The network dominates other networks in terms of number of users and total value locked in.

- Asset tokenization reaches stablecoins, gold, and Treasury bonds.

- Networks such as Stellar and Avalanche also stand to benefit from RWAs.

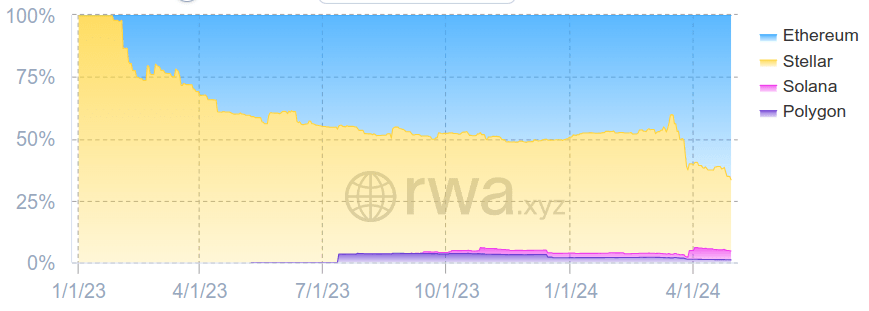

A report from asset manager Grayscale gives the Ethereum network the best position to drive real-world asset tokenization or RWA (real-world assets). RWA refers to the tokenization or representation of physical or financial assets as tokens on a decentralized network, such as Ethereum, Stellar, Solana, or Polygon.

According to the company, the network co-founded by Vitalik Buterin can be considered “meaningfully decentralized and credibly neutral for network participants, likely a requirement for any global platform for tokenized assets.” Therefore, he believes the network is currently “in the best position among smart contract networks to benefit from the tokenization trend.”

Ethereum has the lead compared to other networks operating in RWAs regarding users, total locked value (TVL), and decentralized applications. The Ethereum network in the RWA sector has a market capitalization of $571 million, followed by Stellar with $380 million, Solana, and Polygon with $47 million and $11 million respectively.

Main sectors in which RWAs stand out

Concerning tokenized asset types, Grayscale highlights that the first application of tokenization technology to find product-market fit has been stablecoins.

In tokenized form, this type of digital cash can be used for payments, benefiting from a network for near-instant settlements, lower costs, and interaction with Smart Contracts.

Grayscale

Gold follows Stablecoins. The two leading projects, Tether Gold (XAUt) and PAX Gold (PAXG,) offer the functionality of a decentralized network, including the ability to transfer tokens on weekends or outside traditional market hours, Grayscale says. Another asset you can tokenize and gain momentum in recent months is U.S. Treasuries. These are designed to function as cash equivalents and can be considered a cost-effective alternative to stablecoins.

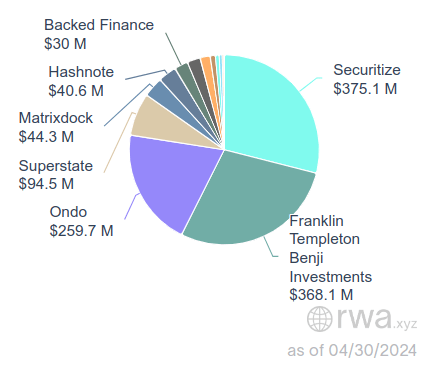

“Now that U.S. dollar interest rates are near 5%, investors have incentives to seek yield-generating alternatives. Rates likely contributed to the growth of tokenized Treasury products.” Among the prominent companies in state treasury tokenization products is Franklin Templeton with its FOBXX fund, as seen in the chart below. It recently joined the BlackRock group through its BUILD fund, launched last March.

Franklin Templeton fund is the first of its kind by market capitalization with $373 million. They took a different approach than most as they launched their fund on Stellar and Polygon. In just a month of Ethereum-based Blackrock fund issuance, it climbed to second place with $304 million by market cap. Approximately 60% of tokenized Treasuries are on Ethereum.

Polygon and Stellar can benefit from the tokenization trend, and layer1 networks designed for tokenization, such as Mantra and Polymesh, could also benefit. Concerning layer2 networks, some believe that in the future, when they are less centralized and sufficiently secure, tokenization projects may move to these networks.