Berckmans, North Rock Digital, and 0xHamZ, the network's economy will move from two factors. These are the issuance of ETH to reward validators and the commissions paid on the network.

The issuance of new cryptocurrency units will now remain in the hands of validators and not miners. The mechanism has its roots in a compensation structure dependent on the number of validators, as explained in the Ethereum 2.0 roadmap.

The chart shows that ETH issuance dilutes as users stack more ETH (i.e., deposited as collateral) on the network. Using this math, with a total of 15 million ETH staked (currently, there are 12.7 million, according to beaconcha.in), you can compute that those validators will earn around 700,000 ETH a year for their contribution to the network.

On the other hand, speaking about commissions, since the implementation of EIP-1559, about 70% of those commissions get burnt, an improvement proposal that modified Ethereum's reward and fee mechanism. The other 30%, meanwhile, goes to reward validators.

In this regard, the more activity on Ethereum, the higher the number of fees paid. If fees go up, more cryptocurrency units will get out of circulation. Thus, in the future, the use of Ethereum will contribute to reducing the circulation of its cryptocurrency.

So far in 2022, Ethereum's gas consumption (i.e., fees) ranged from 248,400 ETH in March to 301,000 ETH in January, according to Glassnode data. Projections show that the Ethereum blockchain would consume 3.2 million ETH annually by the end of 2022, of which only 978,000 ETH would remain in circulation.

Ethereum will become deflationary in the long run

In version 2.0 of the network, users expect Ethereum to become deflationary. The issuance of its ether cryptocurrency will be less than the amount burned. For practical purposes, DeFi Surfer calculates the economic outlook for Ethereum 2.0, considering the staking of 15 million ETH and total commissions of 2.2 million ETH per year.

The consequence is that Ethereum would get a deflationary rate of 0.7% annually. Of the 2.2 million in commissions, 70% (1.5 million) will get burned. The remaining 700,000 ETH would go to validators.

ETH staking is likely to increase when the merger finalizes because there will already be more certainty about how the network will work. The lock-in period for funds to be a validator will be shorter than now (where coins are locked indefinitely, at least until the merger occurs). It could also raise the return for validators to be on par with other networks that operate on a proof-of-stake (PoS) basis.

With this, the discloser's theoretical calculations indicate that it could go from the current 11% of the circulating 120 billion ETH staked to a potential 28% after the merger, translating, as stated, into lower ETH issuance. But ether deflation can be achieved, according to DeFi Surfer, even with low on-chain activity. In the event of lower-than-average fees, issuance will reduce compared to the current allocation, so not as much ETH will need to be burned to regain a correct balance.

Added to this, if the activity on the network is higher, the burns will be even higher. Therefore, the negative balance would increase even more, and with that, Ethereum would become deflationary even faster. Currently, Ethereum has a primarily positive balance in terms of daily ETH issuance, as seen in the chart below.

The merger of Ethereum 2.0, a key milestone for the network

Developers are betting on achieving the expected transition in the year's second half. However, the difficulty pump, which will end mining as we know it, has already been postponed several times. In the meantime, the whole process is still being tested and refined in test networks.

The CFXN Token is a utility token that allows users to use the platform's services. The token is based on Ethereum and uses the ERC20 standard. The token allows users to pay for goods and services on the platform, as well as receive discounts and rewards. Additionally, the token can be used to invest in projects on the platform.

CFXN Token investing is a great way to get in on the ground floor of what could be one of the next big cryptocurrencies. While there is risk associated with any investment, CFXN has a strong team behind it with a proven track record. If you're interested in getting involved, now is the time to do so before the price goes up even more.

QuickBooks Point of Sale is a software programme that helps small business owners keep track of their sales and inventory. Business owners can use the programme to track product sales and instantly see how much inventory they have left. The programme is designed to replace the traditional cash register and works in conjunction with other QuickBooks accounting software. The programme is designed to make inventory management much easier; once inventory is entered into the programme, all changes automatically update inventory status.

1. Launch QuickBooks Point of Sale and choose "New Item" from the "Inventory" tab on the main menu. Enter the information you want to include for each individual item you're adding to your inventory. Specify the department to which the item belongs, the item's name, and any other relevant information about it, such as colour, size, brand name, and so on. You can also upload an image for the item.

2.

Indicate how many of the item you currently have in stock. Once you've entered the quantity, the programme will automatically update whenever you sell an item. QuickBooks Point of Sale also allows you to set a reordering reminder when the quantity falls below a certain threshold.

3. Fill in all of the information for the item's price and the order cost for yourself. The item price will be applied to sales of the item, and the order cost will assist you in keeping track of profit and loss each time you need to replenish the item's inventory. After adding each item, remember to save the information. If you do not save the data, you will lose everything you have entered.

4. Continue to add information about each inventory item. Once you've entered all of the product information you want to include, go to the "Inventory" tab and select "Item List." This will allow you to see all of the items in your inventory and make changes as needed.

5. Select "Reports" from the main menu's "Reports" tab, and then "Items." You will be able to review inventory reports as a result of this. Choose the report you want to look at and click "View Report." By selecting "Modify Reports," you can also change the reporting dates you want to see.

CFXN Token is an ERC-20 token built on the Ethereum blockchain, which means it’s based on the “Ethereum standard.” This makes it compatible with any wallet or exchange supporting tokens of this type.

Libonomy was created to make digital currencies easier to understand and use. Libonomy believes in the power of blockchain technology, but also knows that most people don't have time for all the details- they just want an easy way to buy, sell or trade their coins without having to worry about technical stuff like wallets or exchanges. Libonomy platform enables this from your mobile phone with no fees! It's so simple anyone can use it.

Uniswap Clone Script is the ready to use defi exchange platform like Uniswap which is built in Ethereum Blockchain. We are at Maticz, who provides bug free Uniswap Clone Script with advanced features to give the best trading experience for the users. Our Uniswap Clone Script supports both swapping and liquidity provisions. Engage with us to be a part of this DeFi world.

Get a Live demo of Uniswap Clone

For instant Connect : 9384587998

You can create NFT Marketplace on Solana in two different ways,

- Built from scratch - Time and cost effective

- White Label NFT Marketplace - Easy to launch

We Maticz the trusted NFT Marketplace Development Company have highly qualified developers to build a NFT Marketplace on Solana.

For Technical Assist for How to create an NFT Marketplace Solana

For instant Connect : 9384587998

Are you a seeker to implement your creative ideas and design in Metaverse?

Then you are at the right place. Maticz the highly preferred Metaverse Development Company who have successfully completed the world’s first metaverse project in this fast running technology world. We are here to help you to get a massive profit in the Metaverse space.

Get a live of Metaverse Development

For instant Connect : 9384587998

Offerings, token wallets, and selling non-fungible tokens (NFTs), payment rails, and other functionalities are all possible with the blockchain platforms. It's fascinating to see how different gaming platforms view games powered by this technology. The top blockchain gaming platforms are making it count with the number of blockchain games being the trend. Start your hunt with any of the top platforms to kickstart your career. Get into touch>>

The NFT Crypto Art Marketplace is fast expanding, with new NFTs and cryptos being created and auctioned for sale worldwide. Young people are interested in the cryptocurrency market, which will lead to a rise in the digital asset market in the future. With users from all across the world, the marketplace has already reached a billion-dollar valuation. Artists who want to sell their work in a few easy steps can use NFTs and cryptos art marketplace development to transform their work into a digital format and sell it on exchanges.

You can create NFT Marketplace on Solana in two different ways,

- Built from scratch - Time and cost effective

- White Label NFT Marketplace - Easy to launch

We Maticz the trusted NFT Marketplace Development Company have highly qualified developers to build a NFT Marketplace on Solana.

For Technical Assist to create an NFT Marketplace Solana

For instant Connect : 9384587998

Maticz is the dominant Solana NFT Marketplace Development Company assuring the development of high geared NFT Marketplace on Solana Blockchain. Solana gained colossal momentum in the crypto sphere as the NFT sales have seen impressive figures across the globe and become the investor's favourite blockchain to build Solana NFT Marketplace. Our proficient experts guide you on developing a prolific Solana NFT Marketplace that drives the users to a victorious verge.

Get a Live demo of Solana NFT Development

For instant Connect : 9384587998

Maticz is the leading Solana blockchain development company providing Solana-based blockchain development services. Solana is the fastest and powerful decentralized blockchain. Here at Maticz, we develop Solana-related Decentralized apps, Smart contracts and NFT Marketplaces. Solana blockchain popularity has been increased due to its node synchronization, where the synchronization affects the entire blockchain, and that reflects in the more transactions in the network.

Get a live demo of Solana Blockchain Development

For instant Connect : 9384587998

Are you a seeker to implement your creative ideas and design in Metaverse?

Then you are at the right place. Maticz the highly preferred Metaverse Development Company who have successfully completed the world’s first metaverse project in this fast running technology world. We are here to help you to get a massive profit in the Metaverse space.

Get a live of Metaverse Development

For instant Connect : 9384587998

Undoubtedly Yes!!! ICO is a digital way of fundraising mechanism for a newly launched crypto project or for crypto-related business startups. Through this methodology, one can drive immense funds from investors globally in the form of tokens(cryptocurrencies). And Hence, can achieve massive growth in their business in a short stretch of time.

Turnkeytown is the prevailing ICO Development Services Company who will take care of your ICO launch through their surpassing ICO Launch services successfully. Besides, they also provide a comprehensive ICO Development handbook which makes you understand your 100% business growth through a successful crowdfunding campaign.

Explore More: https://www.turnkeytown.com/ico-development

Contact Details: info@turnkeytown.com

Call: +91 9384801116

People love to sell valuable assets for a good price when they learn about NFTs (nonfungible tokens). Individuals, celebrities, companies, artists and others all prefer the NFT marketplace to directly trade their digital assets. NFT marketplaces are popular because it is easy to get ownership and rights for NFT trading. NFT facilitates users by offering them an in-depth assessment of the asset's history.

Many people spend billions of dollars without even thinking about it. So why not make more money from this? To learn more about building an NFT market place on Ethereum, you can also read the following write-up.

These are some of the many benefits that Ethereum offers. Find out what advantages you will get by building an NFT marketplace on Ethereum.

- Decentralized Nature

- Permissioned Networks

- Fast Deployment

- Data Privacy

- Better Performance & Scalability

- Decentralized Nature

Ethereum's decentralized design makes it easier to distribute data and makes it more reliable. This eliminates the need for network users to depend on one authority to manage the system, and all transactions.

- Permissioned Networks

To develop NFT on Ethereum, you will need permission from ConsenSys Quorum, an open-source protocol layer. This allows the solutions to be approved by the regulators and secures them.

- Fast Deployment

It is not necessary to build a blockchain execution entirely from scratch. Firms have the ability to install and manage the exchange, as well as its mining and storage on Ethereum.

- Data Privacy

Private consortia, which are secure transaction layers that allow companies to obtain privacy on the Ethereum platform, can be created by companies. ConsenSys Quorum doesn't allow any participant to access personal data. The private data is encrypted and only shared with the person who requests it.

- Better Performance & Scalability

Firms prefer the Ethereum network because it can work with multiple nodes and can handle large numbers of users.

NFT marketplaces have become a new asset class in crypto. NFT marketplaces Platform offer a simple way for digital artists and buyers to sell and buy unique digital artworks and collectibles. A firm with expertise in Blockchain can help you develop a NFT marketplace.

Clarisco Solutions can help users trade on the largest Ethereum network using NFT. NFT Marketplace Development company will provide the best NFT solutions for your business to ensure that it is profitable.

Grab a live demo now!

Website - https://www.clarisco.com/nft-marketplace-development

Email - business@clarisco.com

Skype - skype:live:62781b9208711b89?chat

Telegram - https://telegram.me/ClariscoSolutions

The Smart Contract associated with the Ethereum upgrade surpasses the 11 million ETH barrier amid expectations ahead of the arrival of The Merge.

Recent data reveals that the Smart Contract associated with "Ethereum 2.0" continues to add more support, surpassing the 11 million ETH deposited as collateral. The figure could suggest that the number of people interested in backing the new version of the Smart Contract network has grown.

Ethereum 2.0 was the name given to the Ethereum upgrade that would see the network abandon its current proof-of-work (PoW) consensus mechanism for a proof-of-stake (PoS) one. The Contract for participation (staking), launched in late 2020, was the first step toward this evolution.

The Ethereum Foundation recently renamed the update to "Consensus layer," abandoning the name Ethereum 2.0 or ETH 2.0. While, in general terms, the community seems to refer to this phase arbitrarily and, in many cases, goes by the last name, it is worth noting that ultimately, once the network moves to PoS, it will continue to be called just "Ethereum."

Smart Contract for ETH 2.0 surpasses 11 million ETH

Data published by the block explorer Etherscan.io also reveals 11,107,700 ETH deposited there, with an estimated value of more than $38.122 million based on the current exchange rate.

Let's consider that each validator interested in backing the network must deposit at least 32 ETH (about $108,000 at current prices). A simple division yields an estimated 344,000 addresses that would be actively participating in the new system for block processing.

Ether becomes scarcer, and blocks get processed via PoS

The Smart Contract represents the starting point for version 2.0 of the network. Ethereum validators who sent funds for the specified amount will participate in the validation of the new blocks issued once this phase is activated.

Let's keep in mind that the development of Ethereum 2.0 continues its path progressively, so various teams are working to make it possible as soon as it is available. The transition to the new version of the network will take place after the arrival of The Merge, a key point at which it would change the paradigm for block processing. The mechanism will implement the Proof-of-Stake (PoS) method instead of the already known Proof-of-Work (PoW), the system it has operated since its inception.

It is worth noting that this new mining system would leave the rewards mainly for those who serve as network validators under this dynamic, reducing the issuance of new ETH directly. Users also expect that the price of Ethereum will go higher.

The Smart Contract race

Expectation about what the Ethereum update will offer is quite hot amid the competition in the ecosystem, among many other projects. Some will try to displace the most popular Smart Contract network by addressing problems mainly associated with scalability and transaction cost.

These include projects such as Avalanche (AVAX), Solana (SOL), Cardano (ADA), and Polkadot (DOT), whose operational proposals have already caught the attention of many developers and enthusiasts. The expectation here is to attract initiatives within the Decentralized Finance (DeFi) and the Non Fungible token (NFT) space, which currently capitalize on large volumes of operations.

However, the arrival of the final PoS version of Ethereum has no estimated date yet, so we, as users, can only look forwards to seeing how the dev teams work towards their objectives.

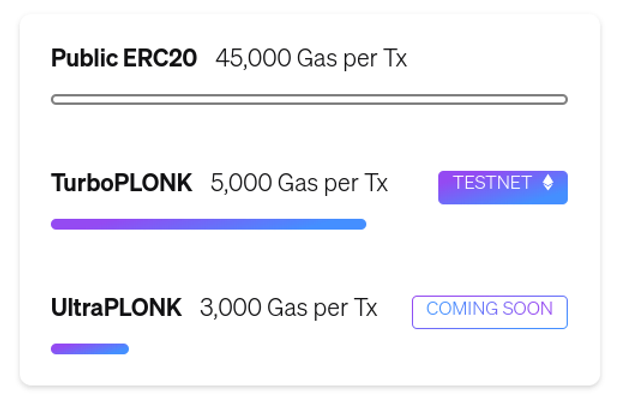

This post analyzes the most successful second layer solutions on the market to scale the number of transactions per second on Ethereum.

As of March 2022, Ethereum remains a layer one blockchain under a proof-of-work consensus mechanism. Due to the rise and accelerated growth of decentralized applications (Dapps) in the decentralized finance (DeFi) and the Non Fungible Tokens (NFT) space. It has a limit of 13 transactions per second, pushing transaction fees into the hundreds of dollars per transaction and out of reach for retail users.

While Ethereum is still trying to address its congestion problem with the long-awaited transition from proof-of-work to proof-of-stake (The Merge) and fragmentation, developers released many Layer 2 scaling solutions. This article tries to make sense of the most prominent Layer 2 solutions.

Different flavors of Layer 2 solutions

Layer 2 networks enable scalability, higher transaction throughput of the Ethereum blockchain. At the same time, they maintain the integrity of the Layer 1 blockchain, allowing for greater decentralization, transparency and security while reducing carbon footprint, less power consumption, which equals a more affordable, faster, and convenient user experience.

There are three main categories of Layer 2 scaling solutions available for the Ethereum network:

Sidechains (Sidechains/parallel chains).

State Channels.

Rollups, Optimistic Rollups and ZK Rollups.

Sidechains

A sidechain is a separate blockchain that runs independently and parallels the main Ethereum network. Sidechains can forge valid blocks(e.g., proof of authority, delegated proof of stake, Byzantine fault tolerance).

Sidechains connect to the Ethereum mainnet via a bi-directional bridge. They are EVM-compliant, meaning that if you want to use your DAPP on a sidechain, it's just a matter of implementing Smart Contract code on the sidechain. The leading Layer 2 Sidechain solution for Ethereum is Polygon.

Polygon ($MATIC / $12.3 billion market cap)

Bridge: https://wallet.polygon.technology/bridge

Polygon, formerly known as Matic Network, is both a sidechain and a sister chain to Ethereum. Jayanti Kanani, Sandeep Nailwal, Anurag Arjun, and Mihailo Bjelic created Polygon in 2017. American billionaire entrepreneur Mark Cuban invested an undisclosed amount in the Mumbai-based Indian cryptocurrency platform.

The parallel chains use the same key pairs as the main Ethereum blockchain. The owner's address on Ethereum can also access any number of sister chains. Other sister chains include XDAI and Optimism. People use Polygon's native token ($MATIC) to pay gas, participation, and governance fees. Polygon uses a Proof of Stake consensus algorithm and has the potential to handle up to 65,000 transactions per second. Transaction fees range from $0.001 to $0.1.

As of January 2022, Polygon reached a milestone of 7,000 Dapps and the most transactions it got in a single day was 9,177,310 transactions on Wednesday, June 16, 2021. According to DeFi Llama, at the time of this publication, the total value locked (TVL) of Polygon is $4.07 billion. The top DeFi apps are AAVE ($AAVE), which currently holds 30.59% of the TVL, followed by Quickswap ($QUICK) and Curve ($CRV).

Status Channels

State channels allow participants to perform multiple transactions apart from the base chain while sending only two transactions on Ethereum's Layer 1 blockchain.

State channels require a part of the blockchain state to be blocked by a multiple-signature (MultiSig) or a Smart Contract, so all participants must agree to update the state. Participants build and sign transactions with each other off-chain. The mechanism keeps congestion low on the chain and allows quick validation between transactions.

Then, the final state is signed and sent back to the blockchain, closing the state channel and unlocking the state once all participants have reached a final agreement. The leading solution for Layer 2 scaling of state channels for Ethereum is Celer.

Celer ($CELR / $313 million capitalization)

Bridge: https://cbridge.celer.network/

The Celer Network is a full-stack platform. It supports dApps such as gaming, online auctions, insurance, prediction markets, and decentralized exchanges. Mo Dong (Ph.D. UIUC) in San Francisco, California, and three other PhDs from MIT, Princeton, and UC Berkeley funded the Celer Network.

Developers launched its main alpha network on July 7, 2019. Its utility token is called $CELR. The network organizes in layers:

cChannel (state channel network similar to Bitcoin's Lightning Network),

cRoute (the payment routing module),

cOS (development framework).

Using Celer off the base chain helps developers create, operate, and use highly adaptable Dapps. Celer's LTV is $443.93 million.

Rollups

With Rollups, transaction execution takes place outside Layer 1. The data gets published to Layer 1, once achieved a consensus. As the system includes transaction data Layer 1 blocks, Ethereum's native security protects the rolled-up information.

Rollup technology can help scale the current transaction limits at layer one from 10 to 45 TPS, depending on the type of transaction and its complexity, to between 1000 to 4000 TPS and more if the space for data sent is acceptable by layer 1 is increased.

Rollups offer a promising path to greater scalability once Ethereum has transitioned to Proof of Stake and other pending upgrades, such as sharding, providing transaction capacity of up to 100,000 transactions per second. Two different security models define two different types of accumulations: Optimistic Rollups and ZK Rollups.

Optimistic rollups send batches of transactions to Ethereum. They are "optimistic" because they assume that transactions are valid by default. In the event of a transaction dispute, it uses the concept of proof of fraud to reverse transactions if necessary.

Optimistic rollups run parallel to the Ethereum chain at layer 2. They can offer scalability improvements because they do not perform any computation by default. Instead, they propose the new state to the main network after a transaction. An advantage of optimistic rollups is that they can execute smart contracts, whereas ZK cumulative packages are mainly limited to simple transactions.

Optimistic cumulative packages can offer up to 100x improvements in scalability, and 99% of layer 1 dApps can be reused and deployed without alterations.

A significant disadvantage of optimistic accumulations is the long time users have to wait to safely withdraw funds to Layer 1, in some cases up to a week. Still, some projects have found solutions to speed up this process. The best optimistic Layer 2 scaling solution for Ethereum is Optimism.

Optimism

Bridge: https://gateway.optimism.io/welcome

Optimism is an optimistic rollup-based layer 2 scalability solution for Ethereum that can support all Ethereum dApps. Instead of running computations and data storage on the Ethereum network, Optimism puts all transaction data on-chain and its computations off-chain, increasing Ethereum's transactions per second and reducing costs in transaction fees. Optimism does not have a token.

Benjamin Jones and Kevin Ho in New York, NY. created the optimism mechanism. They launched their mainnet (mainnet) on December 16, 2021. According to DeFi Llama, the network's total stored value (TVL) rounds $385.66 million.

Optimism can provide between 200 to 2000 transactions per second. It also allows network participants to take part in an auction for the ordering of transactions. These actors are named "sequencers" and "verifiers." Sequencers are nodes responsible for executing transactions at layer 2 and sending the transaction data and new state existing at layer 2 back to Ethereum layer 1. Verifiers are nodes responsible for testing frauds. Verifiers do this by comparing the new root state with the state sent by a sequencer.

Both sequencers and verifiers run L2gEth, a modified version of gEth, the most popular implementation of the Ethereum protocol, written in the goLang programming language.

Zero-Knowledge Rollups

Zero-knowledge rollups execute the off-chain computation and send a proof of validity to the layer 1 chain, accumulating hundreds of off-chain transfers and building a cryptographic proof. These proofs can come as a SNARK (non-interactive succinct knowledge argument) [PDF] or a STARK (scalable transparent knowledge argument) [PDF].

The SNARKs and STARKs are proofs of validity consensus algorithms and get published in Ethereum's layer 1. There is a ZK-rollup Smart Contract to maintain the state of all transfers in ZK Rollup layer 2. You can only update the state with proof of validity. No transaction data is needed, only the proof, making block validation faster and cheaper, as the process uses fewer data.

Zero-knowledge rollups, unlike optimistic rollups, do not assume that all participants are acting in good faith but rely on evidence to ensure that this is indeed the case. ZK-Rollups are computationally heavier than Optimistic Rollups, making the hardware requirements for ZK-Rollup computers more demanding.

The mechanism constantly checks the state, so ZK-Rollups do not have long periods to fall back to Layer 1, and users can enjoy instant liquidity. However, ZK-Rollups also have some drawbacks. Given the complexity of testing, it is more challenging to create zk-Rollups compatible Virtual Machines, making it difficult to launch and scale dApps without rewriting them. The best ZK-Rollup Layer 2 type scaling solution for Ethereum is Loopring.

Loopring ($LRC / $1.38 billion market cap).

Bridge: https://loopring.io/#/layer2

Loopring is a decentralized token exchange protocol. Loopring operates as a public set of Smart Contracts responsible for trading and settlement, with a group of off-chain actors aggregating and communicating orders. Daniel Wang and Jay Zhou founded Loopring in Shanghai, China. Daniel Wang worked at Internet companies such as Google and JD.com.

Loopring ($LRC) launched in 2017, and Loopring's decentralized exchange went live in February 2021. Loopring's LTV is $364.21 million. Loopring has a high throughput of approximately 2000 transactions per second and guarantees the same level of security as the Ethereum blockchain. It makes use of zk-Rollups. Loopring is blockchain independent, and you can integrate any Smart Contract blockchain into it.

Loopring's decentralized exchange runs on its native utility token ($LRC), which is used for governance, incentivizing good behavior, and paying transaction fees on Loopring's decentralized exchange. 80% of transaction fees go to liquidity providers, and the system splits the remaining amount between insurers and the Loopring DAO.

$1.61 billion worth of ETH tokens has left exchanges this year, ahead of Ethereum's final protocol meltdown.

The number of Ethereum's ETH tokens managed by crypto exchanges fell to its lowest level since last September, reflecting investors' intention to hold their tokens in the hope of an ETH price rebound throughout 2022.

Recently, nearly 550,000 ETH worth approximately $1.61 billion has exited centralized exchanges this year, according to data provided by Glassnode. The massive outflow of ETH has decreased the exchanges' net balance to 21.72 million Ethereum units. An amount below its record high of 31.68 million ETH in June 2020.

Biggest Ether tokens drop since October 2021

As IntoTheBlock data shows, more than 30% of all ETH withdrawals from exchanges witnessed in 2022 occurred earlier this week. In detail, more than 180,000 ETH left cryptocurrency exchanges on March 15. The figure made the ETH outflows to just over $500 million by March 18 in just a week.

Likewise, Chainalysis data showed similar readings. The average amount of Ether tokens leaving the exchanges this week was 120,000 ETH per day, indicating a clear bullish signal.

"Assets held on exchanges increase if market participants are more interested in selling than buying assets," Chainalysis

IntoTheBlock provided a similar bullish forecast to Chainalysis. By citing market behavior in October 2021, when Ethereum's price rose 15% ten days after the Ethereum network detected massive withdrawals of ETH from centralized cryptocurrency exchanges.

Ethereum supply crisis likely

The increase in daily Ethereum withdrawals from exchanges averaged 150,000 ETH this week. A significant amount moved to the "stETH liquid staking" pools on the Lido platform.

Lido is a non-custodial staking service that allows users to overcome the difficulties associated with staking on Ethereum 2.0 Beacon Chain. Ethereum staking requires at least 32 ETH. Lido tries to solve the capital efficiency problem by issuing a tokenized version of the staked ETH known as "stETH."

According to Etherscan data, more than 1 million ETH were added to the Ethereum 2.0 contract in the last 30 days as the protocol prepares to completely switch to the new "Proof of Stake (PoS)" algorithm later this year.

ETH price rally continues

Optimism surrounding Ethereum's switch to Proof of Stake (PoS) has led Ether to enter a rebound mode this week. The price of ETH rose more than 17% during the week to position itself at nearly $3,000.

IntoTheBlock noted that users deposited around 190,000 ETH in the last week for staking on the Ethereum 2.0 network (the next Ethereum network upgrade) using the Lido platform. The Ethereum 2.0 staking contract, or staking contract, currently has more than 10,000,000 ETH staked on it. That accumulates to more than $29 billion in wagered value on the ETH 2.0 network.

You cannot ignore Ethereum's gains in the current crypto market situation. Each of the top 10 cryptocurrencies in the market, plus Terra, have seen their share price rise by at least 5% this week. Particularly after the Federal Reserve announced a 25-point interest rate hike on Wednesday. Bitcoin, in particular, has risen by 8%. However, BTC also suffered an outflow from exchanges of 39,000 BTC on Friday, amounting to around $1.6 billion.

As NFT World still looking for the finest art marketplace to invest in, launching NFT Marketplace for Artists is a savvy decision. There are numerous NFT Art Platforms( EX. Art Blocks Clone ) that really made a large injection of capitals in recent years. So Developing the NFT Art Marketplace consists of various building blocks and you can fine-tune your Crypto NFT Art Marketplace with adequate carbon footprint proffers by recent blockchains.

Dig More: https://www.turnkeytown.com/nf...ketplace-development

In 2021, the NFT Marketplace has grown higher and it continues to grow in the future as well. It gives a prime feeling for owning the digital arts. Cryptopunks is one of the equivalent revenue-yielding NFT Marketplace with 24x24 digital collectibles along with 10,000s of digital collectibles in numbers. Each NFT token is very unique from one another even if it's an auto-generated punk. So if you are a crypto enthusiast you can start your own nft marketplace like cryptopunks and also reach the peak in the crypto market. There are so many blockchain developing companies around you who created the white label cryptopunks clone at reasonable prices.

Discuss more: https://www.turnkeytown.com/cryptopunks-clone

Ethereum 2.0 reaches a new milestone regarding the number of validators and ethers deposited, an important landmark as the second-largest blockchain migrates to the Proof of Stake consensus algorithm.

In Short

The role of validators is central in the new version of the network.

ETH deposits from new validators lead to new records in this contract.

As Ethereum transits its way to its new version, some important milestones are being reached that lead to it taking hold. Last Sunday, February 27, the number of validators reached 300,000, its all-time high, and deposited funds already exceeded 9.6 million ethers (ETH).

According to statistics reflected on the Beaconcha.in site, the number of current Ethereum 2.0 validators is 300,500. The 300,000 validator milestone was reached less than 24 hours ago when writing this article.

Since its launch in December 2020, Beacon Chain (the first shard of 64 that the new blockchain will have) has already had 21,000 validators. By December 2021, that number was already at 270,000; this equates to a 1,100% growth in one year. Two months later, it grew another 10% to over 300,000.

Far from being just a number, this figure indicates the Ethereum network is growing and becoming more secure. Validators are in charge of confirming new blocks in the so-called consensus layer, i.e., Ethereum 2.0. Their role is fundamental to the functioning of this consensus algorithm, called Proof of Stake (PoS).

The new version of this blockchain will no longer work with miners like the current one but will rely on validators who must have at least 32 ETH in staking (equivalent to $85,000) to confirm new blocks.

While this increase in the number of validators is noteworthy for the network, it is also important that other conditions, such as decentralization, are met. Recently, some sites saw high centralization in Ethereum 2.0 due to many stake pools using the same client, Prysm, for their nodes. Coinbase, one of the pools with the most validators, dismissed this alert and assured that it further diversifies the clients it works with.

Deposits in Ethereum 2.0, also at record highs

Just as the number of validators grew, so too have the ethers deposited in the new consensus layer smart contract reached an all-time high. There was more than 9,646,000 ETH deposited in it, according to etherscan.io, representing 8.15% of the total stock of the cryptocurrency in circulation.

Users added 170,528 ETH to this Smart Contract in the last ten days. From the chart below, the number is three times higher than that recorded on the same day (February 28) in 2021.

Of course, such a milestone directly relates to the rise in the number of validators. As detailed, each must have 32 ETH to validate new blocks on the chain, so both figures are directly related.

Need to use the Ethereum blockchain? Take advantage of low rates while they last. Ethereum fees are at levels not seen since September 2021.

In Short

Migration of users to other blockchains may cause low fees on Ethereum.

A month ago, it came to pay almost five times more than now, on average, to use Ethereum.

Fees on the Ethereum network are at their lowest level, on average, in the last five months. When writing this article, the amount expressed in U.S. dollars is $13.9. Data from block explorers show a similar average of commissions not seen since last September.

Last January 10, Ethereum saw an average transaction size almost five times higher than today: $53. Unlike on other blockchains, Ethereum's fees are not only for sending money (i.e., transactions in the native ether currency) but also for interactions with Smart Contracts. The latter includes, for example, trading transactions on non-fungible token (NFT) marketplaces, movements on decentralized finance (DeFi), or shipments of ERC-20 tokens, e.g., tether (USDT), DAI, or Shiba Inu (SHIB), among others. Gas limits the amount of computation running in a Smart Contract. Gas expenditures are helpful when a poorly programmed code loops forever, for example, since the Ethereum Virtual Machine (EVM) uses programming languages that are Turing Complete, such as Solidity.

Why did Ethereum fees drop?

The average fee chart does not provide a definite cause for the drop in fees, but we can think that it is due to the migration of users to other blockchains. BSC, Solana, or Fantom have scraped some of the markets, usually in the hands of Ethereum.

Also, layer 2 solutions, such as Polygon sidechain, help decongest the network. Something similar happens with rollups, Ethereum's second layers, that bundle transactions and execute them outside the main network.

It would not be unusual that, in a few days, Ethereum fees will again increase significantly in value. If the low amounts of trade on the network attract massive users again, the network will become congested, and the cycle will repeat itself.

Ethereum remains the blockchain of choice for dApps and Smart Contracts. Despite the expensive and slow user experience that Ethereum's mainnet can offer in its current state, the blockchain created by Buterin nearly monopolizes the market for DeFi and decentralized applications according to the trading volume and total value locked (TVL).

The Block's metrics show that the value locked in Ethereum significantly outperforms its major competing blockchains - Terra, Binance Smart Chain, Avalanche, and Fantom, plus ten other smaller networks.

Opensea will be the First choice if you want to acquire heights in NFT Marketplace in a short span of time. It is the only platform to have a trading volume of $46.75 million according to DAppRadar. So entrepreneurs can boldly leap into the NFT marketplace like OpenSea platform development process. The white label opensea comes with an actionable dashboard that gives you a clear-cut view of the trading assets, Dual Auctions, Drop selections, filter, and sorting options, finally integration with the various digital wallets. Hence the Cryptoprenuers can easily induce endless growth by launching opensea clone.

Know More: https://www.turnkeytown.com/opensea-clone

Numerous blockchain development companies are available in the current era. And undergoing the white-label NFT marketplace development is much more affordable than starting from its groundwork. That is why the entrepreneurs prefer the instant solution and a way to flourish in the cryptoverse, so if you are willing to start with a budget-friendly solution venture with a white-label NFT platform now.

VeChain VET Promo Video - #VeChainVideoContest

Here's my submission for the #VeChainVideoContest !

I appreciate the voting of this crypto community on my tweet and YouTube video if you liked the video and found it beneficial, thank you!

• Tweet - https://twitter.com/_C_R_Y_P_T...461831759597576?s=19

• YouTube -

Learn more about Vechain!

• Whitepaper 2.0 - https://www.vechain.org/whitepaper/#b...

• Reddit - https://www.reddit.com/r/Vechain/

• Twitter - https://twitter.com/vechainofficial

Sources used:

• Official Vechain Youtube channel - https://www.youtube.com/channel/UCqKE...

• Official Vechain Medium channel -

https://medium.com/vechain-foundation

• DNV GL Youtube channel - https://www.youtube.com/user/DNVGL

• Whitepaper https://www.vechain.org/whitepaper/

• VeChain Latest News: https://www.vechain.org/news/

• https://www.prnewswire.com/news-relea...

• https://manager.vechainstats.com/vnt-...

• https://www.nasdaq.com/articles/vecha...

• https://www.pwc.com/gx/en/industries/...

• https://medium.com/@tylerjayboyd/can-...

• https://coinmarketcap.com/alexandria/...

Free and licensed footage obtained from:

• Google Images (Free to use assets)

• https://www.pexels.com/

#Vechain #VET #crypto #cryptocurrency #blockchain

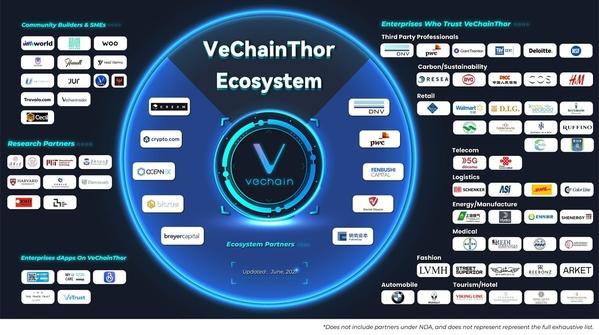

#VeChain $VET is definitely destined for greatness and the value of this coin will appreciate multiples folds in the future (at least a dozen) no doubt about it. With their rock solid partnerships and real life use cases / applications it's really just a matter of time before its mass adoption by more nations like San Marino and more institutions like Walmart China and the likes. This beast of a blockchain project will awake again soon and soar like a bald eagle.

Non-fungible tokens have been on the market for a long time. They have become a buzzword when we talk about the blockchain. However, for many people, NFTs are very difficult to understand.

What are NFTs?

An NFT is a digital asset which represents a real world product, thing or cameo. Most people know NFTs which are associated with music, pieces of art, videos, minerals and real estate. Like cryptocurrencies NFTs are purchased and sold online. In other words NFTs are tokenized real world objects, physical features or snapshots of events.

What is the difference between NFTs and cryptocurrencies?

Basically, NFTS are created using the same kind of programming as cryptocurrency. Nonetheless, the two categories of digital assets are very different. Cryptocurrencies are fungible, meaning that units of the same cryptocurrencies are identical and people can interchange them. For example, two units of bitcoin are interchangeable.

In contrast, this is not the same with NFTs. A single NFT is completely unique; therefore, people cannot interchange them. Usually, each NFT shows ownership of an object such as a house, artwork or music.

Here are a few facts to help you understand what an NFT is:

- Every NFT has each own unique identifier.

- Each NFT has an owner and which people can verify on the blockchain.

- Currently people create, purchase and sell them on the ethereum blockchain.

- The creator of every NFT can therefore, prove his/her ownership of it.

Characteristics of NFTs

More importantly, the easiest way to understand NFTs is to study their characteristics.

Uniqueness: Two NFTs are completely unique or different. There can never be 2 or more NFTs which are identical. That is why people say that NFTs are rare digital assets.

Indivisible: We cannot divide NFTs as we do with cryptocurrencies. With cryptocurrencies we can send a fraction of a unit, such as 0.6 BTC. On the contrary people can only sell complete NFTs.

Ownership: An NFT represents an ownership of an object or snapshot of a moment.

Uses of NFTs

There are different types of NFTs, based on their functions.

Gaming: NFTs are used to show ownership of some in-game assets, such as weapons as well as fuel. If the game item you buy is tokenised, it means that you can recoup the money you used to purchase it, if you no longer need the tool.

Digital content: Artists can tokenise their work thereby showing ownership of it and act as intellectual property. For instance, musicians can tokenise their music or videos and protect them from copyright infringement.

Real estate: People can also tokenise their real estate such as houses and use the NFTs to prove ownership of the real world assets.

Conclusion

In a nutshell, NFTs are digital assets, like cryptocurrencies, which represent some physical objects or cameos. People can buy and sell NFTs, whose values can change from time to time.

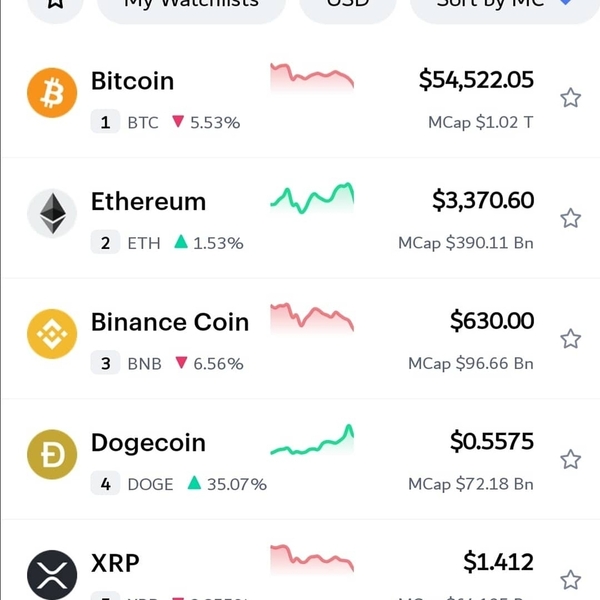

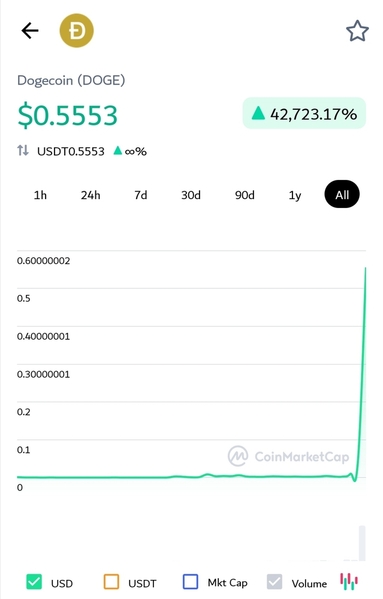

Sad for the crypto space that a shitcoin like $DOGE with practically no use cases whatsoever makes it up the ladder to the top 5. #crypto should be all about blockchain powered tech companies taking pride of their fundamentals, real life applications and stellar partnerships. Very sad indeed. More like an insult to the crypto industry.

Why I feel #Vechain $VET will make enormous tsunamis 🌊 rather than ordinary waves in the coming days / weeks:

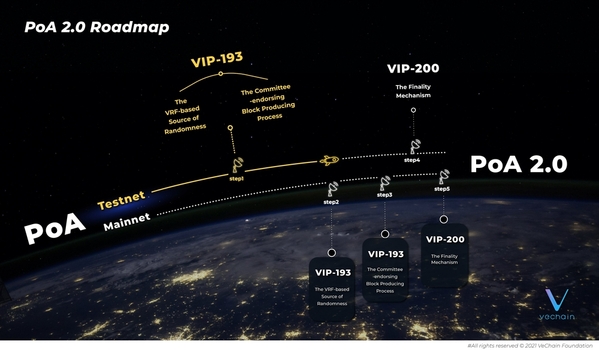

1. PoA 2 mainnet

2. #Coinbase listing

3. #Vexchange

4. #DeFi

5. #NFT

6. More stellar partnerships.

Brace yourselves #VeFam, we haven't even started yet!

#crypto

#VeChain $VET has been one of the top performing coins every month since 1 year...

At this pace I feel we are getting to the 20 cents milestone within 2 days at best. Unless #Bitcoin $BTC goes down by few thousands bringing down #VET and the rest of the Altcoins with it. #VeFam