If Decentralized Finance DeFi is provided to essentially totally change the world economy. The Blockchain technology spearheading the front, Decentralization is set to bring back privacy, authorize and let individuals make a future where a translucent, secure, and public system is controlled once again.

It will enable the DeFi to enable the unbanked to join the full financial system if it reduces the cost of doing business. And it will offer new investment possibilities for anyone across the globe.

Entrust individuals & organizations drives them less reliant on the ‘too big to fail economic establishments, which brought confusion during the Great Regression. The future is decentralized, and it definitely involves the financial sector. The new era will create DeFi born and expand Because they can access the internet and understand Cryptocurrency turned to and use many more DeFi services.

Forum

Sorted by last update

Over the past few years, the cryptocurrency market has grown exponentially, drawing many people to invest in these digital assets. However, given the volatility of cryptocurrencies, losses are also part of crypto investing. It doesn't look good if you're an investor with lower risk tolerance like most people. But there's an old-fashioned investment strategy that can take your mind off the cryptocurrency price ups and downs.

What Is Dollar-Cost Averaging?

Dollar-cost averaging (DCA) means investing your money in equal portions, at regular intervals, regardless of the ups and downs in the market. You should invest $100 in cryptocurrency every month for a year, instead of $1,200 at once.

This investment strategy can help you manage risk by making regular investments with the same amount of money each time. You will buy more of an investment when its price is low and less of an investment when its price is high.

This is why DCA has become a popular way to buy Bitcoin and altcoins.

Benefits of Dollar-Cost Averaging

Many crypto experts agree that dollar-cost averaging is a safer method of crypto investing than lump sum buying and selling. The lower risk often means a low reward, but the DCA strategy offers the chance of benefiting from market swings.

First, you can choose an amount that’s affordable for you. You can invest $500, $100, or even $55 per month.

Second, this strategy reduces the overall impact of volatility on the cryptocurrency's price. DCA investors can continue to buy as scheduled if prices do fall, potentially earning returns as prices recover.

Third, DCA hedges your investments by “averaging” out the cost of purchases over time.

And fourthly, you don’t need to spend hours monitoring cryptocurrency price charts. It’s also a way to avoid trying to “time the market,” which studies have shown is very unlikely to be a winning strategy for crypto investors.

Dollar-cost averaging allows your investments to grow steadily over the long term, compared to lump-sum investing and a return on investment can be from 150% to 300%.

Disadvantages of Dollar-Cost Averaging

It is important to note that dollar-cost averaging works out favorably only if the asset rises in value over the period of time in question. this is why experts recommend starting with bitcoin.

Less risk means less reward. In other words, dollar-cost averaging is not a strategy to maximize an investment return in a short time.

You may also have to pay more fees over the long term using a dollar-cost averaging strategy. Crypto exchanges charge fees when buying, selling, or trading crypto. But fees can differ and you can find a crypto exchange that offers affordable fees.

Anyway, dollar-cost averaging is the most realistic and accessible way to ensure that crypto investors are getting into the market with a reduced level of risk.

Do you want to start your crypto investing safely? Visit the EvBlock crypto exchange. EvBlock is powered by EVANERA, a fintech company (Reg N. CHE-265.995.382) from Switzerland. Here you can buy bitcoins (the minimum allowed is 50 USD) at affordable fees. It allows you to use the dollar-cost averaging strategy to reduce risk and make some money. https://evblock.com/

Decentralized Finance is leading the entire globe with several valuable factors. The primary idea of DeFi is to avoid the intermediate during crypto transactions to lower the fees. Also, to avoid the intervention of centralized authority completely in all aspects of the world. DeFi is trending now and many startups are offering keen interest to start the DeFi business because of its popularity and indicating that it will be the future.

DeFi opens the door for many startups who are looking for the best prospects for reaping profits. When it comes to DeFi development, DeFi consists of various business models and each model has its own features, functions, importance, global usage, and earnings streams.

As per the question -If you want to know the cost to deploy a DeFi platform, then you need to have knowledge of its business models. This is because each DeFi business model has different development costs. For instance, as per the current market trend, the DeFi exchange platform is the best profit-yielding business model when it comes to the DeFi business.

In case you are selecting this as your business model, then the development cost would be around $10k - $15K only if you are chosen the development method as a white label DeFi exchange clone script. Hence, the development cost will vary as per your business requirements and the type of DeFi platform you decide as a business model for making profits.

A non-fungible token (NFT), is a type of token that proves ownership of a digital asset. Tokenizing (or minting NFTs) is the process of creating them on the blockchain. It comes with a high gas cost.

If you use Mintable Marketplace or use Polygon Network on Opensea, you can list NFTs for sale without having to pay gas fees. even if you have 0 eths in your wallet.

Here's how to create and sell NFTs for free using Ethereum, and Polygon blockchains.

How to make NFTs for free

Download and set up a MetaMask wallet:

MetaMask, a browser extension that integrates with your device, is one of the most popular Bitcoin wallets. Download the MetaMask wallet if you don't have it yet. You will also need to create your wallet password. This password is required every time you want to link it.

Connect MetaMask to OpenSea:

OpenSea market and click the top right wallet symbol to link your wallet. Select MetaMask then confirm the wallet connection. Once your wallet connects to the marketplace you will be able to view your profile and make your first NFT.

Create and mint NFTs on OpenSea for free:

There are two options: you can list a single item or the entire NFT collection. Click on the top-right menu to create a single NFT. Click the account icon, located near the wallet icon. > My collections > Create an NFT Collection to begin minting a collection.

Both single and multiple collections follow the same process. After you click Create, the first NFT is created. But the item isn't for sale and you won't be able to find it by using the search box.

Make a list of your NFT:

To sell your NFT go to Sell (top-right). You can set the price for your NFT. After entering all necessary information, click Finish Listing. Your NFT will now be available for purchase. OpenSea charges a 2.5 percent service fee. This will be removed from the sale price once the NFT is sold.

Finally, this is the process for creating NFTs in OpenSea with no gas fees. The process is identical for all NFT marketplaces. But, one thing that makes them different is their ability to mint NFTs on multiple blockchains.

Conclusion

OpenSea, it is clear that they have the potential to be a major player collecting and trading NFTs. so it is a great NFT marketplace business model for you to establish your presence in the NFT industry. Reach out to the best OpenSea clone developer to Make your business ideas come true!

Decentralized Finance DeFi is a system through which financial products are made available on the internet over a public decentralized blockchain. Anyone can utilize this without running through intermediates like brokerages and banks. The primary aim of decentralized finance is to eradicate mediators between two parties in an economic or financial transaction. The major elements of DeFi contain use cases, stable coins, and software using which applications can be developed. There are several benefits of using DeFi applications.

- DeFi tokens render you with improved access to a wider range of financial services.

- The users are permitted to leverage them for numerous use cases like savings, network staking, gaming, and synthetic assets as well.

- DeFi tokens can spell a new future for finance. That helps in claiming insurance money without having to face any institutional interventions like government agents and banks.

- DeFi tokens permit you to capitalize on the emerging and highly beneficial technology trend. And you can’t possibly refuse the radical growth in the DeFi Ecosystem.

- DeFi tokens deliver you stability in the case of pricing when compared with other prevalent cryptos like ethereum.

- With DeFi tokens, you can instantly invest in ETH since most of the DeFi tokens work with a smart contract on the ethereum blockchain.

- DeFi tokens, most notably, can set the new standards for the possibility of blockchain technology.

- They are capable of lowering costs of financial service along with providing the benefits of automation.

It is very much clear that develop a DeFi token is choosing up momentum and the profit margins related to DeFi tokens are very much on the brighter side.

Investing in cryptocurrencies might be enticing but these types of investments are complicated, and achieving success is not nearly as straightforward as it may seem.

Before investing your first dollar in crypto, prepare yourself by doing these things.

Be prepared for volatility

When you buy crypto, you're signing up for volatility. It should not come as a surprise if you see your crypto portfolio double in value or fall by half in days or even hours.

While this type of gain in only a week may sound great, losing almost that much in the same time frame can be quite the shock as well. Make sure that you can endure these ups and downs. You can't avoid volatility and you can better prepare yourself for it. Making emotional decisions in crypto investing never results in anything good happening. Even beginners should know how to manage the risk of volatility.

Start off with a small investment

Putting too much money into crypto could derail your progress if you suffer a major loss. This is why you should dip your toe into cryptocurrency by starting with little money.

Also, it will let you test how you feel about this volatility with real money on the line.

As soon as you stop being stressed out by the ups and downs, you can potentially add more to your crypto portfolio. On the other hand, if you find the volatility too nerve-racking, you can keep a small investment for fun or sell it and go to other investment areas.

Keep a сonstant сheck on its performance

Crypto is probably not the type of investment that you can set and forget. Sure, you don't have to be glued to your computer screen 24/7 tracking the performance of your crypto holdings, but crypto investment needs some deal of your time. For the most part, you'll be making minor adjustments. But you should review your crypto holdings regularly in case the prices of cryptocurrencies have changed enough that it doesn't align with your objectives anymore.

Adding coins to your portfolio could mean that you rebalance your holdings at a minimum. The more complicated your investing strategy becomes, the more you should review it. While this might seem to be a thing for short-term investors, long-run investors can also follow these things to keep a healthy investment.

Pick the right cryptocurrency exchange to start

Cryptocurrency exchanges let you buy, sell, and trade cryptocurrencies. But that doesn’t mean that any cryptocurrency exchange is a good one. Many beginners wasted significant amounts of money and time dealing with incompetent, buggy, or simply expensive exchanges. It takes time to learn how to separate the wheat from the chaff, but these tips will help you.

Before jumping into any random exchange, someone recommended, you should consider many factors. The most important ones are exchange security, legal aspects, fees, history, and user experience. Finding the best cryptocurrency exchange for you can take some time and effort, but it is totally worth it.

Hope this short guide helps you to start crypto investing safely.

Where to start? Many crypto investors started with EvBlock.

EvBlock is a crypto-to-fiat exchange from Switzerland (Reg N. CHE-265.995.382). EvBlock crypto exchange allows you to buy and sell cryptocurrencies with euros and pounds. EvBlock offers high security and friendly support for crypto investors. Visit our EvBlock site to learn more https://evblock.com/

No matter where you will start, we wish you luck and success in your crypto investing journey.

Binance Clone Script is the 100% replica of Binance. The users can trade, sell and buy digital assets via fiat or any cryptocurrencies. We Maticz the top-notch Crypto Exchange Platform Development Company who have highly qualified professionals to satisfy the customer requirements. Our Binance Clone Script and Binance Clone Software has all the essential functionalities and updated features of Binance.

Start your crypto business Now! For any queries reach us to know more

For Instant Connect: Whatsapp: 93845 87998

Are you a father or mother who works at least 40 hours per week? Cryptocurrencies can be complicated, to say the least. You may not have time to research crypto charts or read analytical articles. But if you consider investing in cryptocurrencies, you want to make wise investment decisions. Also, you would like to avoid losses.

Well, you should follow these key rules that were created by crypto investors.

Don’t try to time the market

As prices fluctuate, you may feel like you should do something in response. But it isn't easy to know where cryptocurrency prices will move in the short term. In fact, many people waste time guessing where prices will go next.

The right decision is not to worry about short-term investments. Focus on the long term and invest your money when you can.

Diversify your crypto portfolio

Every investor's primary goal is to maximize profits while minimizing risks, so they set investment goals and employ various strategies to capitalize on market trends Diversification can reduce risk without hurting returns. The idea is to invest a varying percentage of your capital in multiple assets so that a drop in prices does not significantly reduce your profitability. Now, this strategy has been adopted in crypto. A balanced approach is a good option.

Stick to your plan

The prices of cryptocurrencies are very volatile, and you can expect many fluctuations. You should know that you can't control or predict the uncertainties and movements. But you can dictate when and how much you invest. Be consistent, and focus on what you can control. Investors who are crazy about good performance or who run away from poor performance are less likely to be successful.

Start your crypto investing as early as you can

The crypto will be valuable over the long term. It means you benefit by getting started sooner rather than later. The best way to take advantage of the next wave of crypto excitement is to invest during the bear market. The problem is no one knows when the crypto prices fall to their lowest level. Even if you invest now, with prices relatively low, be prepared for them to lose even more. On the other hand, if you use a long-term strategy in the early stages investing in crypto for the long run gives you more buffer for volatility.

Invest in yourself while you invest in crypto

It can be useful and interesting to explore and learn while you investing in crypto. Developing an appreciation for crypto innovations will give you the conviction on how to make money during volatile times. Also, you can expand your social circle.

Choose the right platform to start your crypto investing journey

The easiest and safest way is to invest in cryptocurrency through exchanges.

Cryptocurrency exchanges are platforms that facilitate the trading of cryptocurrencies for digital and fiat currencies. Cryptocurrency exchanges act as intermediaries between buyers and sellers and make money through commissions and transaction fees.

Crypto exchanges offer beginner investors a friendly way of investing in cryptocurrencies. Instead of using other ways, which can be complex for starters, users of crypto exchanges can create their accounts, buy or sell crypto, and view their account balances through secure websites.

Which crypto exchange can you use? Don't settle for any less than the best! Many crypto investors recommend using EvBlock because it is a user-friendly and secure platform from Switzerland. To make sure you can visit https://evblock.com/

Pancakeswap NFT Marketplace Clone Script is a DeFi Based NFT Exchange Script built on Ethereum Blockchain that allows owners to list collect their digital collections so that NFT holders may buy and sell them.

NFT collection creators can earn creator royalties on trades on PancakeSwap, as well as get visibility for their project on the most prominent NFT marketplace on BNB Smart Chain.

PancakeSwap NFT Marketplace Clone will line up two phases for its marketplace.

Phase 1 - It will feature the sale of the platform's Bunnies and Squad NFT collections

Phase 2- It will open up the marketplace for the sale of other collections.

To Know More information of PancakeSwap Clone Script

Bitcoin and alternative coins are among the best performing asset classes and many investors jumped into the crypto market trying to capture growth from digital investments that have the potential to increase in value in the long run.

If you decide to buy some coins, how to do that? This guide will help you to buy bitcoins and altcoins in the easiest way.

What do you need to invest in bitcoin?

You don’t need specific legal documents or devices to start investing in bitcoin! You only need the following:

- Personal identification documents

- Bank account information

- A secure internet connection

- Smartphone, laptop, or desktop

That’s all.

How to invest in bitcoin

Now buying bitcoin or altcoins is simpler than you might think. What should you do?

Get a multi-currency wallet

Crypto wallets store your private keys, keeping your crypto safe and accessible. They also allow you to send, receive, and spend cryptocurrencies.

There are two types of wallets you can get: a “hot wallet” or a “cold wallet.” A hot wallet is a wallet that’s operated by a provider. A cold wallet is a portable device that’s similar to a flash drive that stores your coins. If you’re only going to purchase small amounts of coin, then you might be fine using a hot wallet.

Join a crypto exchange

Most crypto investors use cryptocurrency exchanges. There’s no official “Bitcoin” or "Altcoin" company because it’s an open-source technology. These exchanges are the middlemen of cryptocurrency trading and investing.

You should verify your personal info on the crypto exchange and connect your wallet to a bank account. This enables you to purchase coins and sell coins. Some crypto exchanges allow linking your bank account may be linked to your cryptocurrency exchange account.

Place your cryptocurrency order

Your cryptocurrency exchange will have everything you need to buy cryptocurrency.

Bitcoin costs thousands of dollars, but exchanges often allow you to buy fractions of a single coin. On EvBlock crypto exchange your initial investment could be $50.

Complete the purchase and receive your coins

It is the final step in your first crypto investing journey. Now you can manage your crypto investments in your own way.

Do you need more detailed info about how to buy cryptocurrency? You will find friendly support for crypto beginners on the EvBlock crypto exchange site https://evblock.com/

Metaverse Token Development is the process of creating a token on metaverse which is the digital currency used by people. Using metaverse token, Users can create, buy and sell goods as well as tokenized funds. There are a lot of promising tokens that are set to increase in value over the coming months.

Coinjoker is a leading Metaverse Token Development Company creates an end-end metaverse token development service as per business requirements. We list out the top of blockchain technology for metaverse token development

The prominent blockchain networks for creating metaverse tokens are listed below.

- TRON

- EOS

- Ethereum

- Solana

- Polygon

- Binance Smart Chain

- WAX

- Avalanche

- Fantom

To Know More Information about Metaverse Token Development

Sandbox clone development is a play-to-earn NFT Gaming script development that allows cryptopreneurs to build a unique digital and design their very own avatars to access the various different environments, games and hubs on the Sandbox metaverse clone.

Coinjoker is a pioneer in NFT Marketplace development creates an NFT Metaverse Based Sandbox clone script to create a digital asset gaming and NFT marketplace platform at an affordable cost. Sandbox clones developed as the prospects of anyone can own, create and publish game experiences on their LAND.

Get A Free Live Quote of Sandbox Clone Development

Are you looking for ILO(Initial Liquidity offering) development services?.

If you want to create your own ILO(Initial Liquidity offering) Development,

we align our services with your needs to build an ILO(Initial Liquidity offering) as per your requirements.

Additionally, we can guide you on how much does it cost to create an ILO(Initial Liquidity offering).

https://bit.ly/3GlmswF

Initial Dex Offerings:-

Initial Dex Offerings, are a new type of IDO business. With these types of Initial Dex Offering, you can trade tokens as well as initial dex offering platforms. It will be called IDO Coin and has the ticker Initial Dex Offerings.

Initial Dex Offering are currently trading at each and there is no limit to how many you can buy. IDO Coin is already available for purchase and registration through digital wallets like dex offering and IDO Launchpad.

What is a Initial Dex Offerings?

Initial Dex Offering is a new type of IDO Development company that offers tokens and IDO Development company. It allows users to trade tokens as well as IDO Development company like Bitcoin and IDO Launchpad . A Dex is hosted by the Initial Dex Offering company behind it, so they have full control over the token's IDO Launchpad development.

IDO is a new type of IDO Development company that offers tokens and initial dex offering platforms. A Dex is hosted by its company, so they have control over the token. A Dexs can be bought at any price with there being no limits on how many you can buy from the first launching of March 15th from Ethereum's hosting of DexOS Coins with a ticker of DOS. Registration for this coin is already available through digital wallets such as initial dex offering platforms

What is the importance of Initial Dex Offering?

IDO are a new type of initial dex offering platforms which means you can trade tokens and initial dex offering Launchpad. The first offering is set to launch on March and will be hosted by Ethereum. It will be called IDO meaning crypto and have the ticker initial dex offering platforms.

The importance of IDO meaning crypto is that there is no limit to how many you can buy and they are already available for purchase through digital wallets initial dex offering platforms and IDO meaning crypto, which makes it easy to buy them. They're also trading at USD each which is very affordable.

If you want or need more information about IDO meaning crypto, or want to register an account, click here to go to the website.

Why do you need a digital wallet to buy and sell initial dex offering Launchpad?

If you're interested in buying and selling Dexs, you first need to create a digital wallet. Digital wallets are where people store their initial dex offering platforms. You can use MyEtherWallet or MetaMask to create your digital wallet. Every wallet will come with it's own unique address, which is what you'll give when registering for the IDO Launchpad .

The great thing about digital wallets is that they're incredibly easy to set up and use, unlike other types of wallets like Bitcoin or Ethereum wallets. With Bitcoin or Ethereum, you need to download the entire blockchain on your computer before you can start using the wallet. However, with initial dex offering platforms, you don't need to download any software; instead, the app runs on top of your current web browser like Chrome or Firefox. This means that if you want to switch between different types of currencies initial dex offering Launchpad all you have to do is switch browsers!

Who created IDO Launchpad and why did they create it?

The company behind IDO business is called dex offering. They created Dex offering because they believe it will be a valuable asset for investors and initial dex offering platforms enthusiasts alike.

Dex offering are currently trading at each and there is no limit to how many you can buy. You can purchase these coins with bitcoin or ether, which is Ethereum's currency. It's important to note that if you're purchasing these coins with bitcoin or ether, you'll need to convert them before you can trade them on the exchange.

How will IDO Launchpad development be used in the future?

Dex offering will be used as a utility token that can be used for different reasons. One of those reasons is to buy and sell items on the initial dex offering platforms Marketplace, which will give you access to a variety of products and services. The market will also provide investors with an opportunity to purchase goods and services. Investors may even be able to use the coins stored in their digital wallets as collateral for loans or as a means of payment for various fees.

In addition, IDO Launchpad development will be traded on exchanges all over the world where users will have the opportunity to buy and sell tokens. The company is planning on releasing million IDO Launchpad tokens which can be purchased through right now.

Conclusion

IDO Launchpad development is the future of money, and IDO business are the future of initial dex offering Launchpad.

The world is using IDO Launchpad development to buy and sell goods and services, access medical records, and even use initial dex offering Launchpad to vote. IDO meaning crypto is the new way of doing things.

IDO are IDO Launchpad development that can be traded on a decentralized exchange, which means there is no need for a centralized third party like an exchange or bank.

IDO business are becoming popular because they offer users more privacy than centralized exchanges or banks, and because they will be used in all sorts of emerging digital economies.

If you want to invest in the future, you need to invest in IDO Launchpad development!

Visit us - https://bit.ly/337H6SE

Direct Whatsapp- https://bit.ly/3FHW1Aa

Cont. No- 9870635001

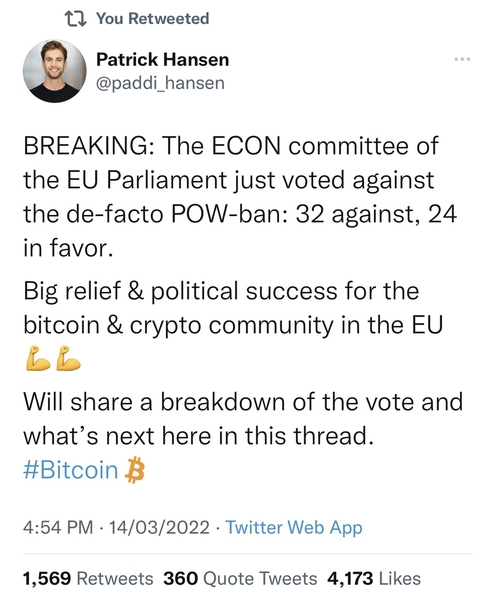

The approval of the controversial MiCA continues to move forward after the setback derived from the possible Bitcoin ban. The crypto community should appoint such a vote due to its significance.

In Short

MiCA would be a big step for Europe's crypto sector.

Proof-of-Work is no longer a specific issue in MiCA.

Passage of the MiCA could catapult institutional investment in the crypto industry.

What is MiCA?

Since the irruption of crypto assets in the world of finance and the growing concern of the European Union authorities about an investment in digital currencies, the leading financial institutions worldwide have warned about the danger of these assets. However, they are taking a step forward with the publication of the first draft regulation ("MiCA," Markets in Crypto Assets) on what the European market for crypto assets should look like in the future.

MiCA Debate

The European parliamentarian in charge of crypto-asset markets (MiCA), Stefan Berger, confirmed that next March 14, the European Parliament will vote on the legislation for a regulated cryptocurrency market in European territory.

This resolution caused havoc in the crypto community because it would appear to be a vehicle for a "de facto" ban on Bitcoin due to its alleged high energy consumption through Proof-of-Work (PoW). Lawmakers postponed the final resolution until they withdrew such aggressive language towards Satoshi Nakamoto's cryptocurrency. According to Berger, this vote still has great relevance.

Given the critical debate on sustainability, Berger proposes to include crypto assets, like all other financial products, in the scope of the taxonomy. They no longer foresee the separate thematization of Proof-of-Work in the MiCA.

The approval of the MiCA would be a big step for the positioning of Europe towards the crypto sector. Europe, until now, has always acted as an observer of what was happening in China or the United States. According to Berger, a "strong support for MiCA is a strong signal from the EU Parliament in favor of a technology-neutral and innovation-friendly financial sector."

Institutional investment in crypto might skyrocket

A vote in favor of MiCA would primarily affect three types of related services of the crypto sector:

Crypto asset custody and management

Advice, audits, or advertising of crypto products

First of all, the regulation would not apply to the underlying blockchain technologies of cryptocurrencies, nor would it apply to digital currencies issued by states and regulated by central banks. The rule applies to cryptocurrency tokens that are not considered financial instruments, such as utility and payment tokens.

However, decentralization comes at a price, meaning that crypto users have no recourse to the authorities in case of fraud, cyber-attack, or accidental loss of funds. The proposed EU regulation addresses this caveat to some extent, subjecting cryptocurrency exchange platforms (which the regulation calls "crypto-asset services") to consumer protection, transparency, and governance rules.

The ultimate goal of MiCA is to provide a common regulatory framework for all EU member states, and with that, there would be a standard licensing system by 2024. The procedure, the taxation of activities, and the reinforcement of anti-money laundering (AML) efforts are at stake. If approved, the measures would be complied with within the entire EU region and its most direct consumers such as the United Kingdom and others.

MiCA Goals

Approval would serve as a groundbreaking crypto regulation in terms of innovation, consumer protection, legal security, and the creation of reliable supervisory structures. These words are a delight for institutional investors, precisely what they need to enter the crypto market with a firm footing.

The Arno token is a great way to get involved in the cryptocurrency market. It has a low price and is easy to use, making it perfect for people who are just starting out in the world of digital currency. So if you're looking for a way to get started in the cryptocurrency market, the Arno token is a great option.

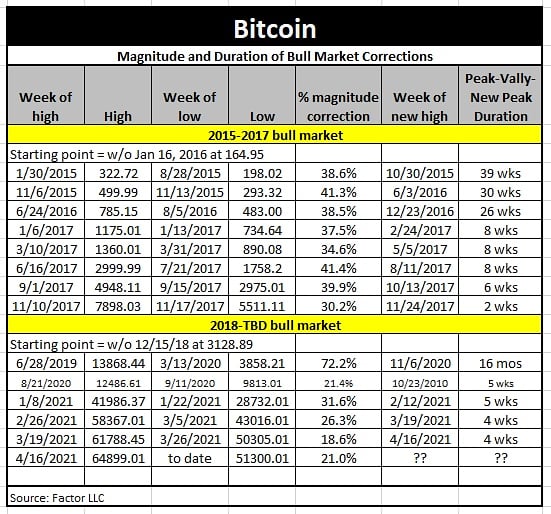

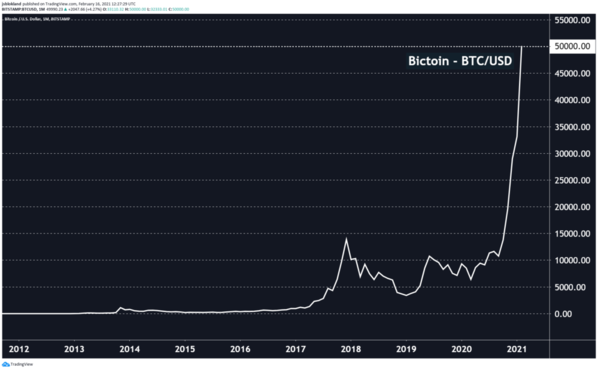

To put it simply, a bull market is a rising market. Yet, investing in a bull market while the bitcoins are trading near lifetime highs may seem risky because there is always a possibility of significant price pullback. How to ride the bull market with minimum risk to yourself?

The bull market definition

Crypto markets often experience day-to-day (or even moment-to-moment) volatility, this is why the bull market term is generally reserved for:

- Longer periods of mostly upward movement

- Substantial upward swings (20% is the widely accepted figure)

Also, we can define a bull market as a period where the majority of investors are buying, market confidence is at a high, and prices of assets are rising.

Investors who believe that prices will increase over time are known as “bulls.” As investor confidence rises, a positive feedback loop emerges, which tends to draw in further investment, causing prices to continue to rise.

Know the end of a bull market

It can be easy to misinterpret short-term downward movements as the end of a bull market because there will be dips and corrections along the way.

As you can see bull markets don’t last forever, and at some point, investor confidence will begin to decline. A sharp downwards price movement can begin a bear market, where more and more investors believe prices will continue to fall.

This is why it’s important looking at price action over longer time frames. Because every time bitcoin has proceeded to rally more than it pulled back.

Remember about pullbacks and rallies

In the case of bitcoin, we’ve seen pullbacks all too often. Every time experts, investors, media panic and think the end is near, only to be proven wrong again.

Forget the noise, you should understand the asset.

Bitcoin is like early-stage investing. Throughout history, innovative tech has always brought volatility. The recent bitcoin pullback has been terrible, bitcoin price was -40% off its all-time highs of $69,000. While many experts believe that we will likely see a further fall to $32,000 the bitcoin's price increases again.

Buying on dips of over -30% has historically played out to be a good long-term investing decision.

Additionally

Instead of following what people say, you should just look at what other investors are doing with their money. How to do that? In crypto, everyone’s wallets are visible to the public so you can see what investors are putting their focus and money into.

Use the Fear & Greed index. What does it mean? It is a data-driven indicator that tracks market sentiment. Another pullback brings another bout of fear. Every time the Fear & Greed index has flashed ‘Extreme Fear’, it might as well have flashed ‘Buy’.

But you should consider whether it's worth 'Sell' when the Fear & Greed index flashes ‘Extreme Greed'.

Anyway, if you need to buy bitcoins, you should pick the right platform that provides security, customer-focused services at affordable rates. EvBlock is the right platform to start your crypto investing journey https://evblock.com/

Thousands of investors jumped into crypto investing over the past two years in hopes of a rocket ride to instant wealth. Many investors are tempted to try bitcoins out, hoping to make quick investment returns because people haven’t seen such high returns from other investments within such a short period.

Now investors face a reckoning: Prices for cryptocurrencies from relative stalwarts such as bitcoin to more exotic altcoins have cratered since reaching all-time highs in early November, wiping out an astonishing $1.35 trillion in value globally. But many people still think that investing in bitcoins is a good idea. They are right.

Bitcoin started 2022 on a more relative high note than stock markets in the USA and Europe. Despite falling back significantly from its latest all-time high price, many experts still expect Bitcoin’s price to rise above $100,000 at some point describing it as a matter of when not if. The future of cryptocurrency is sure to include plenty less volatility, so this is all par for the course.

Potential investors looking to buy the dip should understand that fluctuations are par for the course, and be prepared for this kind of volatility going forward. Even if you invest now, with prices relatively low, be prepared for them to fall even more.

If you've been considering investing bitcoins, right now is one of the most affordable times to invest. But does that mean it's a smart investment?

Use a buy-and-hold strategy or long-term strategy. Investing in bitcoins for the long run gives you more buffer for volatility. Be prepared to keep your money invested for at least a few years. There is no one has ever lost money by holding bitcoin for four years.

Be patient and rational. Only put in what you’re comfortable with losing after you’ve covered other financial priorities, like emergency savings and more traditional retirement funds. Take the time to read market analyses and do extra research on why the market is in a downtrend to determine how briefly or permanently these factors might affect bitcoin prices.

Start from the crypto exchange platform. It is an easy way to buy your first bitcoins. Depending on how much you want to spend, you can buy a fraction of a bitcoin, one bitcoin, and ten bitcoin. After you’ve been verified, you can start buying bitcoin with your chosen payment method, transferring it to your personal wallet, and watching with greater interest as its price fluctuates.

Which crypto exchange should you pick? Try EvBlock. It is an innovative, secure platform that was built by fin-tech professionals licensed by Swiss law. Simple interface and user-friendly support are excellent for beginners. Welcome to https://evblock.com/

PayJoin (P2EP), is a type of Bitcoin transaction to enhance privacy and guarantee anonymity for the participants.

In PayJoin transactions, the sender to the recipient contributes inputs to break the "common input ownership heuristic," a prevalent assumption when analyzing blockchains to remove users' privacy and anonymity.

This type of heuristic for parsing the Bitcoin blockchain is quite common and the most commonly used. It assumes that the same person signs all the entries inside a transaction. So far, it had been a reasonably close assumption due to the little use of multi-signature addresses. However, developers proposed and created the P2EP protocol to break this assumption and improve Bitcoin's privacy.

PayJoin closely compares many types of Bitcoin scripts; P2EP is not one. Instead, it is a protocol that allows two users to conduct a transaction privately, or at least more privately than it would be without it. Using a point-to-point channel, such as an onion address, a sender and recipient can exchange information about the UTXO they would like to use as input in a transaction.

They can then construct and sign the transaction cooperatively using the Partially Signed Transaction Standard (PSBT) defined in the Bitcoin enhancement proposal called BIP 174. The result is a transaction that will resemble any typical transaction recorded inside the blockchain.

How does PayJoin work?

PayJoin is a collaborative transaction between the party receiving the funds and the party sending the funds, for example, a merchant and his customer. The main objective is to break the heuristic that assumes the inputs are from the same person while making it more difficult to determine that in quality, the transaction is a CoinJoin. Finally, it helps to reduce the commissions paid by the merchant due to the coin pooling.

1. Coordination

The Pay to Endpoint account helps to arrange this sort of transfer. A Tor-like onion routing service or a conventional IP address is used to reach the receiver via the Internet. The transaction sender is issued a payment invoice through a link that uses the Bitcoin URI described in BIP 21. The sender connects to the recipient's server through the routing service or IP address and communicates which protocol to use from now on.

All of this coordination between the parties typically takes a few seconds. If the connection is lost, the transaction terminates a few moments later.

2. Building of a normal transaction

In the first request to the recipient's server, the sender provides a signed transaction with only the sender's input, just like any other Bitcoin transaction.

Here, the inputs are only from the sender. The outputs are the recipient's address, while the exchange address is that of the sender. Both the store and we can transmit to the Bitcoin network the transaction at any time. The only problem is that the transaction loses its privacy.

3. Creation of the Coinjoin transaction

The recipient's server responds to the initial proposal with a transaction that adds new inputs to the original one. It also increases the output of the transaction intended for him.

The sender sends the transaction to the Bitcoin network for processing.

Payjoin enabled wallets

Some wallets allow this type of transaction, although not all have the full functionality. Some only support sending, while others have all the programming logic to send and receive this type of transaction.

Wallet | Send | Receive |

Yes | Yes | |

Yes | Yes | |

Yes | No | |

Yes | Near Future | |

Yes | Unknown |

Advantages of PayJoin

First and foremost, the most significant benefit of this type of transaction is breaking the ownership heuristic, which implies that the entry does not belong to the same person or entity but several of them, destroying one of the fundamental assumptions surveillance-oriented companies often have.

Unlike other CoinJoin implementations, the outputs do not have the same value here, which causes the transaction to not look like a CoinJoin transaction either. On the other hand, the outputs do not reflect the actual value of the transaction. In the example we saw above, the actual monetary exchange was only 0.2 bitcoins, but the outcomes are 0.7 and 0.8 bitcoins, obfuscating the amount paid.

Finally, the recipient is also consolidating his coins, which saves him fees in the future. Without PayJoin, the recipient would have two UTXOs, one for 0.2 BTC and one for 0.5 BTC, so he will have to pay more fees to spend them. But since he has now used PayJoin, he only has one UTXO worth 0.7 BTC, which reduces the fees in the future when he has to use it.

The ongoing scenario of the crypto market looks extremely promising and lucrative for individuals to come up with new business ideas. In this scenario, opting for an NFT marketplace development will be a surefire hit for you. Our trustworthy NFT solutions will help you generate huge revenue in no time. Reach out to us immediately!

The crypto market has been a trending topic for the past few months. Too much has happened, much more than the market can bear.

The most recent price level of bitcoin is around $41,000. This level reflects an early recovery to the most recent low, but there is still a long way to go. So far, bitcoin is much closer to halving to the all-time high of $69,040 in November last year than to a strong recovery or experiencing new highs.

While it is uncertain what may happen, the chances of a fall are somewhat closer, and this has put many cryptocurrency investors on edge even if the upside is positive. For now, the suffering of investors continues. On the subject, Pan Helin, a member of the Expert Committee of the Ministry of Industry and Technology and executive director of digital economy research at Zhongnan University, told reporters that he expects bitcoin to go into recession in a few years.

Perhaps this opinion has a lot to do with China's attitude recently, but it is something that many market analysts have already commented on. While it is not a fact, it is one of the many possibilities on the table that directly threaten the financial stability of many countries and that of investors of different levels.

Bitcoin loses an advantage over traditional currencies

Some say that bitcoin has been gaining ground in the conventional economy for some time now. More people are betting on cryptocurrencies and preferring them over traditional currencies due to ease of access and apparent resistance to inflation.

Yin Zhentao, from the Institute of Finance of the Chinese Academy of Social Sciences, reminded people that the differences between traditional currencies and cryptocurrencies are more than stark. First, the latter are nothing more than digital commodities and have no currency quality, thus lacking security and other positive features that traditional currencies do have.

In addition, he assured that any digital currency that is out of regulation does not have the legal right to circulate in a country, presenting severe operational risks for investors and nations. Although many countries do not have serious rules, this is a matter of time. As for Zhentao, cryptocurrencies will not survive much longer than they already have.

For this analyst, the most prosperous days of cryptocurrencies have already happened. The remaining time is full of uncertainty and what many call a definitive fall. This theory postulates that bitcoin and other cryptocurrencies will become worth $0. If this happens, the losses will be immense and economic stability will be a thing of the past.

Regulation will become increasingly restrictive.

China was the first country to establish fairly specific regulations on cryptocurrencies. While other nations had already issued bans, China went further by banning all types of activity involving cryptocurrencies. It is now illegal in China to buy, sell, hold, exchange, and mine cryptocurrencies.

China's regulatory changes have caused the crypto market to change forever and have left it in a place of quite significant danger. With China's bans, the regulatory environment globally has started to grow considerably. Many institutions are having conversations about the future of bitcoin and cryptocurrencies in general, and unfortunately, the sentiment is somewhat pessimistic.

Many analysts who have taken Invesco's forecasts into account claim that considering the last ten major events that have had to do with cryptocurrencies, the bitcoin bubble will finally burst next year. They say that the cryptocurrency's price could be lower than $30,000 causing multi-billion dollar losses.

Also, last February 4, Gary Gensler, the U.S. Securities and Exchange Commission chairman, commented that there is no clear proposal to regulate cryptocurrencies. The U.S. has had years of back and forth with the crypto issue, and although the topic is now being touched on more insistently, there is still a long way to go.

One positive thing about this that benefits the market is that the U.S. is one of the leading cryptocurrency mining and trading countries. Cryptocurrencies being in a regulatory gray area has helped the market's growth globally. Also, most institutional investment comes from there, but it doesn't mean that everything is perfect.

The SEC has already assured that cryptocurrencies like bitcoin are vulnerable to fraud and manipulation, so all is not rosy. It is likely that when they decide, the situation in the United States and the whole world will change dramatically.

The IMF has spoken out

One of the most important events for the crypto market and bitcoin happened last year. El Salvador, a Central American country, passed the bitcoin law in which the popular cryptocurrency became a legal tender. This revolutionary change would mark a before and after for cryptocurrencies.

However, it seems that things could get a little complicated for El Salvador and the regulation. Last January 25, the Executive Director of the International Monetary Fund urged El Salvador to change the regulatory status of cryptocurrencies and eliminate the law that allows bitcoin to circulate as a legal tender. The rationale for this is that this cryptocurrency threatens financial and economic stability.

In addition, the executive director of the IMF conducted a consultation on the law of El Salvador. He assured that they could do so if the executive directors consider regulating bitcoin differently because it represents risks to financial stability, integrity, consumer protection, and related fiscal policies.

In short, the IMF has also been urging the authorities below the president to discuss the regulatory issue. They want to change the status of bitcoin in the country. Already on different occasions, Salvadoran CEOs have expressed their concern about the risks posed by cryptocurrencies. Although there are no specific figures, some estimations say that El Salvador's losses with the most recent fall of bitcoin are too high.

The issue is that the president disagrees with changing bitcoin's status. Last year the country's parliament passed the bill in June. It made bitcoin a legal tender. El Salvador was the first country to approve such a measure when it went into effect in September of the same year. But for some, it has been the first country in the world to put its citizens at risk.

Things could get more and more complicated

El Salvador was not enough. The regulatory trend is practically worldwide. Last January 20, the Central Bank of Russia commented that it was considering submitting a proposal to ban cryptocurrency trading and mining of this asset class. This project intends to ban decentralized digital assets from being used in any activity in the country.

Regulatory agencies in the UK, Spain, and Singapore spoke against cryptocurrency advertisements. They think that ads put the protection of investors at risk. As a result, the possibility of much stricter regulations on promotions has been raised, which could seriously affect the market.

With everything going on right now, it is practically a perfect combination for the collapse of the overall crypto market. For many analysts, that bitcoin and the market will collapse is unavoidable. It's something they've been expecting for a very, very long time. The thing is, we hear this kind of commentary all the time as every time bitcoin crashes, the naysayers use it as an excuse to discredit cryptocurrencies.

The truth is that the year has just begun, and many predictions claim that the value of bitcoin and other cryptocurrencies could increase considerably in the coming months. Some projections suggest that the value of bitcoin could reach $100,000 very soon if the conditions are right. But so far, it is uncertain what will happen to the market tomorrow. Everything could change radically, but it is not known for better or worse.

Much of the daily traded volume of cryptocurrencies is due to stablecoins such as USDT.

In Short

Tether has a total market value of close to USD 74 billion.

In the last two years, its market capitalization has grown 1,500 percent.

Tether seeks to comply with the FATF Travel Rule using Notabene software.

A report by the firm Protos, named "The Protos Papers," published last November 10, highlights that almost 60% of the Tether stablecoin (USDT) supply concentrates in the hands of two market makers: Alameda Research and Cumberland Global. Tether is a U.S. dollar-pegged stablecoin born in July 2014 as Realcoin, later named USTether and finally USDT. Over the past seven years, USDT has become a crucial part of the cryptocurrency ecosystem, enabling liquidity management and growth.

Protos traced the history of USDT transferred between Tether's treasury and third parties, which fall into three categories: market makers, funds, and companies and individuals. The total USDT transferred between those entities is $108.5 billion, including USDT, returned to the treasury.

The chart below shows the total transferred to market makers, funds, companies, and individuals. Market makers are independent firms that intervene as liquidity providers and facilitators of asset trading.

According to Proto's figures, $37.2 billion USDT has returned to Tether's treasury. If you subtract that figure from the total transferred to the earlier mentioned entities, you get $75.8 billion. According to CoinMarketCap, Tether's current supply is $73.86 billion, which yields a 2.5% discrepancy with Proto's figures.

High concentration of USDT in the hands of Market Makers

In the case of Cumberland Global, a subsidiary of investment the firm DRW, they acquired $23.7 billion in USDT, which is equivalent to 22% of the outbound volume from the Tether treasury. Then, the report highlights that Alameda and Cumberland have received 55.8% of all the Tether distributed in recent years.

Much of the regulatory attention in the U.S. focus on stablecoins. Tether, Binance USD (BUSD), and USD Coin (USDC) stablecoins are among the top five cryptocurrencies by daily traded volume. At the same time, USDT doubles bitcoin's daily traded volume, according to figures from CoinMarketCap.

Despite the doubts that USDT raises among regulators, market participants prefer this stablecoin over more tightly regulated stablecoins such as USDC and Gemini Dollar (GUSD). Also, USDT is far superior in traded volume than more decentralized stablecoins such as DAI (DAI) or TerraUSD (UST).

Three U.S. regulatory agencies, the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), and the President's Working Group on Financial Markets (PWG), warn that stablecoins could become a common means of payment in the future.

Tether's shared data

Tether is implementing software that will enable them to comply with the Travel Rule and combat money laundering across its global network. The Financial Action Task Force (FATF) suggested these actions, as Tether revealed in a statement released on October 26.

The company explained that, with Notabene, the company behind the protocol that Tether will use, would "protect" users' information when transacting between cryptocurrency platforms, without anything leaking along the way. Notabene explains that its software includes a wallet that allows it to identify whether a transaction is coming from a personal custody wallet or by a third custodial party and determine whether the transaction complies with the Travel Rule.

Tether indicated that it would begin testing the solution compatible with various protocols and combat crime and money laundering in cross-border transactions between exchanges.

Tether to comply with FATF

Later in the press release, the company mentioned the FATF guidelines that require virtual asset service providers to meet the same standards as regulated financial institutions and those related to the Travel Rul [PDF].

"We are proud to lead the charge on behalf of all stable currencies to make a positive change towards protecting our customers," Leonardo Real, Tether executive.

Virtual asset service providers must accept The Travel Rule, including exchanges. The objective is to share information about users who perform transactions exceeding $1,000.

Although the FATF is an international body whose recommendations are not binding, i.e., it does not mandate laws as these are the responsibility of each jurisdiction, Tether has decided to comply with its guidelines. Member countries of the FATF group usually abide by the recommendations to avoid being sanctioned or being "blacklisted."

The new Bitcoin Taproot update is coming soon to optimize network security and privacy.

In Short

Taproot upgrade will resolve important Bitcoin issues

A bug so far was partially fixed, pending a new software update.

Taproot's official arrival on the Bitcoin mainnet will arrive in mid-November.

Bitcoin, the world's most important cryptocurrency and the one that opened the doors to a new decentralized financial system, is about to add further improvements through the Taproot update. The network is preparing to receive its latest and most significant update, scheduled between November 14 and 16. Bitcoin developers reported in June that they'll activate Taproot as a soft fork on block number 709,632, which will be mined around the dates indicated.

Taproot, Bitcoin's most anticipated upgrade

Through Taproot, Bitcoin will activate new improvements and functionalities that will optimize the network. The latest update focuses on improving Bitcoin's security and privacy and making transactions within Bitcoin run faster and cheaper. In addition, Taproot will introduce several changes to simplify the execution of Smart Contracts on the Bitcoin blockchain to make it easier to create them. Developers integrated Taproot into Bitcoin Core in October 2020. Bitcoin's most significant upgrade is less than 1,650 blocks away from becoming a tangible reality on the network. Overall, Taproot promises to revolutionize Bitcoin.

Bitcoin, which leads the crypto market by market capitalization, wants to remain a leader in innovation and development. In addition to improving its security, privacy, and scalability through Taproot, the network will support complex Smart Contracts and enable faster and cheaper transactions. This set of improvements and optimizations will make Bitcoin a much more competitive network.

More complex smart contracts

Taproot is one of the most critical and anticipated updates to Bitcoin. Bitcoin will improve its ability to process Smart Contracts through this soft fork, creating and executing more complex Smart Contracts within its blockchain network. Currently, smart contracts are one of the most valued and demanded functionalities within the crypto industry, dominated mainly by blockchains such as Ethereum, Solana, Polkadot, and now Cardano.

According to data from the Taproot Watch web portal, there are 12 days left until the activation of this critical update in Bitcoin. In June this year, Bitcoin nodes voted in favor of Taproot's activation on the mainnet, indicating their support through the blocks mined on the network. As noted by developer Jameson Lopp, 92% of blocks mined during a single period indicated support for Taproot's activation on the Bitcoin mainnet. Before the upgrade, the network required signals from 1,815 blocks. Each period in Bitcoin consists of 2,016 blocks, mined approximately every two weeks.

Four years in development

However, despite the consensus of nodes to approve Taproot, currently, only 49% of nodes have upgraded to receive the soft fork. The web portal created by Luke Dashjr, a Bitcoin developer, tracks the real-time status of the network's nodes concerning Taproot.

Enhanced security and privacy

What is Taproot?

Taproot activation

History of Taproot

SegWit

Some problems remain

Bitcoin price and gold

Even though this industry is only a little over 12 years old and has gained much attention, the general public still does not seriously take their bitcoin's security.

Anyone can become a victim of cryptocurrency theft if they do not take care to follow good practices. The result is plain to see, large amounts of money are lost or stolen. Bitcoin's enormous advantages in terms of decentralization also mean that hackers can disappear with all the money.

Why protect your Bitcoin?

Just like we keep fiat money or credit cards in a purse or wallet, we also use apps called by the same name to manage our bitcoins. There are many types of cryptocurrency wallets that we will talk about today while showing their strengths and weaknesses.

What is essential to understand is that it is not a wallet as such, having cryptocurrencies inside it, but only manages the private keys that allow us to access them on the blockchain. Some options will be more secure than others, but what is interesting to understand is that the protection of our bitcoins is up to us. We are the ones who determine how safe we want them to be.

Cryptocurrencies, especially Bitcoin, give the user great power, transforming them into their banks. But that comes with a huge responsibility that not everyone contemplates. One of the main risks of Bitcoin is that the user loses the private key or that someone has stolen it.

What matters is the Private Key

Hot Wallets

The different options that exist are:

Exchanges

Tablets

These wallets present a risk of creating and sometimes keeping the users' private key on those devices connected to the network. They are very convenient when accessing our funds and making and sending transactions, but we give up some security in return. Of course, they are not a complete danger, and there are cases where their use is interesting. Few people take the necessary precautions because they don't know how to protect their money.

It is not uncommon to read that someone has been robbed of funds and in different ways. If we go to Reddit, we will find a series of posts telling what has happened to their bitcoins for not storing them in the right way. The whole point of these wallets, or at least how we should use them, is as a place to carry little change. We don't go out with our wallets loaded with euros or dollars when we leave home, only with what we need to have a coffee or make a small purchase. That should be the purpose of these wallets.

The central idea of all this, and I repeat this for the sake of clarity, is basically to have as few funds as possible and to use another medium, as we will see below, to store the more significant amounts. A mention must be made of the exchange wallets because, as we have already said, we do not have control over those funds, but a third party, presenting the risk of someone stealing them, a server with hundreds or thousands of BTC is very tempting. This company will disappear in the future.

It may sound crazy, but banks, institutions that we would think of as safe because they have physical brick and mortar offices, have "disappeared," leaving their customers without money. Few of these companies have insurance in place to replace cryptocurrencies in the event of a problem. And while they have security measures in place, such as holding much of the funds in cold wallets, at day's end, it defeats the purpose of cryptocurrencies.

There is a phrase that goes:

Your keys, your bitcoin. Not your keys, not your bitcoin. Andreas Antonopoulos

And I couldn't agree more. In the end, so much technology and advantages to give the power to someone else is not the wisest decision in the world. But these wallets have the problem of internet connection, which creates an attack point for anyone who wants your cryptocurrencies. That's why we will now look at the second group that is more secure.

Cold Wallets

Paper Wallets

Physical Wallets

Inside them, there is software that takes care of all the technical details to make this option the most secure, from signing the transaction inside the device to never revealing it to requiring the user to enter a PIN to approve it. Since they connect to a computer to gain access to the Internet and what is transmitted is the transaction, no matter the security level of the PC, the hardware wallet is not affected.

Some options feature open-source software, leaving it up to the community to determine how secure they are. The downside is that while they are the best choice for someone who cares about security, they come at a cost that not everyone wants to pay at the end of the day.

Cold wallets are the best option for storing Bitcoin, although they require extra steps when sending funds. They need some additional technical knowledge to use them and get them up and running, but it is well worth it if we intend to have a lot of BTC. If you are starting, it is good to learn what alternatives exist and analyze them. Then decide whether you can afford to spend on a wallet or use a free option.

Protecting your online Wallet

In the exchange's wallets, knowing what a private key is or the address is not necessary. They make everything easy so that someone with little knowledge can operate. Even these services are very similar to those found in a bank account.

We do not need anything special, just a browser or download an app to start using them. That's why I'm going to give you some tips oriented explicitly to how to keep this kind of wallet safer, so you don't end up with a bad experience. Just remember to use them for small amounts and to learn, then it is a good idea to learn about the other wallets. Here are the best practices to raise the level of security:

Use Double Authentication Factor (2FA).

Do not use the phone as 2FA.

If you have the phone number associated with your account, it is best to use a different number to receive the code, a secret SIM card that no one knows.

Use separate email accounts.

I'm sure you are just like many people who use a separate email for daily communications, our Facebook, Twitter, PayPal, etc., account. We share the address with everyone, friends, family, and co-workers so that they can send us things, but it's also easy for attackers to know it.

If our exchange account ties to this email, the attacker already has vital information to access our wallet. The advisable thing to do here is separate the emails, one for personal use and one for the wallet (that you do not use for any other purpose). Different email addresses minimize the chances of a malicious agent discovering your account.

Tips to protect your Bitcoins

1. Choose a Hardware Wallet.

We know that they have a cost, approximately $100/€80, but as soon as we have that value in cryptocurrencies, the price is justified. I like to see it this way if we have $100 in an unsecured wallet, it means the possibility of losing it and having $0, better to have $0 in cryptocurrencies, but a wallet of that value that will serve us for the future.

Maybe it is a bit extreme, but when we pass a number we no longer feel comfortable losing, it is best to think about shopping. The best options are Trezor and Ledger, which offers several models with different features and pre-installed security and encryption capabilities.

2. Keep the private keys offline.

Whichever system you choose, the critical thing is always to take the necessary precautions to avoid an unpleasant surprise the day we need it.

3. Always use a secure Internet Connection.

Of course, if we can avoid any gadget to send a transaction and wait until we get home, all the better. However, this does not imply that we are completely protected.

4. Use a good, updated Antivirus.

While Windows users are vulnerable to various malware, all operating systems share malicious programs. We must check that the computer has reliable antivirus software installed. Viruses and malware are the gateways to our devices, so scanning before installing the wallet is essential.

5. Do not access suspicious links or web pages.

Curiosity killed the cat, which is why some links and buttons on the Internet look very attractive to click. We must be careful with these, as they can be dangerous. If we feel that something is not right, it is because maybe you are. Don't download pirated movies or watch inappropriate things on the same computer where you have your coins. That's a bad idea.

If you are using an exchange wallet or website, verify that you visit the official URL before entering any data. Some attacks consist of replicating entire websites to make the user believe that he is browsing in the right place. We must also be careful with email scams, such as phishing, which involves sending emails inviting you to click on a link and then stealing your information.

6. Use a very strong password for your online wallet.

Choosing the password is not trivial like entering "123456" or "password," nor should it be your home address or any data anyone can get. That's the first thing an attacker tries. Phone numbers, birth dates, names, favorite movies, that's information you're sure to share freely on your Facebook or Instagram feed.

Look for an alphanumeric combination that makes sense only to you or doesn't, and avidly write it down somewhere safe. Also, try adding special characters to make it even harder. Another thing to consider is not to use the same password for all services.

7. Never reveal your Private Key.

8. Keep a separate wallet for your daily transactions.

It is extra work because we have to send funds continuously from our central purse to the daily bag, but it will pay off.

9. Use Double Authentication factor (2FA).

We talked about this before, and when it comes to exchanging wallets or some mobile ones, it is good to activate this extra authentication measure that is simple but effective.

10. Always check the Bitcoin Address.

When you make a transaction, always pay attention to the address to which you are sending the money.

Malware running in the background can intervene when we copy and paste bitcoin addresses to change the result and send our BTC to another address. If we do not pay attention, we can end up sending the money to someone else.

11. Make backup copies of your Digital Wallet.

A backup copy will allow you to access your wallet if you lose it or your device breaks down. These are files generated by the wallet or seed phrases. Choose a place other than the wallet to store the backup copy securely. In case of theft, we will be able to recover the wallet with this information.

Even if they cannot access the wallet inside the device, we will want to remove the funds from there as a precaution.

12. Encrypt your Wallet.

The wallets that we generate on the computer or a cell phone can create a file to retrieve the wallet, a backup copy as we have already seen. But we must encrypt this file, either with the function offered by the wallet or with an external program.

The idea is that we can only access this file, which contains the private key, with a password. If a hacker gets access to the file, he cannot get to the key's most critical part.

13. Use Multi-Signature (MultiSig).

The concept of a multi-signature wallet is crucial because it allows dividing the responsibility and increasing the protection by needing more than one signature to send a transaction. An example is that the wallet consists of 5 people, but we only need 3 to approve a transaction. So, as long as three people are willing to carry out the transaction, it is sufficient.

Multisig reduces the risk that someone has access to the wallet of one of the people and can control our BTC. It also reduces the risk of loss since if one of the five is lost, there would still be four others who could sign.

14. Update the software you use regularly.

The operating system's software or some tools that we use, as in the browser, always receives updates. The ones we are interested in are the security ones. We should always have everything updated to the latest version to avoid vulnerabilities coming from software that we do not control.

We should also be concerned about updating our wallet software with new features and bug fixes that make it more secure. Try to check if developers release new updates before an attacker discovers them and can take advantage of them.

15. Do not forget your password.

Do not forget your password. Whether you have written it down or written it somewhere (that's why the mental wallet is not the most recommended), you have to have access in the future.

Summary

As the Bitcoin and cryptocurrency industry has grown, so has the interest of attackers in stealing people's money.

Those who are proactive can take steps to protect their digital assets better.

One of the best ways to protect our investment is using a secure wallet such as hardware wallets. However, any cold wallet is always preferable to a warm one.

Security experts advise not to have too many cryptocurrencies in exchange accounts.

Conclusion

Don't forget that if you lose our BTC, there is no way to get them back. There is no support to call to solve the problem. That's why a proactive attitude is vital before anything else.

#Bitcoin #BTC historical new #ATH $ 65k +! 🎉 🎊 💪🏻 🚀 🌚

China's mining shutdown has led to a broader distribution of the Bitcoin hash rate. The U.S., Kazakhstan, and Russia have become the top mining markets.

In the wake of China's Bitcoin crackdown, the U.S. has positioned itself as the epicenter of Bitcoin mining globally, according to the latest data shared by the University of Cambridge.

According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), U.S. miners now hold a 35.4% share of the Bitcoin mining market in terms of total global hash rate distribution. The U.S. nation's positioning comes after the Chinese government banned cryptocurrency mining earlier this year.

The hash rate is the unit to measure the processing power of a Blockchain network. A lower hash rate means less competition among miners to validate new blocks. It also means the network is less secure, as the scale of resources needed to perform a 51% attack is reduced.

China loses its crown

In April 2021, the U.S. had only 16.8% of the global hash rate share, meaning that the U.S. market share has increased by 105%. Similarly, Kazakhstan and Russia have increased their share by 120% and 61%, respectively.

Good sign for Bitcoin

The effect of the Chinese crackdown is a broader geographic distribution of hash rate worldwide, which is a positive development for network security and Bitcoin's decentralized principles.

May saw ATH for many cryptos to start the month, the selling press in the middle of the month was extreme. The last week of May had stability. I feel we are currently in a trading range for the next 2 weeks. I feel there will be one more downturn, until we start the next cycle of the bull market.

In broad terms, a journal is a record of what an individual does within a day. It is like a diary. However, a trading journal is a special type of record which captures the trading activities of an individual within a period of time such as a day.

What is the essence of a trading journal?

Traders record their performances and the reasons behind them. This helps to develop their analytical and decision making skills. This is because they give a reason or justification for each action they carry out. In the end, these records help the trader to make self-reflection, learning from what they have done right or done wrong.

The continued analysis of what you do as a trader results in professional growth. As you continuously study your trading records, you can easily tell where you have gone wrong or right.

Thus you gain the experience to tell winning and losing trends and strategies. Thus, the more data you record, the more you learn from that. What in particular should you record?

Trade performance

A trader should include essential information about every trade he/she makes. For example, one should record the cryptocurrency, forex or commodity, the entry date, the entry price, initial stop loss, technical or fundamental aspects, exit date, exit prices, profit/loss and the state of mind of the trader. It is also important to include screenshots in your records. For example screenshots of the candlesticks when you entered or exited a trade.

Market conditions

The trader needs to describe the existing market conditions on the time of entry. Some aspects of the market conditions a trader records include type of consolidation (e.g. slow consolidation), type of buying pressure (high or low) and daily trading volumes.

Specific benefits of keeping a trading journal

We have discussed the broad reasons for having a trading journal. Now let us focus on specific benefits. How does a trader really benefit?

Here are the main benefits:

- The trader learns to develop working strategies.

- One is able to learn how to control his/her emotions.

- An individual avoids impulsive trading actions.

- It helps you to plan your trades.

How to organize your journal?

Many traders use online platforms to journalize their trading experiences. Here are a few crypto trading journal sites.

Coin Market Manager (CMM: Although it is a portfolio manager, it also doubles up as a trading journal site. It has features that allow anyone to capture the most important information relating to his/her trading experience.

Cryptojournal: This website has well developed features that enable a trader to record all his/her daily activities in a meaningful way.

Other platform where you can keep your trading journals are:

- TraderSync

- Trading Journal Spreadsheet (TJS)

- MyCryptoJournal (MCJ)

However you can also maintain a trading journal on spread sheets. The greatest complication is that, this becomes very difficult if you have many trades, with different trading sites. The paper work becomes overwhelming.

Conclusion

One reason why many trading novices make loses is their failure to keep organized records of trading activities. In the end, they repeat similar mistakes. On the other hand, many professional traders are successful because they keep detailed records of their trading activities and learn from them.

What is next after losing 2.5 BTC to scammers?

Well, you have two options, one is to accept the loss and let the scammers have your hard earned money.

This act will make the scammers thrive, because you didn’t stop them, more people will fall victim, these victims will probably be your friend or your relative.

On the other hand you can file a report with bitcoin recovery experts such as @BitcoinRevelation on Telegram they will help you trace and recover your bitcoin, @BitcoinRevelation will help bring these scammers to book.

As long as you have the scammers wallet address, you are good to go.

I wish you best of luck in your bitcoin recovery.

Website: www.recoverlostbitcoins.org

Telegram: @BitcoinRevelation

Email: recoverlostbitcoininc@gmail.com

WhatsApp: +1 (909) 447-9535

[img]https://iili.io/fk5GN2.md.png[/img]

Decentralized Perpetual Trading Platform YFX starts Genesis Mining

YFX, the first DEX that offers 100x trading leverage on perpetual contracts has just announced YFX token distribution plan. Anyone can participate genesis mining to get rewards of YFX token on Binance Smart Chain, Huobi Heco Chain and TRON.