Trading bitcoin shares on exchange involves a process that links the ETF issuer, liquidity providers, custodians like Coinbase, and more.

- People purchase Bitcoin ETFs through traditional regulated brokers.

- Shares of Bitcoin are purchasable and redeemable in U.S. dollars.

An ETF is a publicly traded security that you can buy and sell as a share (stock) at a securities exchange or brokerage house (broker). Often, an ETF is not just a single asset but is “multiple assets or securities,” a basket of items; it can also trade against an underlying asset.

Issuers like BlackRock, custodians like Coinbase, exchanges like Nasdaq, and brokers like Charles Schwab must go through several procedures before an authorized participant (AP) or primary market investor can purchase a bitcoin ETF, which is then listed and traded on exchanges. Let’s begin with an elemental truth: you are an investor who wants to speculate on the price of Bitcoin safely and conveniently without having to hold or manage it. As a result, you obtain many bitcoin ETFs and are a bona fide owner of these assets.

How to buy bitcoin ETFs? – To have a Bitcoin share, you have to buy it, or someone gave it to you as a gift. Where? Through a broker that supports ETF trading, of course. Buying through a broker is perhaps the easiest and most accessible way to acquire these financial products.

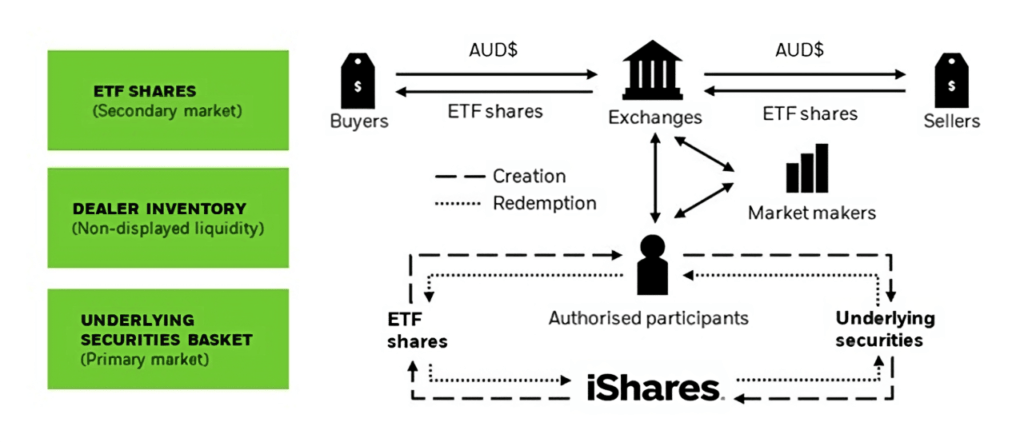

How did these bitcoin ETFs get to the broker platforms where they sell them? – Through liquidity providers, who link buyers, sellers, and exchanges or through a direct channel with authorized participants.

What are authorized participants (AP)? – AP banks, exchanges, or financial institutions that are the first link in the ETF chain after the ETF issuer or provider, be it BlackRock, Grayscale, WisdomTree, or Valkyrie.

What is the role of the APs? – In addition to overseeing the issuance and redemption of ETF shares in the primary market, they are in charge of transporting these shares—or their cash equivalent—to the secondary market, where the ETFs are made available to the general public and allowed for stock exchange trading. Issuers can interact with liquidity providers, exchanges, and the general public through authorized participants.

How do you manage the creation and redemptions of ETFs? – By requesting or redeeming bitcoin shares in a predetermined amount in return for cash or by exchanging cash with the issuer for shares of ETFs, as appropriate. When regulating the “supply” of bitcoin shares between the primary and secondary markets, APs consider the supply and demand of the primary market, namely the demand from liquidity providers and the ETF trading orders on the exchanges.

Why should APs regulate the amount of BTC shares available in the secondary market? – Because markets price these financial goods for speculating and generating positive returns due to the match between supply and demand. Recall that these stocks are financial products with a single objective—making money for their owners—that has nothing to do with the functional and technological benefits of Bitcoin. If there is an excess of supply, the issuers receive their bitcoin shares back from the APs, therefore once more maintaining a balance between supply and demand and allocating shares by market demands.

What incentives do APs have to bring Bitcoin shares to the secondary market? – Economic. They can profit from the tiny discrepancy, or spread, between the prices between the acquisition price in the primary market and the price deployed in the secondary market. These incentives include, for instance:

If an ETF share is trading at a slightly better value than the market price of its underlying asset, the creation of new bitcoin shares will be cheap relative to that and will produce profits for traders. If the value of the share is unfavorable concerning its underlying asset, the sale of shares will yield dollar gains. Not so with bitcoin: remember that bitcoin shares must, by SEC mandate, be redeemed in U.S. currency on a mandatory basis.

Blackrock’s AP business model

BlackRock, one of the most important issuers of the recently approved ETFs, proposes the following example to understand the AP business model.

For example, suppose that when the market opens, the price of an ETF and the value of its underlying assets are $100. If the value of the underlying assets falls to $99 while the ETF’s price remains $100 (i.e., the fund trades at a premium), an AP could profit by creating new shares of the ETF. Specifically, AP could purchase the underlying assets for $99, deliver them to the ETF issuer to create ETF shares, and sell the ETF shares at the market price of $100. This results in a profit of $1 per share for AP.

BlackRock, a financial asset management firm.

Similar profits are made for AP by exchanges, liquidity providers, and the ETF issuer itself through brokerage charges, spreads, trading fees, and other traditional modes of monetizing services.

Why do shares of bitcoin ETFs cost more than one bitcoin? – As of this writing, a share of the Bitcoin ETF costs $24.89. On the other hand, one bitcoin costs $43,589. If it makes sense for a bitcoin ETF share to cost the same as a bitcoin on the spot market, how do you explain the difference? The explanation is straightforward: shares are not fractional. On the exchange, a 0.05 of a share does not exist. Traders must buy units 1, 2, and 3. These complete shares are just $20 less expensive than a single Bitcoin since they must have a fair price.

Logistics of the Bitcoin ETF process

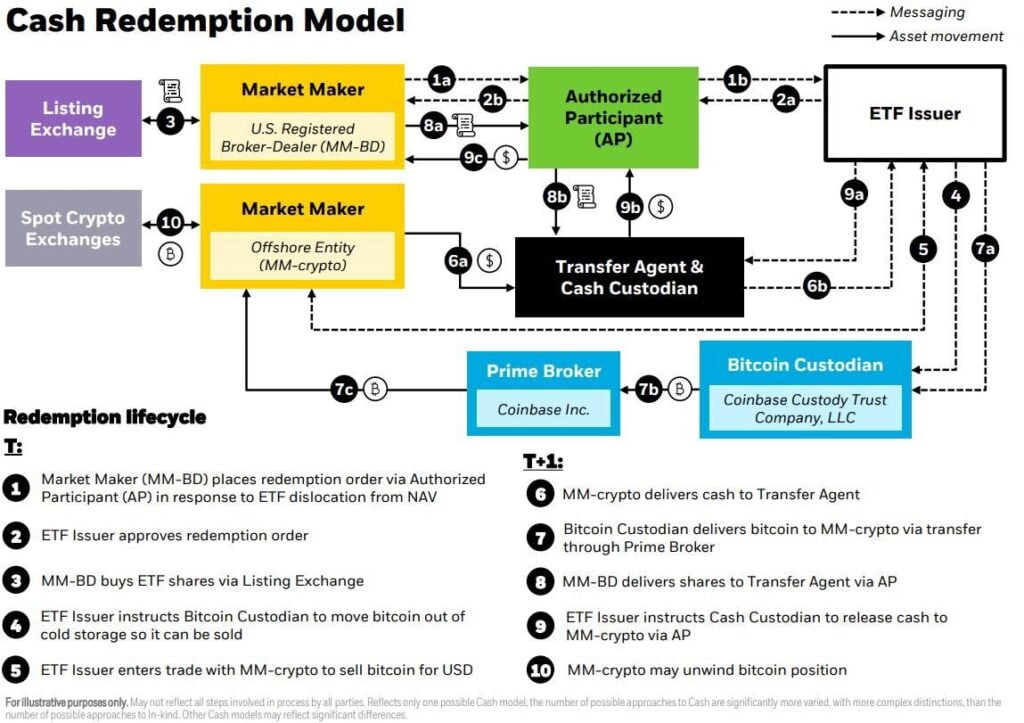

The process of creation, purchase, and redemption of Bitcoin shares in the primary and secondary markets is as follows:

Here is a summary of how Bitcoin ETFs work. Note that this is a rough model of the process and logistics of ETFs, and in no case does it reflect perfect accuracy:

- When a broker wants to receive dollars, it sends a redemption order for its ETF shares to the issuer (e.g., BlackRock).

- The issuer approves the order and advises Coinbase to withdraw in BTC the amount equivalent to the sale that lies stored in the company’s cold wallets.

- The ETF issuer sells the bitcoin through a market maker on Coinbase Prime Broker, its brokerage solution for large firms.

- This market maker sends the dollars to an external transfer agent.

- Finally, the broker sends the Bitcoin shares through the AP while the transfer agent releases the dollars to the broker.

- Each party receives its asset, unwinding the previous positions.

What is the role of Coinbase, the bitcoin custodian for most ETFs?

Coinbase, the U.S. cryptocurrency exchange, will take custody of the BTC used for the issue of each of the bitcoin ETFs created before they are offered for sale. As the custodian of the BTCs, Coinbase must, when instructed by BlackRock, Fidelity, or any other issuer, withdraw the bitcoins from cold storage to trade them.

People trade through Coinbase Prime, an exchange solution for companies that, in addition to offering asset custody, also allow trading, portfolio management, and lending. 9 out of 11 companies with approved ETFs use or will use Coinbase as custodian.

At the time of writing, cryptocurrency exchange Coinbase claims to custody $114 billion and has a quarterly trading volume of $78 billion. Gemini, the cryptocurrency bank, will also have custody of bitcoin held by fund managers.

Some myths about bitcoin spot ETFs

Days, weeks, and months before the authorization of ETF applications, part of the community’s concern lay in this: big money “had to” enter the ecosystem from the hands of institutions. The inflow of capital was necessary to finance the sale of ETFs on a spot basis.

You must estimate when and how much bitcoin would be bought into the controlled funds. Some contended about the impact of the bitcoin price because this sum needed to be high enough to meet all demand. In each case, some people accuse claimants of controlling the market to lower the BTC price and purchase significant amounts of the asset at a reduced cost for exchange-traded funds (ETFs).

According to Dave Abner, former CEO of WidsomTree, one of the ETF issuers, these “seed rounds” are “marketing and almost completely irrelevant in terms of ETF functionality.” He finishes later, saying they “don’t necessarily show new investment interest.”

Any company registered as an ETF liquidity provider can sell these securities; ownership of the shares is not a prerequisite. The issuance, not simply the sale and purchase of ETFs, is subject to supply and demand, as they create these shares later that day when clients ask for the product.

The same executive claims that because older bitcoin goes “from one container to another.” These seed rounds artificially increase trading volume. Seed rounds create the illusion of additional investors who are highly interested in the product.