Although halving is a fundamental event for the Bitcoin market, there are several misconceptions and misunderstandings about what it entails.

Bitcoin (BTC) halving is a fundamental event for the digital currency that halves its issuance every four years. However, several myths and misconceptions can distort its impact and significance. A few days before the next halving, which will occur around April 20, 2024, it is more than timely to banish the misinformation that revolves around it.

1. Halving impacts the price of bitcoin

Some believe that Bitcoin’s halving automatically causes an increase in its price. But this is not the case. Like any financial asset, its rise depends on the demand and supply balance. The halving bitcoins issued per mined block halves the amount of issued BTC per mined block. The event lowers the amount of BTC released to the market by miners. This decrease in supply allows the price to rise if there is enough demand. It does not happen promptly, since miners can dump coins they have held before into the market.

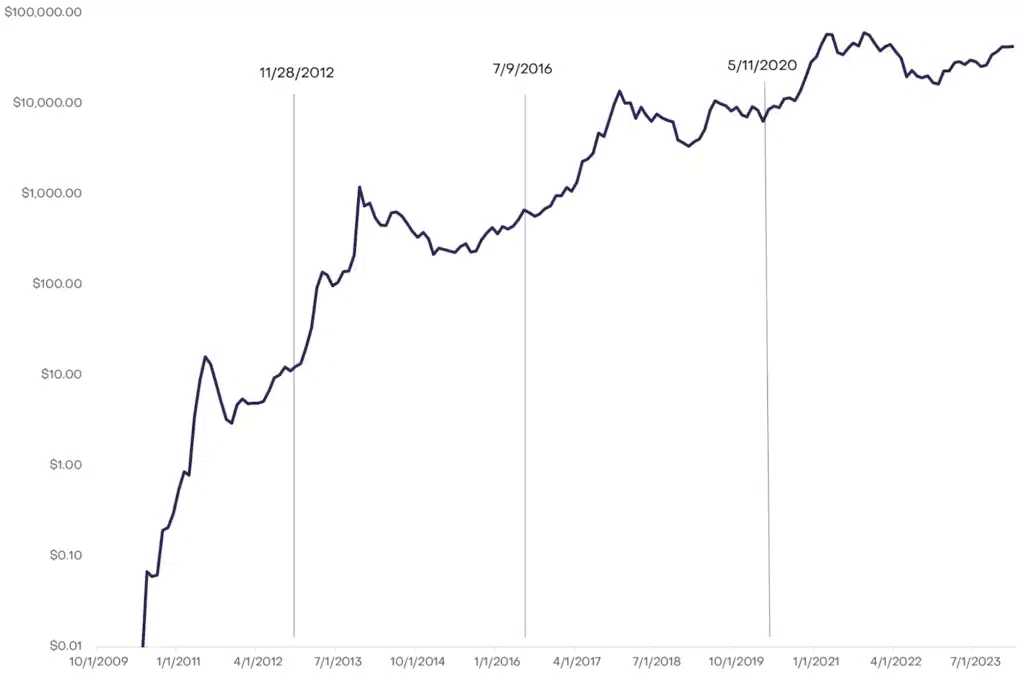

Therefore, halving is a crucial factor for Bitcoin’s rise, but it does not fully determine it, as it depends on the supply and demand perceived at any given moment. Historically, this event has acted as a catalyst amid other macroeconomic conditions, which drove the price to new highs a few months later, as the chart shows.

2. Bitcoin halving guarantees a bullish cycle for all cryptocurrencies

There is a misconception that Bitcoin’s halving triggers a bullish cycle for all cryptocurrencies. But, the truth is that there is no direct relationship between this bitcoin event and the prices of such assets. The rationale behind this myth is that the approach and attainment of halving have always driven a bullish cycle for Bitcoin, generating an impact on cryptocurrencies. With its rising price, investors’ appetite to take more risk grows.

The demand for cryptocurrencies increases, putting upward pressure on their prices. In this scenario, the most popular cryptocurrencies with low capitalization experience yields that exceed those of bitcoin. Many cryptocurrencies do not have solid fundamentals to sustain their rise. That is why, after price surges, large profit-taking occurs, causing its price to plunge, leaving many traders in losses. For this reason, it is essential to foresee the risks involved in trading them. It is also possible that many cryptocurrencies, despite Bitcoin’s halving and the general bull market, will never see price rallies.

3. Bitcoin halving is triggered externally

Some may believe Bitcoin halving is an externally triggered event or human decision. Far from it, this event occurs automatically and predictably every 210,000 blocks mined, occurring every four years. Blocks of the coin are data units containing a set of confirmed transactions. Miners compete to add these to the chain by solving mathematical problems, earning bitcoin as a reward for their work. The protocol that gave birth to Bitcoin 15 years ago determined these actions. The creator behind all this uses the pseudonym Satoshi Nakamoto.

4. Bitcoin halving is equivalent to deflation

Although halving decreases the issuance of new BTC, this process is not equivalent to deflation. This term fits better for monetary systems where issuance is negative (i.e., there is coin destruction), which is not the case for such a digital currency. The number of bitcoins in circulation will continue to increase until reaching the maximum limit of 21 million BTC. What halving produces is that, until reaching this milestone planned for 2140, the issuance rate halves every four years or so, as seen below.

Some prefer to call Bitcoin “anti-inflationary,” as it will cease to have an inflationary monetary system when no more coins are issued. This characteristic is one of its bullish catalysts that makes it different from fiat money, pressured to devaluate by its unlimited issuance at the hands of governments.

5. Halving makes Bitcoin mining unprofitable

Since halving halves the amount of bitcoins issued in each block, some think it makes mining no longer profitable. However, the activity remains profitable if the BTC price remains higher than mining costs. In the end, for it to be profitable, it all depends on supply and demand in the market and whether miners can adjust their operations to adapt to the new environment of reduced rewards.

The challenge for miners in halving correlates to technological advances that allow them to do their business at lower costs through more energy-efficient equipment. Therefore, we expect that efforts to find innovations will continue as long as interest in Bitcoin continues. If the number of Bitcoin miners decreases, the remaining miners could mine more coins on average. Therefore, while halving may lead some to quit the activity, others get favored as long as they can profit from their achieved holdings.

6. Bitcoin halving increases transaction fees

There is a belief that Bitcoin halving increases transaction fees on the network. However, while this event may have an influence, it does not directly and necessarily lead to it. As rewards for miners decrease for such an event, miners may select transactions with higher fees to include in the blocks they mine. The action depends on whether demand wants to pay more expensive fees; otherwise, this will not be the case. Therefore, supply and demand determine transaction fees.

7. Halving is the only element that gives Bitcoin its value

Although bitcoin halving is critical for the scarcity of the currency, it is not the only element that gives it value. Multiple factors make this asset considered valuable digital money to people. Anyone can access Bitcoin without any restriction and can transfer it freely. Also, if you use self-custody wallets to do this, it is impossible to confiscate holdings and allow them to be kept private.

Likewise, the value of Bitcoin lies in the fact that its issuance is defined and done in a decentralized way by those who want to be part of this activity. All this occurs while maintaining the security of the network. All these attributes motivate the demand for Bitcoin, propitiating its upward trend. These characteristics led some to label the currency as a store of value.

Understanding these common misunderstandings is critical to interpreting the impact of halving on Bitcoin and cryptocurrencies, especially at this time when the eyes of the market are on this important upcoming event.